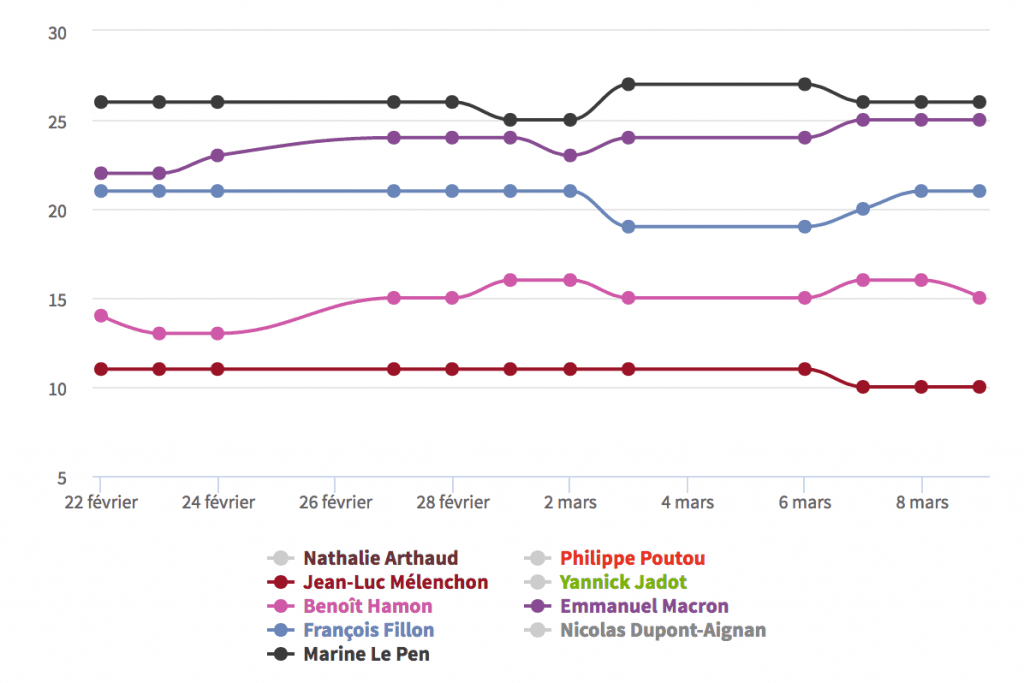

Marine Le Pen, president of France’s National Front, a far-right political party and a candidate in France’s upcoming election, appears to be gaining ground on her opponents. Opinion polls show that support for the anti-euro candidate remaining at 26% with Macron and Fillion remaining unchanged around at 23% each.

French Polls

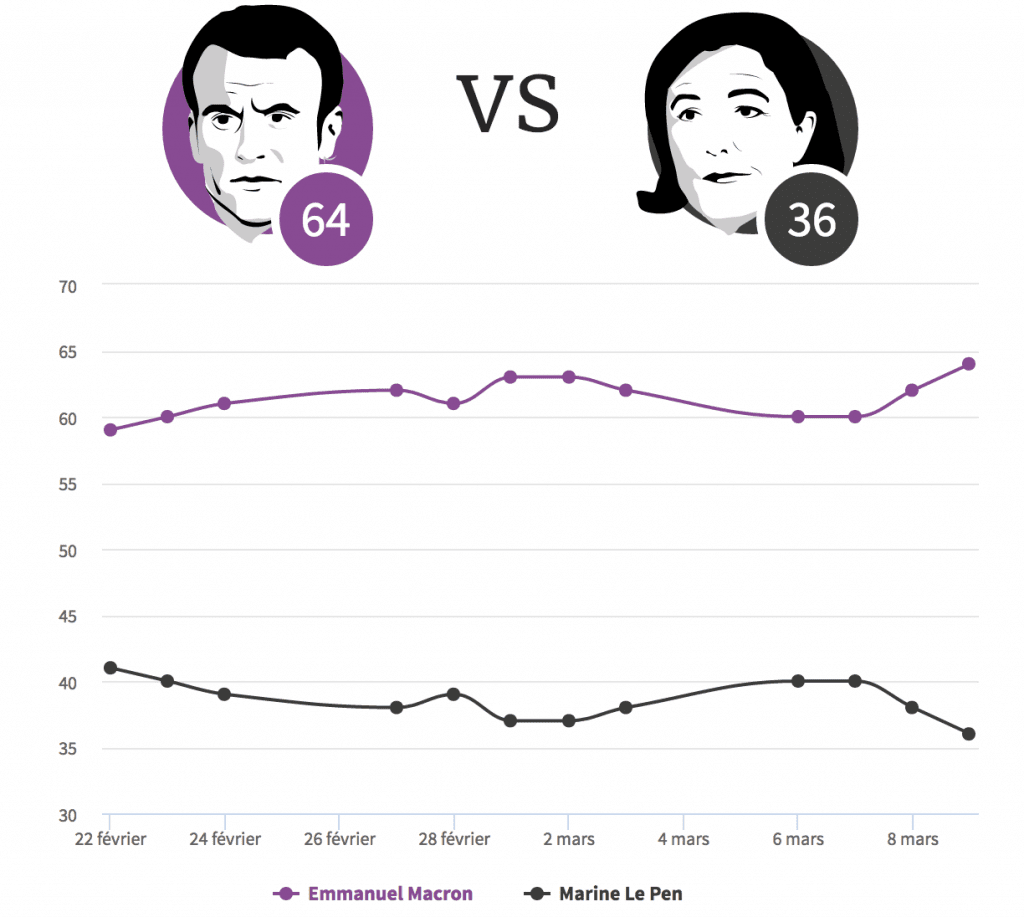

Though polls are not predicting a victory for Le Pen in May, she is making up ground very quickly as she has roughly cut Macron’s lead by half in less than two weeks. Le Pen’s tough stances on terrorism and her support of leaving the European Union have begun to win her support from those growing uneasy in the face of increased terror attacks.

Le Pen, who is opposed to free trade and autarky, advocates a viewpoint that seeks to control the out of control and unchecked free trade torrent. She supports an international monetary system and the end of unbridled free trade through reasonable protectionism that encourages cooperation in trade among nations. She also supports a French departure from the European Union.

Le Pen Consequences on the Global Market

A Le Pen France would have major consequences on the global market especially for crude oil trade. This week marked the largest potential change in the Brent crude oil benchmark in a decade. With the addition of a new grade added to the mix, the price benchmark appears to be headed for a large shakeup. Norway’s Troll crude will be included alongside existing grades of crude oil that make up the Dated Brent benchmark. Troll crude has been pumping at a rate of around 200,000 barrels over the past year.

The Brent benchmark is used as a baseline for a majority of the world’s state-run oil producers who sell to other consuming nations. With the addition of Norway’s Troll grade, it will lead to an increase of 20% more barrels to the equation. This will create a boost for some producers and a decrease for others.

If Le Pen can make up the deficit in her opponents lead and win the election this could bounce crude oil trade with France and Europe on its head. Currently as long investments in oil are at record levels; it seems that crude oil trade stands to lose the most in the event of a Le Pen victory. Estimates show that with a Le Pen victory that the Euro could fall as much as 10% if Le Pen wins and oil could fall as much as 5-10% as well.

The travailing consequences would have negative effects on currencies around the world and drastically affect crude oil trade and benchmarks. A departure from the EU would create a negative pressure on oil prices that would be driven by oil companies risk aversions. If Le Pen does somehow take office and implements her ideologies the oil markets would have to react immediately and it would make oil trade very difficult. As Norway’s Troll introduction may help the crude oil industry to rebalance supply and demand a Le Pen victory would quickly overwhelm and disrupt oil trade.