In recent weeks, the Euro has moved higher against the US dollar. Given the current charts setup and political catalysts, there is good reason to believe that this move higher can continue. Additionally, the recent January lows are a good stop out point.

How We Got Here

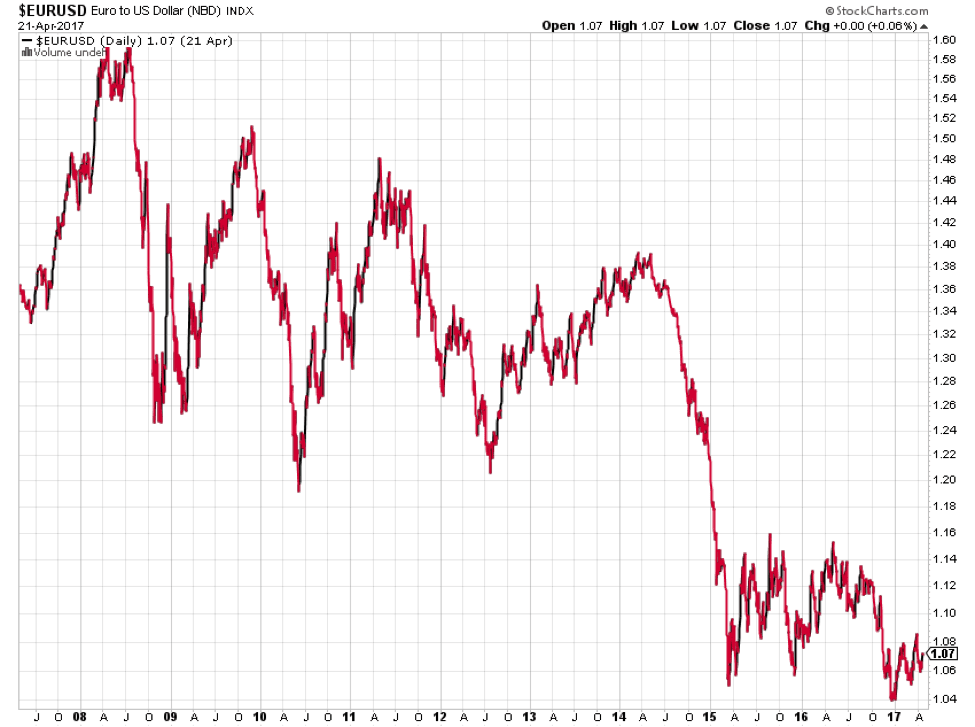

- One major story in the markets over the past decade is the outperformance of the US dollar and US stocks against the Euro and European markets. The EURUSD pair is 3.8% above its 10-year lows.

- The major fundamental factor driving this currency pair is the European Union’s struggles with deflation, weak growth and political strife to a much more severe degree than the United States

- Although these issues persist, recent price action indicates that a lot of bad news has been priced into the market. Further, economic numbers continue to improve while recent European elections have been won by candidates who are committed to the European Union.

Trump Jump and Slump

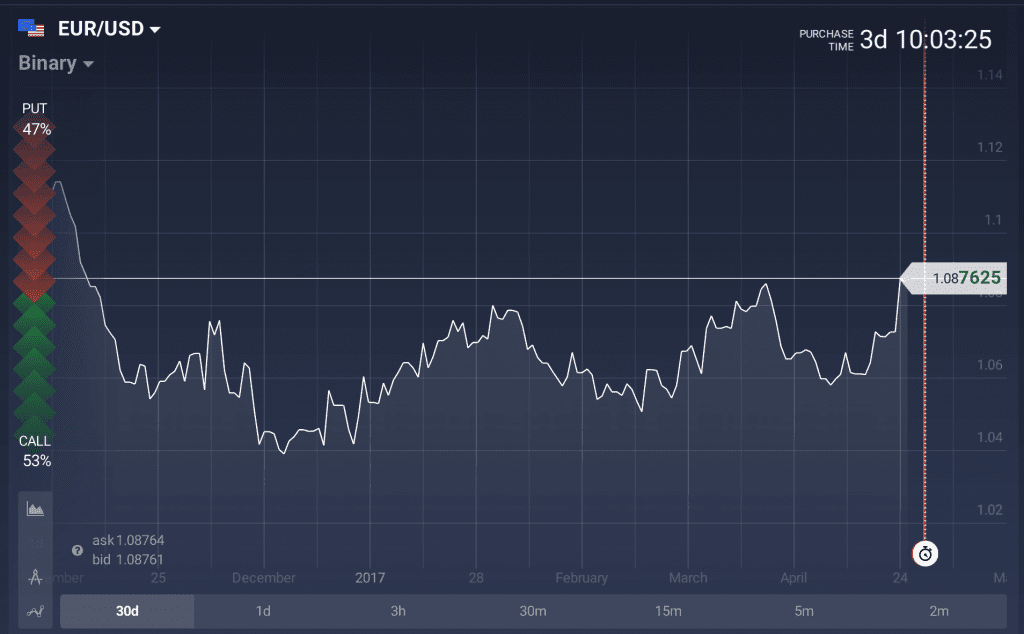

The euro dropped 8% in the two months following Donald Trump’s surprise victory. Investors were optimistic that he would pass his campaign promises of tax cuts and infrastructure spending given the Republican Congress and Trump’s popularity within the Republican party. They poured into the dollar and US stocks in anticipation of an acceleration in growth.

The euro has clawed back half of these losses as significant legislation has failed to materialize, and US economic figures have disappointed with first quarter GDP downgraded from 3% to 0.5% over the last three months. Other misses have included a continuous decline in retail sales, an underwhelming jobs report, and weaker than expected inflation.

This will result in a more cautious Fed which translates to lower interest rates and a weaker dollar. In contrast, Europe is outperforming expectations with 0.7% GDP growth compared to expectations of 0.4%. Additionally, inflation figures, employment numbers, and manufacturing has surprised on the upside. Of course, the US is dealing with high expectations while Europe has very low expectations.

Trade Setup

The euro has trended lower since 2008 and conditioned traders to continue selling the rips. This can be seen in sentiment readings which show extreme bearish sentiment towards the euro despite the recent move higher. Getting long the euro is a contrarian trade with a definite downside and significant upside.

Most of traders prefer to stay bullish on the euro at current levels with a price target of 1.15 and a stop loss at 1.03.

Get 90%* profitability on EUR/USD today from 13:00 to 15:00 GMT.

*Amount to be credited to account in case of successful trade