Central banker leaders across the globe are tasked with balancing economic conditions with interest rate setting amongst other tools. Monetary policy can have a significant impact on capital markets as well as global economic activity through consumer and business spending. Interest rate policy also has the power to influence inflation and recessionary periods. While the economic impact often lags policy decisions by months, market impact can be realised immediately.

The ECB interest rate decision comes this Thursday 8th June 2017 and although the European economy has been showing significant improvement, expectations are for rates to remain unchanged. Although consumer and investor sentiment has been on the rise and the Euro currency has been strengthening, employment and inflation worries continue to pervade the agenda for European Central Bank President, Mario Draghi, and his policy setting team.

Draghi has acknowledged that low inflation remains a particular concern despite other improving economic parameters – inflation in the euro zone fell to 1.4 percent in May, its lowest level since December 2016.

When it comes to the stock market we would expect to see continued growth in equity prices through 2017 given the continuing depressed low interest rate level – investors are offered a far superior rate of return in this asset class versus assets that have their return profile pegged to interest rates. Further to this changes to interest rates also influence consumers and businesses spending which leads to knock on effects to the stock market. As interest rates rise, business and consumer spending is reduced, causing earnings to drop and subsequently stock prices can fall. In the case of the current ECB decision we expect interest rates to remain depressed – this could induce further consumer and business spending and add to European stock market gains over the short to medium term.

Meanwhile fixed income products are also heavily impacted by interest rate policy – investors will seek out the assets that offer the best rate of return for their money within the asset class. Bond prices exhibit an inverse relationship with interest rates. Falling interest rates facilitate easier borrowing and stimulate greater amounts of bond issuance for financing, leading to higher demand for high-yielding bonds and driving bond prices higher.

Economists are forecasting interest rate rises for 2018 at the earliest for the Europe area – at this time we might expect a fall in bond prices. However, until this time there is a forecast for a moderately flat policy – with suggestions of some unwinding of the quantitative easing policy of asset purchases that was implemented to help the economy recover from the 2007 financial meltdown.

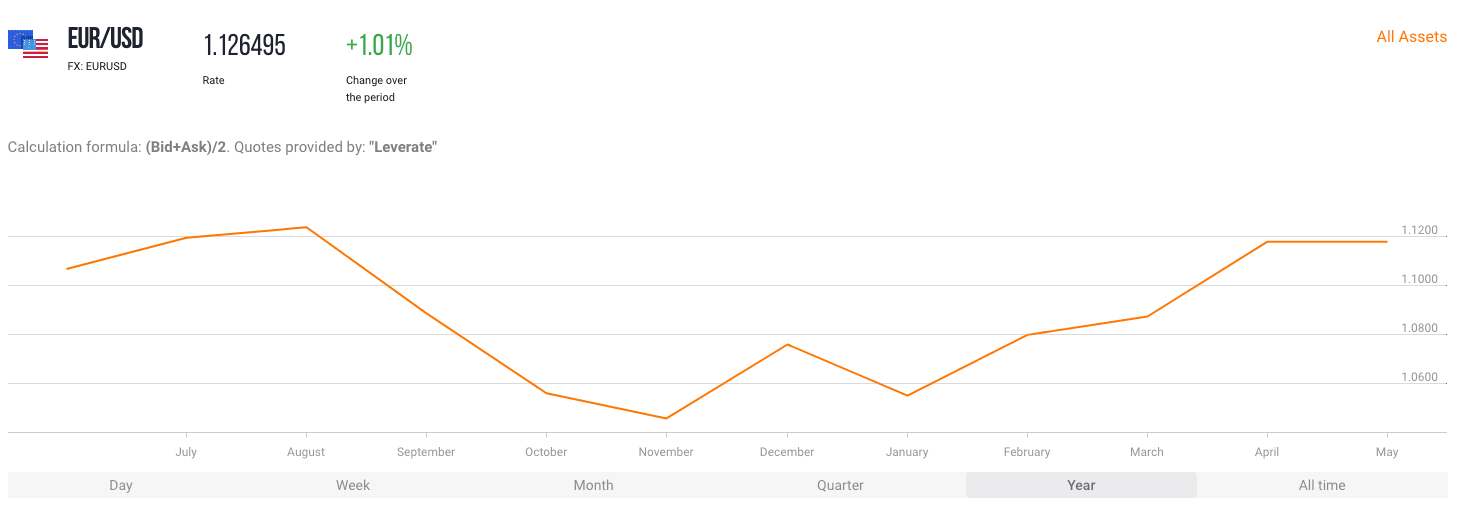

The European economy has had a strong start to 2017 – with France and Germany leading growth in the Eurozone that was double that of the US for Q1 2017. The euro against the dollar is trading at its strongest level in the past half year as the European economic outlook continues to improve.

Crucially, although investors and economists are expecting no interest rate change from the ECB announcement tomorrow at 12:45pm the comments that follow will also heavily influence global markets. This may indicate when interest rates will in fact be raised and the ECB outlook moving forward and help investors position their asset holdings accordingly.