A difficulty bomb is set to explode across the Ethereum network. The bomb will increase the mining difficulty for the Ethereum network exponentially and will, eventually, bring the network to its knees. As bad as this sounds it really isn’t something to worry about because it has been in works for a long time. The difficulty bomb is in fact part of the development of Ethereum 2.0 and designed to force consensus among nodes.

For those not in the know, Ethereum is a proof-of-work blockchain network just like Bitcoin, Litecoin and other top digital currencies. The problems with proof-of-work, slow network speeds and a high cost of mining, are problems that Ethereum’s developers want to solve with a switch to proof-of-stake. Proof-of-stake is another type of mining protocol that uses less energy and will allow several of Ethereum’s planned updates to function to their fullest potential.

The reason for the difficulty bomb is simple; Ethereum’s development team wants to incentivize and eventually force all of ETH’s miners into the new protocol. If they don’t we may end up with another situation like the one which spawned ETH Classic; two competing groups of miners where one follows the old protocols and the other follows the new.

The problem for Ethereum’s developers now is that the difficulty bomb is set to go off in early 2019 but the network isn’t ready for it. The bomb is meant to coincide with the launch of the Casper upgrade (Casper is the Proof-of-stake protocol) and Casper isn’t ready to go; no surprise there. Casper has been in the works for two years and has yet to be completed. At last report the ETH development team said they expect it to be ready in early 2019 but there is no guarantee they will meet the deadline.

What this means now is that Ethereum will still move forward with important upgrades like Plasma and Sharding and will work to push off the difficulty bomb to a more opportune time. Both Sharding and Plasma are intended to improve security and network speed and are intended for launch following the release of Casper. What traders need to be more aware of is the upcoming Constantinople hard-fork, a follow-up fork to the Byzantium upgrade last year, and it is due out next month. Within the Constantinople fork is proposition EIP1234 which would put off the difficulty bomb by 12 months.

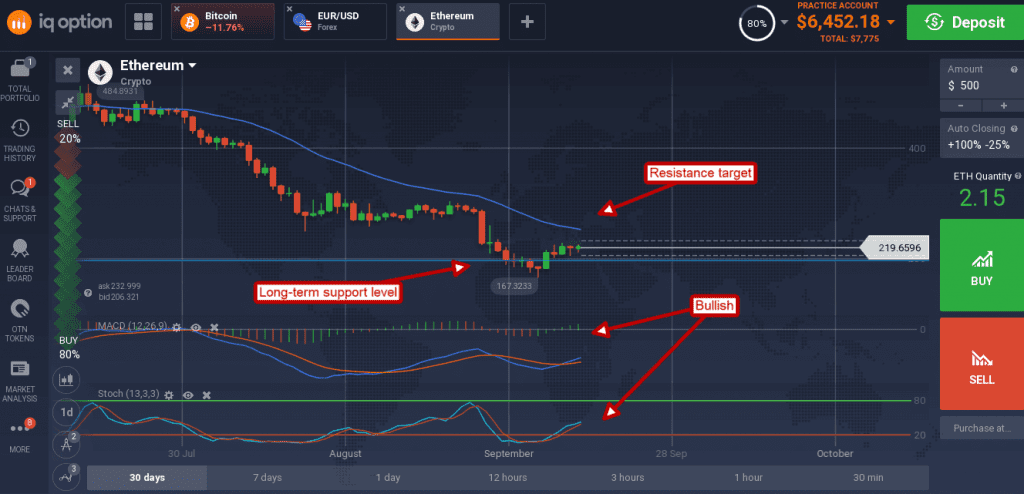

ETH/USD rebound from a long-term low last week and looks like it may move up in the near-term. The move may be impeded by the short-term moving average which is hovering near $250 as of this writing.

A move above the short-term moving average, sparked or supported by the Constantinople fork, would be very bullish and likely take the token up to $300. The indicators are both bullish and in support of upward movement, all we need now is for the market to agree.