Five most important news to start your day. These events are very likely to influence the market and trigger exchange rate fluctuations. Read to stay informed.

China’s New Military Base in the South China Sea

A new military facility, presumably of Chinese origin, has been spotted on one of the islands in the South China Sea. Washington has already expressed its concern. Being treated as one of the most important partners by the United States, China still poses a certain degree of risk to other states in the region, including major US allies. Political tensions between China and its western counterparts can potentially lead to major economic disruptions but are not expected — at least now — to do so.

A new military facility, presumably of Chinese origin, has been spotted on one of the islands in the South China Sea. Washington has already expressed its concern. Being treated as one of the most important partners by the United States, China still poses a certain degree of risk to other states in the region, including major US allies. Political tensions between China and its western counterparts can potentially lead to major economic disruptions but are not expected — at least now — to do so.

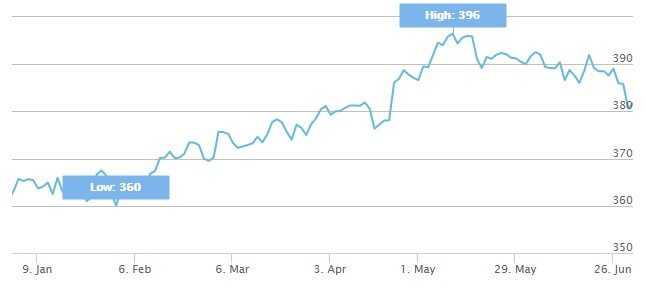

Nike: Good Results, a Deal with Amazon

Not only the major US-based sportswear company reported higher than expected financial results in the last quarter, it also announced a deal with Amazon. The news sent Nike shares (NYSE: NKE) 7% up. For strategic reasons Nike did not cooperate with Amazon and other online retailers for quite some time, but finally decided to make the first step. A limited assortment of goods, including footwear, apparel and accessories will soon be offered through a special Amazon’s e-commerce platform.

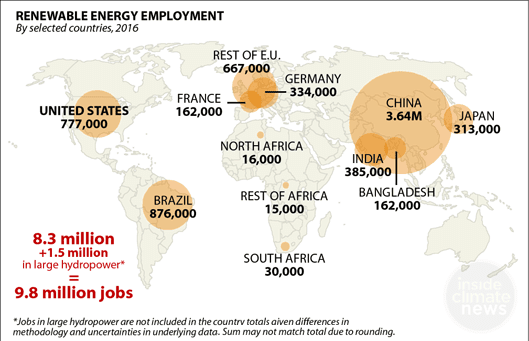

Chinese Companies Turn to Renewable Energy

Elon Musk may be the hero of the environment-aware millennials but small Chinese companies are the ones behind a major energy revolution. Enough factories will be built in China to provide batteries worth 120 gigawatt-hours by 2021, or just in four years. Tesla plant in Nevada, that will be finished in 2018, can only boast 35 gigawatt-hours. In four years China is expected to take two-thirds of the global lithium-ion battery market and enjoy a dominant position in the changing energy market.

Trade Talks Between US and UK to Start July 24

Two countries will negotiate new terms of trade cooperation following the beginning of Brexit. Britain, which will soon become independent from the rest of Europe, now has to renegotiate hundreds of international agreements. However, it can become a tricky task for the United Kingdom, that has now lost the bargaining power of the entire EU behind its back. “There are some very, very big markets that we will be able to take advantage of,’’ says UK Trade Secretary Liam Fox.

European Shares Expect the Worst Month of the Year

With June almost over, it is possible to call this month the worst in a year for European stocks. The pan-European STOXX 600 index is down 2 percent in June. Oil and gas sector, represented by the .SXEP index, lost 0.6 percent in just one month. UK retailer Greene King became an absolute leader in terms of stock deterioration, losing as much as 6.6% of its market capitalization. *

* – Material based on market research