One of the best news trading techniques in forex or any other form of financial speculation is to buy the rumor and sell the news. Why? Because the market will move on an expectation of what will happen providing an opportunity for savvy traders to profit when the news is released. If, and this is often the case, the news fails to meet expectations a massive swing in prices can occur as the market realigns itself with reality. If, on the other hand, the news exceeds expectations a continuation of the current trend can be expected.

Why is this important now? Because fear over Italy’s new government is causing the euro to sell off in a way counter to its fundamentals. Sure, the dollar is rising on US inflation and FOMC expectations but data in the EU suggests economic activity is still expanding, inflation is rising, and the ECB will need to engage in some form of policy tightening within the next twelve months.

The fear; populist parties are forming a coalition government to overthrow the current, centrist, government. The latest proposals would slash taxes while increasing government spending to a point analyst say will threaten their sovereign credit rating. A downgrade to credit ratings, along with the coalitions stance toward the EU, would also threaten the stability of the broader EU economy. Italy accounts for more than 15% of EU GDP, any hiccup in activity would have a far-reaching affect.

The reality; German PPI, released in the early hours of Friday morning, show a surprise gain in producer prices that reinforces the idea of an upcoming ECB action. Producer prices rose 0.5% in the last month, hotter than the 0.3% expected and much hotter than the previous months 0.1%. This gain pushed YoY PPI to 2.0% from 1.9% versus an expected decline to 1.8%. Traders looking for the EUR/USD should be wary of this number as it may foreshadow similar data in the EU PPI next week.

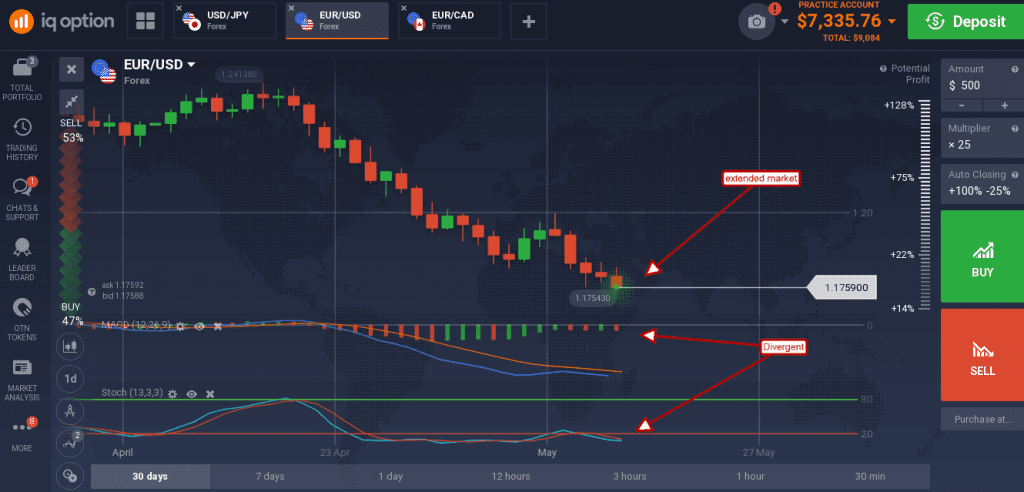

The EUR/USD extended its decline in Friday trading, but did not set a new low. Candle came to rest on the 1.770 level, coincident with a low set earlier this week. The indicators are both bearish but show divergence from the low indicative of waning momentum, support and the possibility of reversal.

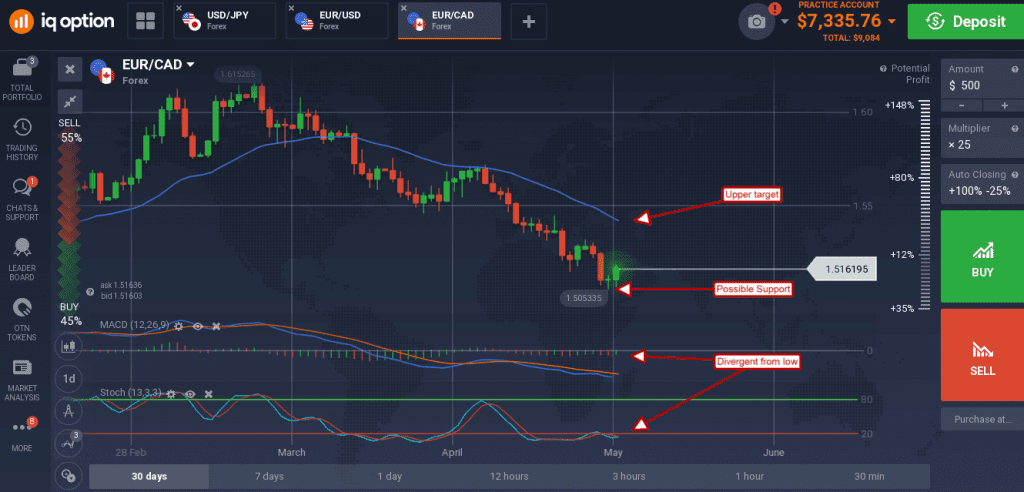

The euro was able to make gains versus the Canadian dollar, aided by weak data from the US northern neighbor. Canadian core CPI rose to to 1.5%, hotter than the 1.4% expected, but the figure was offset by weaker than expected and declining headline CPI coupled with weak retail sales figures.

The EUR/CAD created a medium sized green candle in early Friday trading, moving up from the 1.5100 level and confirming Thursday’s small hammer doji. The indicators are rolling into bullish crossovers as well, further indication a bounce is forming, but the signs are not strong yet, so caution is due.