Trend following techniques are bread & butter for financial traders regardless the style of trading or type of asset in question. Trends are sustained price movements with predictable entry points and reliable targets. In most cases trends are slow and lumbering; the trick to success lies in waiting patiently for entry signals to develop, not trading to soon and then waiting for profits to come. In some cases, the trend is fast and sharp, price movements are rapid, gains are large and entry points less evident; as is the case in many of today’s dollar pairs.

Global growth, specifically inflationary pressures, have been a bit weak in recent months while US data has shown enough acceleration to heighten expectation for three more FOMC rate hikes this year. This situation has put the FOMC, and the dollar, on a divergent path from other banks and their currencies (the Bank of Japan, the Bank of Canada and the Bank of India specifically) driving the dollar higher. While moves in these pairs (USD/JPY, USD/CAD and USD/INR) have been large, they are not over. In fact, they are just beginning. When a strong trend forms it often pays not to wait as momentum can carry it forward for an extended period.

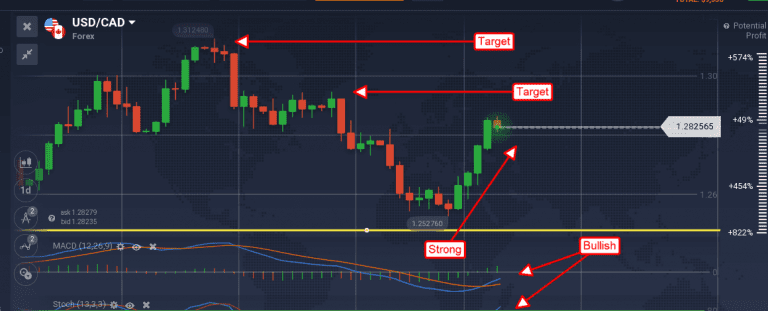

I highlighted the USD/INR last week in my post Three Forex Pairs With Big Gains On The Way and since then the pair has outperformed my expectations. I was looking for a break to the upside, past $65.75, with a target of $66.50 over the next 2 months or so. The break out occurred the very next day, the pair exceeded my long-term target and is now consolidating at a new resistance level.

The indicators are consistent with resistance, both MACD and stochastic have formed peaks, but both are also very strong. MACD has formed an extreme peak convergent with the new highs indicative of underlying strength within the market. The pair is now expected to form a consolidation pattern, possibly a flag or small triangle, before moving higher. A break above new resistance, near $66.75, will be bullish with a target near $68.75. Support is present at $66.30, an entry point for bullish swing traders.

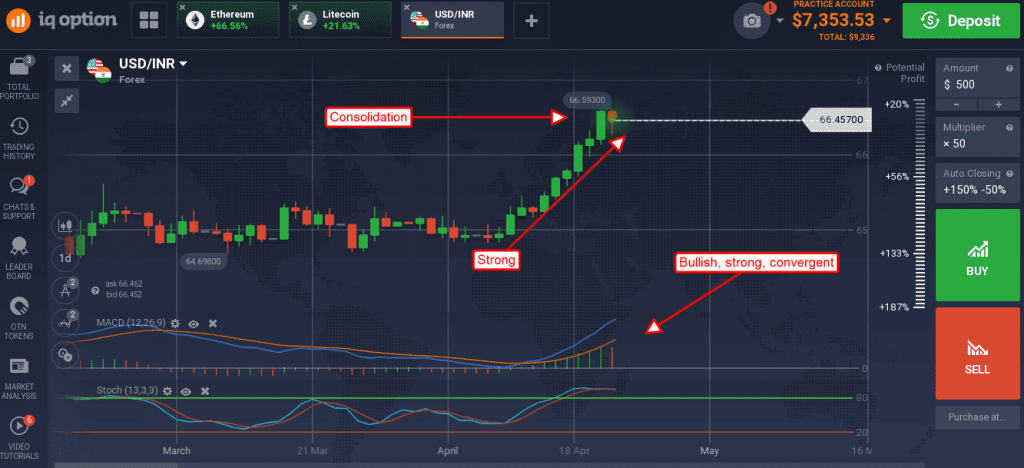

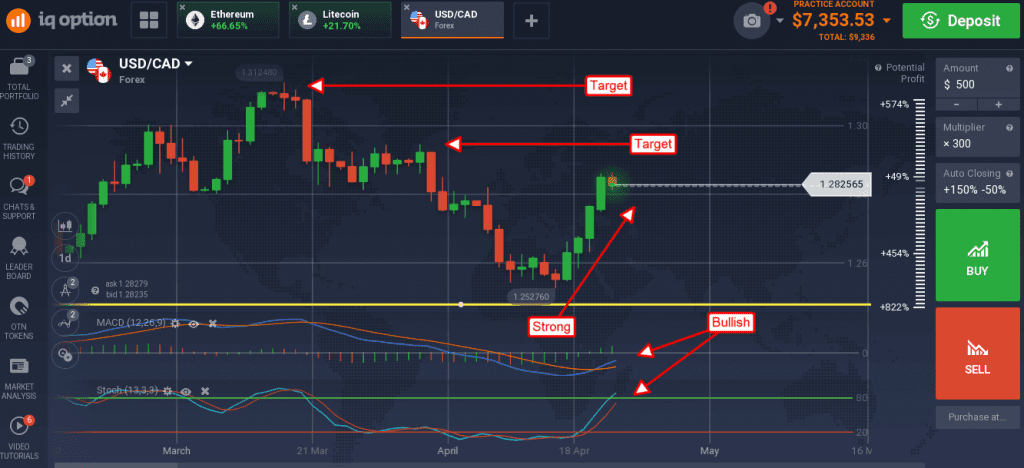

The USD/CAD has made a major reversal on dovish BoC outlook and hawkish FOMC outlook. The pair has broken through possible resistance at the short term moving average with no trouble and now sitting just below another potential resistance target at 1.2850. This level is the neckline of a head & shoulders reversal pattern which formed only a month ago, the peak of which marks the top of a likely trading range. The indicators are both bullish and on the rise in support of higher prices so a break of resistance is very likely. Once it fails targets at 1.2950 and then 1.3100 come into play.

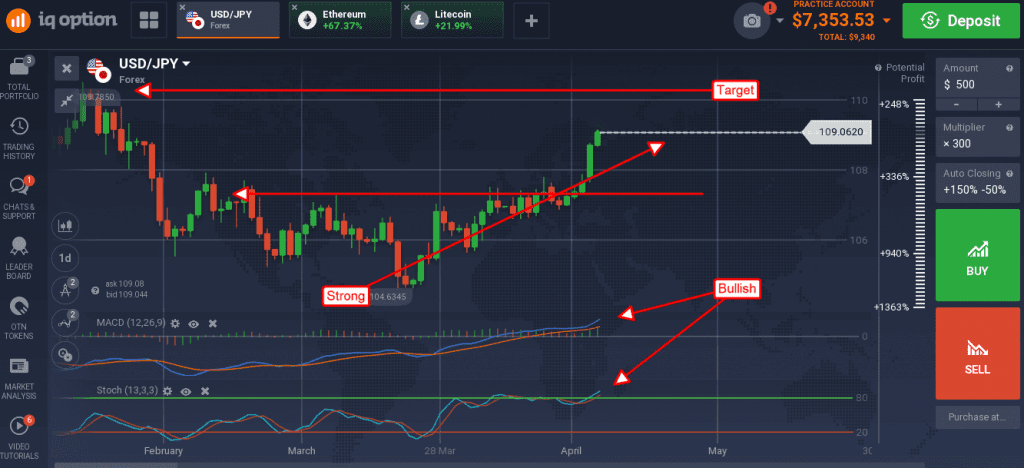

The USD/JPY formed a reversal on fundamentals, Japan’s economy is struggling while the US is strong and accelerating and is extending its gains on dovish comments from the BOJ. The BOJ governor Kuroda says QE is needed for a long time, well past next year, and that is fueling the rally.

The pair has already blown past resistance targets at 108.50 and is headed higher. The indicators are both strongly bullish and convergent with the highs confirming this outlook. The next target for resistance is near 110.50.