Grid trading is a method in which a trader does not just open one deal, but rather creates a sequence of orders at incrementally increasing or decreasing prices around the current price point. The amount of orders depends on the trader, what matters is that they are all set in regular intervals.

When could it be potentially used?

This method is intended to take advantage of the market volatility and execute as many orders as possible during price fluctuations. The grid method might be useful in a ranging market when there is no particular trend.

The advantages of such an approach are evident: this strategy usually works in unpredictable conditions where the price keeps bouncing up and down. With that said, the trader should still have an approximation on when to end the grid and exit the deals.

Nonetheless, it is worth noting that no indicator can guarantee accurate information 100% of the time. From time to time all indicators will provide false information, and the Grid method is not an exception. It is your duty, as a trader, to understand true signals from false ones.

Running with or against the trend

There are two ways to implement this method. Trading with-the-trend suggests placing Buy orders above the entry point and Sell orders below it, when expecting the price to trend in one direction. An opposite method involves placing the Sell orders above the entry and Buy orders below it, if the price is expected to swing up and down. This approach is called against-the-trend.

How to apply it?

Let’s look at an example of how the grid method could be executed on Forex on the IQ Option platform.

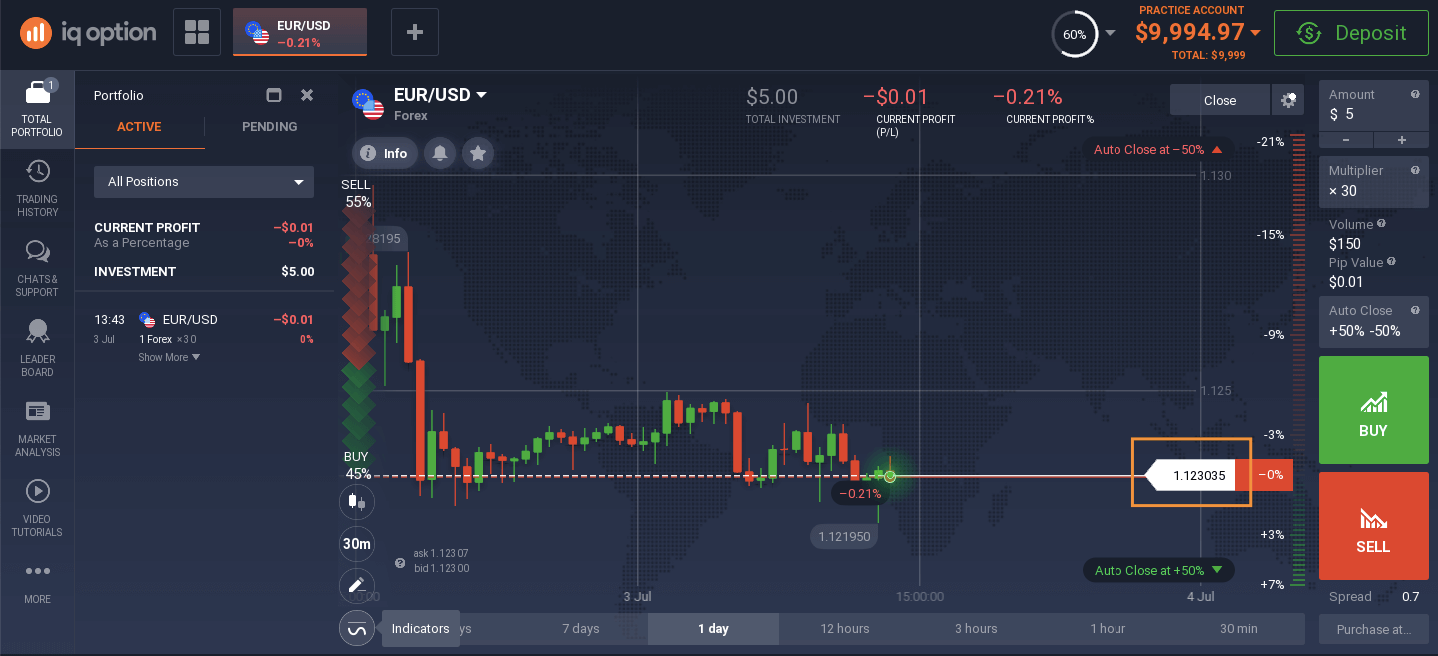

In the example, the with-the-trend approach is being used. A Sell deal was opened on EUR/USD with a $5 investment. The deal is opened at the level of 1.1230.

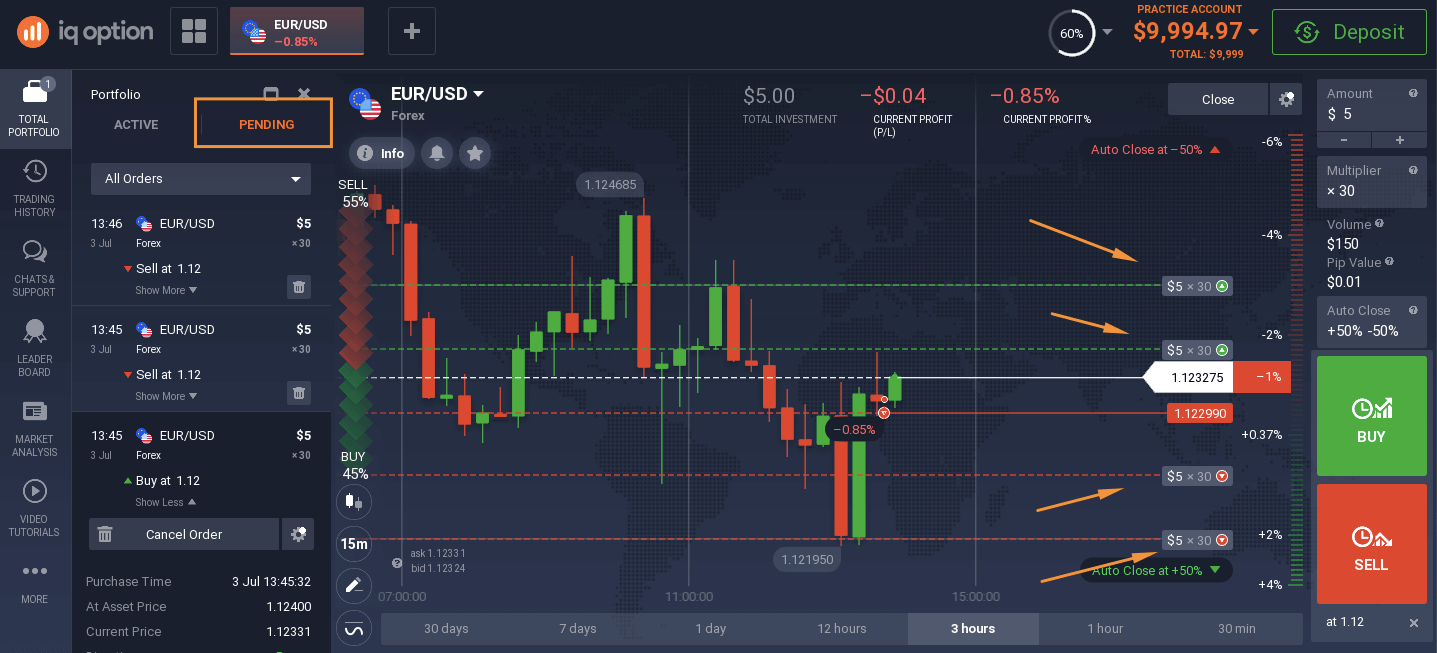

According to the grid strategy, several pending orders should be created at the same distance from one another. In this example, an interval of 5 pips was chosen and 2 levels above and below the starting point. Which means that two pending Sell orders at the levels of 1.1225 and 1.1220 and two Buy orders at the levels of 1.1235 and 1.1240 were created.

Take Profit and Stop Loss levels were also set for each of the deals, which is very important as it adjusts the order to close if it reaches a certain profit or loss level. It allows for managing the risks related to this strategy.

What is left to do is to wait until the price runs up or down, triggering the orders. There could be more orders in the grid, the standard amount that traders generally use is 3-5.

There are two ways to exit the deals: either close the full grid at the same time, or close the deals one by one once they reach a certain target.

Step by step guide

In order to better understand how this approach works, you may try it out on the practice account. Here is a checklist of the necessary steps in order to implement the grid trading method. You may save them or write them down for your next trading plan.

1. You may decide if you will be opening orders with-the-trend or against it.

2. You may decide on an entry point, amount of pending orders and the interval between them.

3. You may determine the investment amount and the Stop Loss/ Take Profit levels. Make sure you have a good understanding of the potential losses you may bear in case the market goes against you.

4. You may create the pending orders, making sure to stick with the plan.

5. You may exit the deals once the desired amount of profit is generated or when the acceptable loss level is reached.

Note that there is no strategy that has a 100% success rate. Grid trading is not an exception: this approach requires learning and strategizing and it may cause financial losses.