Five most important news to start your day. These events are very likely to influence the market and trigger exchange rate fluctuations. Read to stay informed.

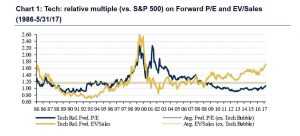

Tech Bubble is About to Bust?

The history is doomed to repeat itself. At least, that’s what they say about the market. Traders tend to fall into all the same traps over the years and decades. The majority of investors didn’t learn anything from the tech bubble of the 2000’s. Those of them who didn’t diversify their assets good enough should have felt the heavy blow of the market correction. On Friday, Facebook, Apple, Amazon.com, Alphabet, Microsoft all lost more than 3% of their value. The abovementioned companies are responsible for 40% of the market growth in 2017. Whether the decline will establish itself is yet to be seen.

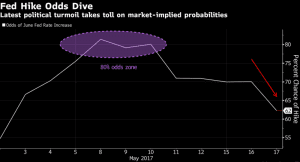

Fed to Raise Interest Rates

The US Federal Reserve is expected to raise the benchmark interest rate. The market will know for sure whether this is true or not on Wednesday at 6 PM GMT. Half an hour later Fed Chair Janet Yellen will hold a press conference and unveil the details to the public. The benchmark rate is anticipated to reach 1.25 percent, as compared to the current rate of 1.00. Higher interest rates can help the American currency to appreciate.

Theresa May Under Pressure

Following the not-so-successful election cycle, Theresa May was criticized by fellow Conservative party members. Now she is at risk of losing her premiership. According to the recent elections results, the Tories lost the majority in parliament. Theresa May is now “considering a different approach to Brexit”, whatever it means. Political instability in one of the leading European economies poses a serious threat to regional and global markets, with the British Pound being the first one to be affected.

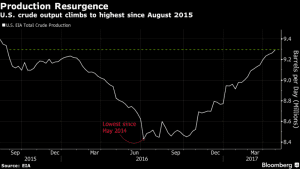

Shale Production on the Rise

Shale production of oil will hit an all-time high in July, US Energy Information Administration says. If the current trend is here to stay, oil prices can be expected to stay low and probably go even lower in the near future. Shale breakeven costs are dropping on a monthly basis. OPEC countries, who could have been expected to react with increased extraction volumes, are too dependent on oil revenues to do so and push the oil prices up, making it easier for shale producers to catch on. This is one of the reasons for the Saudi government to launch an IPO of Aramco as soon as possible, while the investors are still not paying attention to worsening business conditions for Middle Eastern oil companies.

China Auto Sales Plummet

Chinese auto market has contracted for the second consecutive month. During 2016 the Chinese government artificially boosted auto sales by cutting the purchase tax in half. The stimulus was later removed and now the consequences of this decision have finally reached the market. This year auto sales have declined for the first time since 2015. The purchase tax can be expected to increase again in 2018, reaching the original 10% level, thus affecting the top line of Chinese auto sellers and manufacturers even more.