Ethereum trading is offering extensive speculative opportunities. When trading with IQ Option investors can choose from two distinctive instruments: cryptocurrency purchase and a contract for difference (CFD). Both options can be used interchangeably, yet a number of distinctive features tailors each of them to particular market conditions and trading strategy.

Ethereum is a cryptocurrency based on the self-named blockchain system and known for the implementation of smart contracts. ETH was designed after Bitcoin by 21-year-old Vitalik Buterin. ETH is currently the world’s second largest cryptocurrency. Certain experts believe that the smart contracts functionality will even let it leave Bitcoin behind at some point in the future. Launched in 2015, Ethereum enjoyed only limited success until the beginning of March 2017 when it finally started growing explosively. Since the beginning of 2017, ETH appreciated 32 times, reflecting extremely bullish market sentiment.

| Ethereum CFD | Ethereum purchase | |

| Orientation | Short-term | Long-term |

| Multiplier | x3, x5, x10, x20 | No multiplier |

| Stop Loss and Take Profit | Available | Available |

Read also: Bitcoin Trading With IQ Option: Three Distinct Approaches

Ethereum Purchase

Ethereum purchase will better suite those who are looking for medium and long-term opportunities. ‘Buy and Hold’ and short-selling are probably the two most popular ethereum trading techniques at the moment. High growth (and contraction) rates make the cryptocurrency market lucrative for thousands and thousands of investors. Ethereum purchase implies higher spreads than contracts for difference. A higher spread is, nonetheless, negated by a substantial increase in exchange rates and relatively low number of deals. This approach is usually associated with making a long-term investment instead of harnessing speculation benefits in the short run.

Cryptocurrency purchase does not provide an opportunity to trade on margin using borrowed capital. It, therefore, bears lesser degree of risk than contracts for difference. It is literally impossible for a trader to lose all his money unless the acquired cryptocurrency is traded at $0. Short-term price movements have little to no effect on long-term positions. By simply holding the position open long enough the trader can neutralize the negative effects of the contra-directional trend.

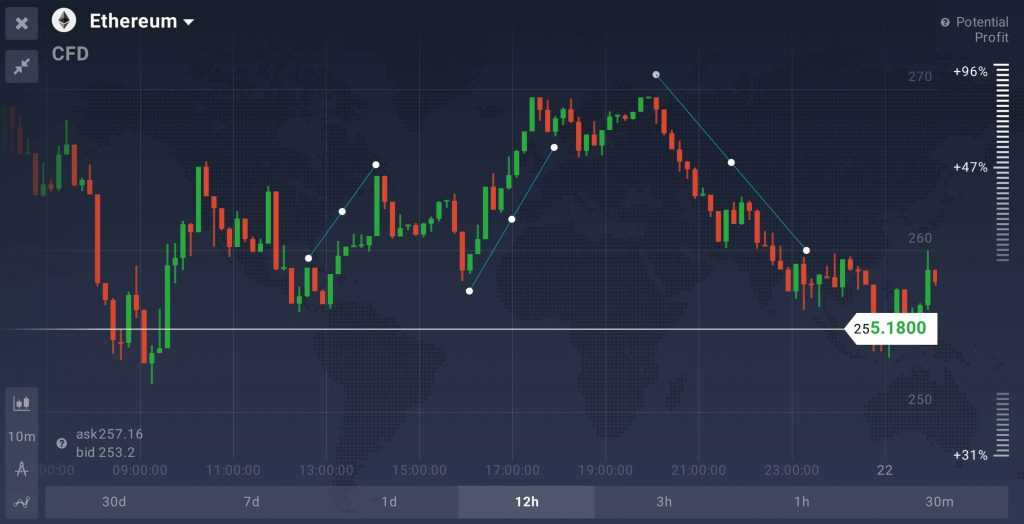

CFD Trading

When buying a contract for difference (CFD), the trader does not spend his money to purchase the cryptocurrency itself. Instead, the trader buys a right to receive the difference between the current and the future asset prices — but only if the trend direction is predicted correctly. Should his prediction turn out to be wrong, he will make a loss comparable to the invested amount.

According to certain experts, CFD trading is more suitable for short-term operations. Lower spread values (when compared to Ethereum purchase) make it a better option for frequent deals. High cryptocurrency market volatility guarantees there are always buying and selling opportunities, when trading ETH.

Contracts for difference allow for the use of a multiplier. Though risky, it can considerably increase the profit potential in case of a successful deal. Investors can use a multiplier of up to x20 when trading Ethereum with IQ Option. This tool will multiply all of your profit (and losses) respectively. Say, you make a $100 investment with an x20 multiplier. The profit you make and the losses you incur in this case will be calculated as though you are controlling a $2000 position. It should be noticed than unexpected price swings can obliterate the position completely.

Both instruments allow the use of stop loss and take profit signals. Automated trading techniques lack accuracy, yet make it less time-consuming and demanding. This option can come in handy during the periods of high market volatility. By opening a take profit order, you determine the amount of profit you consider sufficient to exit a trader and close your position. Stop loss, in turn, is aimed at minimizing possible losses, letting you withdraw the remaining funds in case of an undesired event.

Conclusion

Both instruments, if used correctly, can provide impressive results. Especially, when considering growth potential and high volatility of the cryptocurrency market. However, each of them is best suited to a particular market cycle and should be used in accordance with long or short-term strategies. Several more cryptocurrencies can be expected to make their way to the CFD section of the IQ Option trading platform in the foreseeable future, thus making the use of contracts for difference even more lucrative and versatile.