Backtesting is a process whereby a strategy or a trading technique is tested using market data. Backtests help a trader know how a strategy will work in the previous market conditions. Backtesting is an important process prior to investing live capital.

Backtesting may never be a deterministic or predictive method of possible future performance. However, there is much to be gleaned regarding strengths, weaknesses and risks. For a trader, there is a lot of utility in building confidence and in weeding out ideas that have never been put into practice.

What Is Backtesting in Trading

Backtesting in trading means applying a defined strategy to past market data to evaluate its performance. The goal is to see how the rules behave across different market conditions, not to search for perfect results.

This process uses historical price data, including entries, exits and risk rules. It helps traders measure consistency, drawdowns and overall expectancy before using a strategy in live trading.

Backtesting is different from live trading. It removes emotional pressure and execution delays, which is why results must always be interpreted with caution.

Why Backtesting Is Essential

Backtesting allows traders to verify whether a strategy has a real edge. Without testing, trading decisions are based on assumptions rather than evidence. Historical results provide a foundation for informed risk taking.

Testing also exposes weaknesses early. It shows how a strategy performs during losing periods, high volatility or sideways markets. This insight helps traders prepare for drawdowns instead of reacting emotionally.

A tested strategy builds discipline. When traders trust their data, they are more likely to follow rules consistently in live conditions.

Common Backtesting Mistakes

Backtesting is only useful when it reflects realistic trading conditions. The following mistakes often distort results and lead to false confidence.

- Curve fitting the strategy – Adjusting rules to perfectly match past data creates results that rarely hold up in live markets. The strategy becomes optimized for history, not reality.

- Ignoring transaction costs – Spreads, commissions and slippage reduce real performance. Leaving them out can turn a losing strategy into a falsely profitable one.

- Using too small sample sizes – Testing a limited number of trades does not represent different market conditions. Reliable results require a broad data set.

- Changing rules during the test – Modifying entries or exits mid-test invalidates results. All rules must remain fixed from start to finish.

- Overlooking losing periods – Focusing only on profits while ignoring drawdowns hides critical risk information. Loss phases are as important as winning ones.

Types of Backtesting

There are several ways to backtest a trading strategy. The choice depends on experience level, available tools and the complexity of the strategy.

Manual Backtesting

Manual backtesting is the most basic and educational approach. Traders scroll through historical charts and apply their strategy rules candle by candle. Each entry, exit and stop level is recorded manually, which forces strict rule awareness and discipline.

This method is slow, but it builds a strong understanding of market structure and behavior. It also helps identify visual patterns and execution challenges that automated tests may overlook. Manual backtesting is especially useful for discretionary and price action strategies.

Spreadsheet Based Backtesting

Spreadsheet based backtesting uses historical price data entered into tools like Excel or Google Sheets. Trades are logged systematically and metrics such as win rate, drawdown and expectancy are calculated automatically.

This approach offers more structure than manual testing and reduces calculation errors. It is suitable for rule based strategies with clear conditions. However, it still relies on accurate data input and consistent rule application to produce meaningful results.

Software and Platform Backtesting

Software based backtesting uses trading platforms or dedicated tools to test strategies automatically. These systems process large data sets quickly and can evaluate thousands of trades across multiple markets.

While efficient, this method carries risks. Poorly defined rules or incorrect data can produce misleading results. Traders must also avoid over optimization, as software makes it easy to adjust parameters excessively without considering real market behavior.

Choosing the Right Market and Data

Backtesting results are only as reliable as the data used. Selecting the right market and timeframe is critical because different instruments behave in different ways. A strategy that works on one asset may fail completely on another.

Historical data must be accurate and complete. Gaps, incorrect prices or missing periods can distort results and hide real risk. Traders should use data that reflects realistic spreads and trading hours.

Timeframe consistency also matters. Testing a strategy on mixed timeframes without clear logic leads to unreliable conclusions. The market, data quality and timeframe must all align with how the strategy is intended to be traded.

Defining Clear Trading Rules

A backtest is only meaningful when every trading decision follows strict and repeatable rules. Clear definitions remove subjectivity and ensure that results reflect strategy performance rather than trader interpretation.

Examples of well-defined trading rules include:

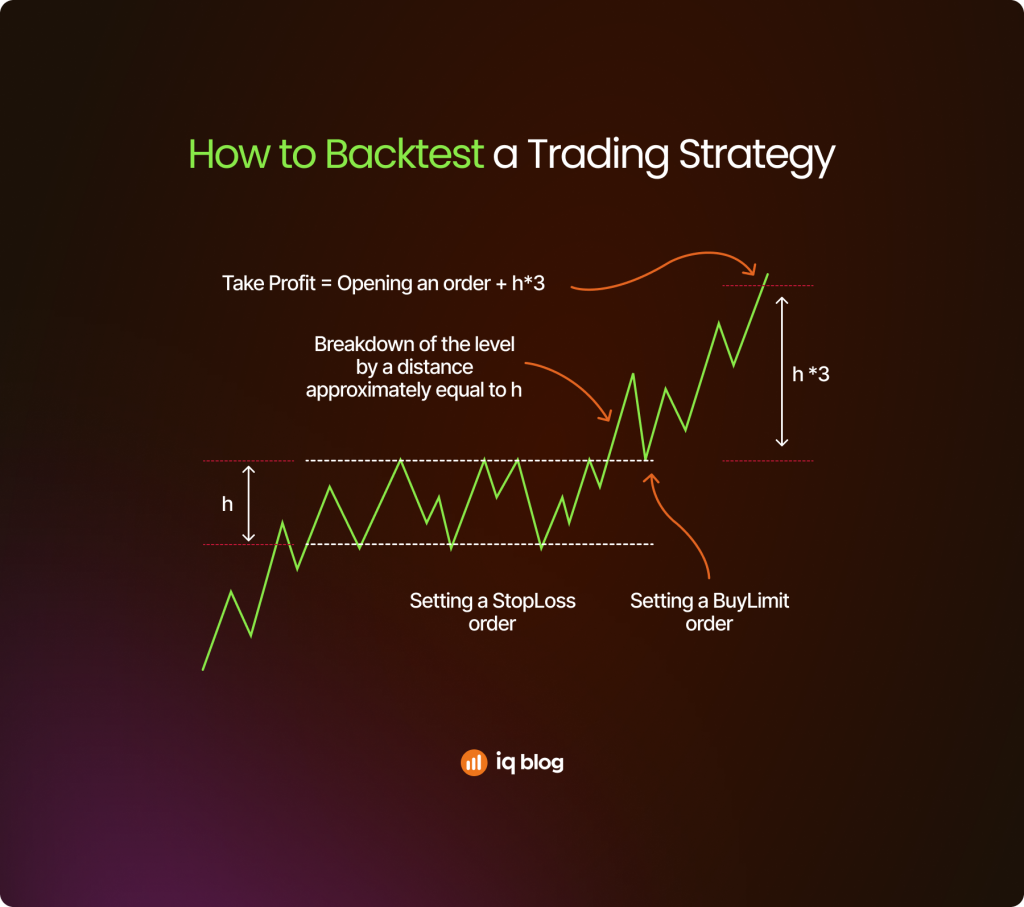

- Entry condition – Enter a buy trade only when the price closes above a clearly marked resistance level and volume is higher than the recent average. This confirms both breakout strength and market participation.

- Stop loss placement – Set the stop loss below the most recent swing low or at a fixed technical level. This limits downside risk and ensures losses are controlled consistently across all trades.

- Take profit rule – Exit the trade at a predefined risk to reward ratio, such as one to two. This creates positive expectancy even if the win rate is below fifty percent.

- Risk per trade – Risk a fixed percentage of total capital on each trade, commonly one percent or less. This prevents a series of losses from damaging the account significantly.

- Time based exit – Close the trade if the price does not reach the target or stop within a set number of candles. This avoids capital being tied up in low momentum trades.

How Many Trades Are Enough

The reliability of a backtest depends heavily on sample size. A small number of trades can produce misleading results that do not represent real market behavior. Consistency across different conditions matters more than short term performance.

Most strategies require dozens and often hundreds, of trades to become statistically meaningful. This ensures exposure to trending, ranging and volatile markets. Fewer trades increase the risk of randomness influencing outcomes.

Backtesting should cover multiple market phases. Testing only during favorable conditions creates unrealistic expectations and weakens confidence in live trading.

How to Run a Proper Backtest Step-By-Step

A proper backtest follows a structured and repeatable process. Skipping steps or adjusting rules during testing reduces accuracy and leads to unreliable conclusions.

- Select the market and timeframe – Choose an instrument and timeframe that match how the strategy is intended to be traded. Consistency here ensures results reflect real usage.

- Prepare historical data – Use clean and complete price data. Missing candles or incorrect prices can distort entries, exits and drawdowns.

- Define all trading rules in advance – Entry, exit, stop loss, take profit and risk rules must be fixed before the test begins. No changes should be made during execution.

- Execute trades consistently – Apply the rules exactly as written, without hindsight or discretionary adjustments. Every trade must be treated the same way.

- Record every result – Log each trade with entry, exit, position size and outcome. Accurate records allow meaningful performance analysis after the test.

Interpreting Backtest Results

Interpreting backtest results requires objectivity. Strong short term profits do not automatically indicate a reliable strategy. Results must be evaluated in the context of risk and consistency.

Traders should focus on drawdowns, losing streaks and performance during difficult market conditions. These factors determine whether a strategy can be traded psychologically and financially.

Backtest results should be realistic. Extremely smooth equity curves or unusually high returns often signal overfitting or unrealistic assumptions rather than a genuine trading edge.

Key Metrics to Track in Backtesting

Evaluating a backtest requires more than checking total profit. The following metrics help measure risk, consistency and long term viability of a trading strategy.

- Win rate – Shows the percentage of profitable trades. A high win rate does not guarantee success if losses are large, so it must be analyzed with other metrics.

- Risk to reward ratio – Measures the average size of winning trades compared to losing ones. A favorable ratio allows profitability even with a lower win rate.

- Maximum drawdown – Indicates the largest loss from peak to trough during the test. This metric reveals how much capital decline a trader must be able to tolerate.

- Expectancy – Calculates the average profit or loss per trade over time. Positive expectancy is required for long term sustainability.

- Number of trades – Reflects sample size reliability. A larger number of trades increases confidence that results are statistically meaningful.

Backtesting vs Forward Testing

Backtesting shows how a strategy performed in the past, while forward testing evaluates it in real time or simulated live conditions. Both are necessary for proper validation.

What Backtesting Shows

Backtesting evaluates a trading strategy using historical market data. It helps identify whether the strategy has a logical edge and how it performs across different past market conditions. This process allows traders to measure drawdowns, win rate and expectancy without risking capital.

However, backtesting removes real world factors such as execution delays and emotional pressure. Results should be viewed as potential behavior, not guaranteed outcomes.

What Forward Testing Confirms

Forward testing applies the strategy in real time using a demo or small live account. It captures real market conditions, including spreads, slippage and execution speed. This step tests whether the strategy functions as expected outside historical data.

Forward testing also reveals psychological challenges. It shows how well a trader can follow rules under live conditions and whether the strategy remains practical over time.

Optimizing Without Overfitting

Optimization aims to improve a strategy, but excessive tuning often destroys its reliability. Overfitting occurs when parameters are adjusted too closely to historical data, creating results that fail in live markets.

A robust strategy should perform reasonably well across different market periods, not perfectly in one specific range. Small changes in settings should not drastically alter results.

Traders should focus on stability rather than maximum profit. Simple rules with consistent performance usually outperform highly optimized systems that rely on precise conditions.

Tools for Backtesting Trading Strategies

Using the right tools improves accuracy and saves time during backtesting. Each tool serves a different purpose depending on strategy type and experience level.

- Charting platforms – Allow manual and visual backtesting directly on historical price data. They help traders verify entries, exits and market context with precision.

- Spreadsheets – Enable structured trade logging and automatic calculation of key metrics such as win rate, drawdown and expectancy. They support detailed performance analysis.

- Platform built in testers – Many trading platforms include strategy testers that automate rule based backtests. These are useful for systematic strategies but require careful setup.

- Dedicated backtesting software – Designed for large data sets and advanced testing. These tools offer speed and depth but can encourage over optimization if used without discipline.

- Trading journals – Support long term analysis by storing backtest results alongside live trades. They help compare historical expectations with real performance.

Turning a Backtested Strategy Into a Live Plan

A successful backtest is only the first step. Moving directly to full size live trading increases risk and pressure. A structured transition is essential.

The strategy should first be traded in a demo or simulation environment. This confirms that execution matches backtest rules under real market conditions. Position size should remain small during early live testing.

Gradual scaling reduces emotional stress and financial risk. Capital exposure should increase only after consistent results and disciplined execution are proven over time.

Final Thoughts on Backtesting a Trading Strategy

A Trading Strategy Backtesting is a key component of forming a dependable trading strategy. It replaces assumptions and conjecture with data and allows a trader to grasp risk and potential rewards prior to investing.

There also has to be a structured, realistic and disciplined approach. Simple techniques, when properly checked, work better than sophisticated models. When coupled with strategic testing and risk analysis, backtesting then really is a potent starting point for long-term trading performance.