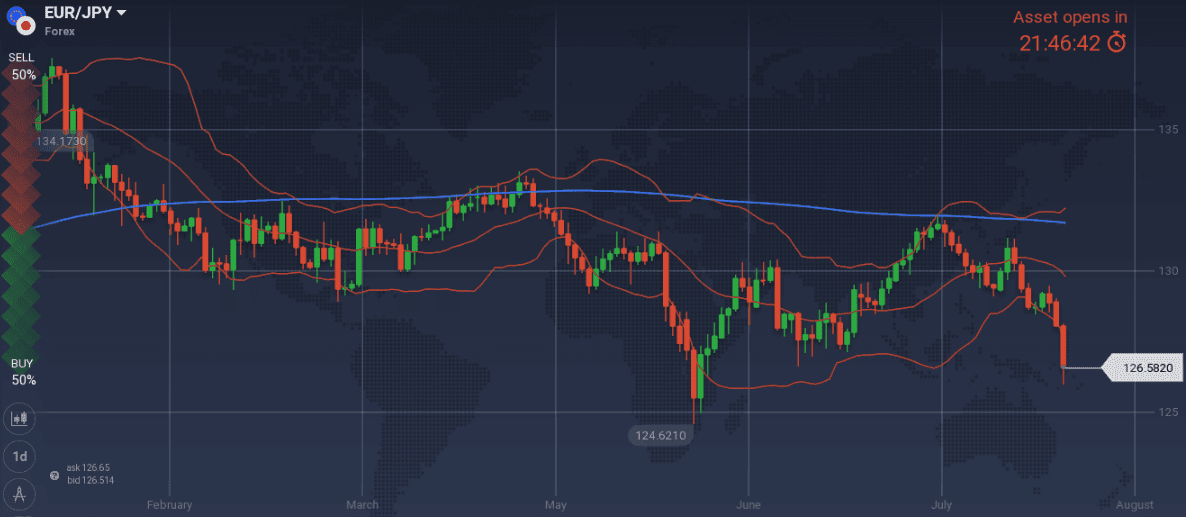

Friday has been disastrous for my last week’s forecasts as TRY plummeted, strengthening safe havens (JPY, USD) beyond expectations. EUR/JPY did not consolidate within 128.30~131.88 range, AUD/USD did not bounce at 0.7365, EUR/USD did not bounce at 1.1510 and GBP/USD found no support. No view has been offered for USD/CAD.

Major last week’s events (a week that traditionally included geopolitical, market moving events):

- Tariffs front: 25% tariffs decided to be imposed as of 23 of August on 16B$ worth of Chinese products. China would retaliate reciprocally.

- NAFTA: No news under my radar

- Turkey: No actions has been taken by Turkish Central Bank, the announcements made on Friday by Turkish government were not persuasive and USD/TRY reached 6.7480

- Iran, Syria, North Korea: Rouhani (Iranian PM) is said to be willing to negotiate with US in a week that marked the first 90-day period for companies to follow US directions and wind down their projects and trading in Iran.

- US Transformation: No news.

- Cryptos: Total market cap collapsed to 207$, -22% w/w, as expectations for an ETF on Bitcoin are fading away

Major next week events:

- Monday’s OPEC monthly report. Note that on latest July’s report a concurrent decline of global demand and increase of global supply has been recorded.

JPY

Snapshot mixed:

- Core CPI (=BOJ’s compass) at 0.8% (vs 2.0% target and BOJ’s members expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.00% annual, 0.5% q/q, 10Y Government bonds yield at 0.10% (-1bps w/w) vs BOJ’s target of 0.00±20% level

- Unemployment at 2.4%

Strengths of JPY:

- QQE will stay, up until core CPI reads 2.0% in a stable manner. The scheduled VAT hike on Oct19, rules out any possible monetary policy change, earlier than 2020.

- increasing inflation, retail sales, improved GDP reading, trade balance, increased Manufacturing PMI

- continued devaluation of CNY

- TRY plummeting

Weaknesses of JPY:

- equities bear scenario is fading away as earnings are impressive and the negative effects of tariffs on global GDP is priced in without exaggerations

- decreased readings of Services PMI, monetary base, household spending, bank lending, machine orders

Watch:

- No market moving announcement is expected

- Next Monetary Meeting on 19 September

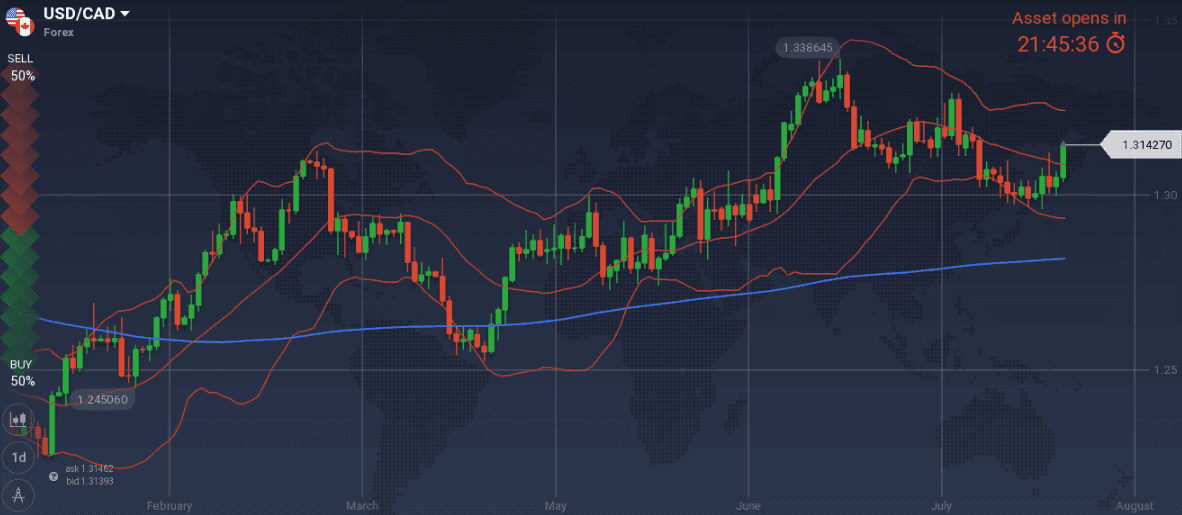

CAD

I could short USD/CAD at 1.3150 and 1.3240 given that OPEC’s monthly report favors oil picking up.

Snapshot mixed:

- Inflation at 2.5% (on target), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 2.3% (vs BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.30% (-5bps w/w)

- Unemployment decreased to 5.8%

Strengths of USD/CAD, weakness of CAD:

- last week’s south move was huge, given that oil did not appreciate, so a bounce back up until 1.3120 level, is possible

- latest disappointing housing market readings

- oil strengthening as a result of sanctions on Iran being implemented, has not yet materialized

Weaknesses of USD/CAD, strengths of CAD:

- strong GDP, trade balance, retail sales and unemployment readings

- Nafta negotiations are proceeding

Watch:

- Monday’s OPEC monthly report on oil market

- Friday’s inflation readings.

- Next Monetary Meeting on 5th of September.

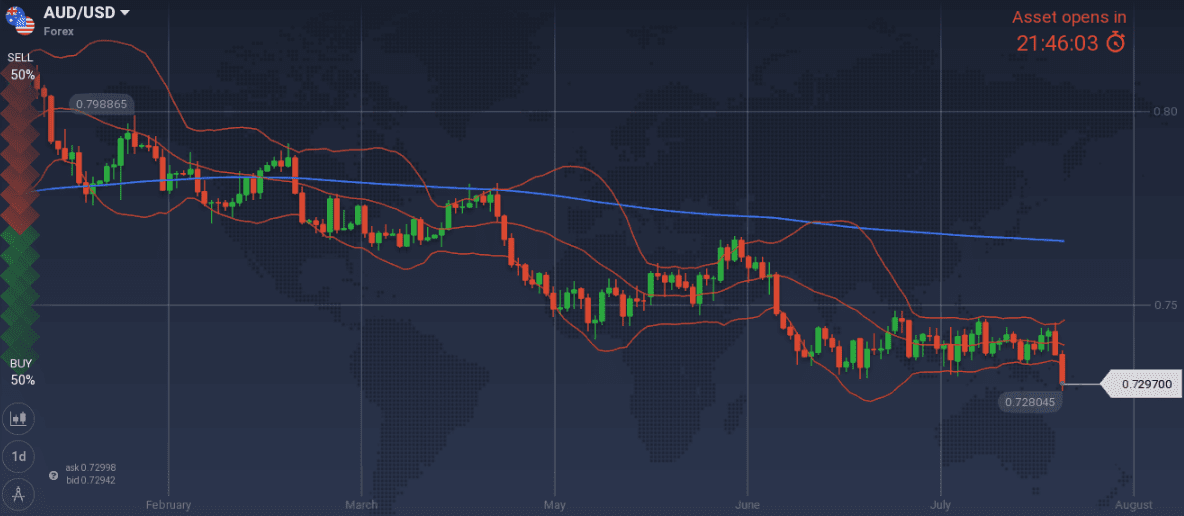

AUD

I could add to my long AUD/USD trade at 0.7284.

Snapshot unchanged:

- Inflation at 2.1% (vs 2.0~3.0% target, and expected to decline during 3Q18), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.59% (-14 bps w/w)

- Unemployment at 5.4% (expected to reach 5.0% by 2020)

Strengths:

- significant increase of GDP

- improved business confidence & profits, private capital expenditure, building approvals, new home sales and latest impressive increase of consumer sentiment

Weaknesses:

- Market participants expect the rates to remain unchanged for a considerable period of time

- Political landscape in Australia is changing following elections in Tasmania and Queensland

- inflation expected to fall, and increased trade balanced is not expected in the near future

Watch:

- Wednesday’s wage price index, Thursday’s inflation expectations and unemployment readings. All releases could show increased numbers and favor the long AUD/USD trade.

- Next Monetary Meeting on 4th of September

USD

Last week I was expecting that USD would eventually weaken. Nevertheless, I have warned my readers to watch for the 10y Bond Auction and the m/m change of Wholesale inventories because an increasing number would contradict the short USD scenario.

I hope the Thursday’s 15.00GMT release of wholesale inventories -before the USD’s north move above 95.23- saved my readers from committing to a short USD trade.

I keep being biased to short USD.

Snapshot unchanged:

- Core PCE (=FED’s inflation compass) at 1.90%, FED ‘s rate at 1.95% (IOER) and expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 4.1%, 10y Bond yields at 2.87% (-8 bps w/w)

- Unemployment at 3.9% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- strong macros: GDP reading, Factory orders increasing, Manufacturing and services PMI continue to be above 55 for an extended period

- the increasing wholesale inventories coupled with decreasing consumer credit are alarming signals that do not help equities and push USD higher as it enjoys a safe haven status.

- TRY plummeting

Weaknesses of USD:

- S&P500 continues to be above the technically significant level of 2822.

- 10y Government Bond yields refusing to cross 3.0% yield

- I assume Erdogan (Turkish PM) will eventually let his central bank defend TRY and current overpriced fear will fade away. Turkey is not Venezuela.

Watch:

- Wednesday’s Unit Labor cost q/q change. A small number is expected, but in case the reading is above 1.0% it may push USD higher.

- Next Monetary Meeting on 26 September, when a new hike is expected.

EUR

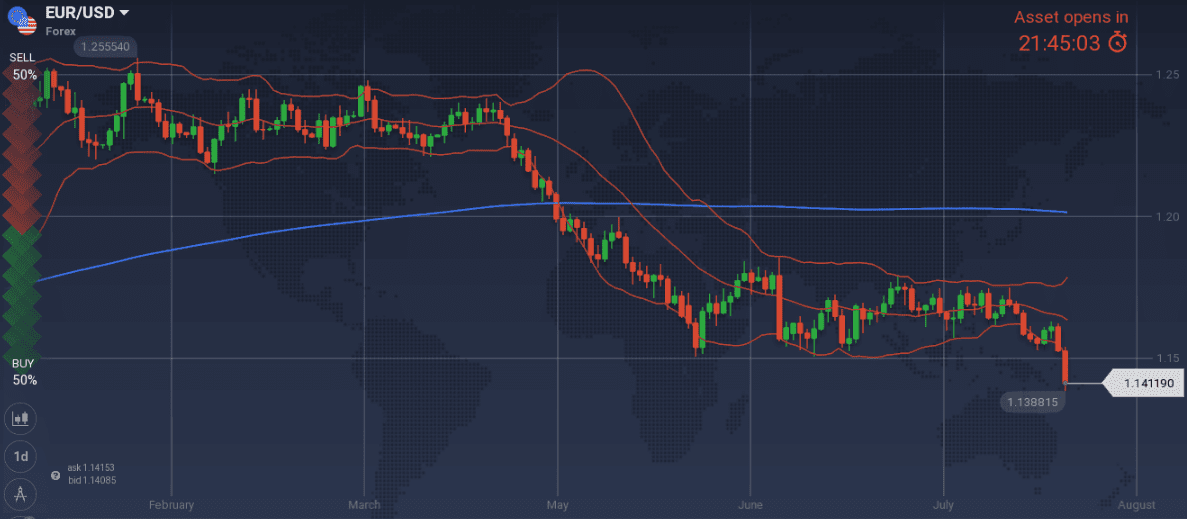

I keep my long EUR/USD position, opened at 1.1510, and expect a bounce as the pair approaches the 200Day Moving Average.

Snapshot unchanged:

- Annual CPI at 2.1%, core CPI (=ECB’s compass) at 1.1%, ECB ‘s rate at 0.00%

- GDP at 2.1% growth (OPEC expects a 2.2% reading), 10y Bond yields of EFSF at -0.35% (-3bps w/w), 10y German Bond yields at 0.32% (-9bps w/w), 10y Italian Bond yield at 2.99% (+6bps w/w)

- Unemployment at 8.3%

Strengths of EUR/USD:

- M3 growth, service and manufacturing PMI levels

- increasing inflation and decreasing unemployment

Weaknesses of EUR/USD:

- the devaluation of CNY argument is pointing more to EUR/USD weakening than strengthening.

- any possible equity sells off

- latest decreased GDP reading, business climate and confidence readings refusing to increase

- divergence of monetary policy between EU and US, that can only be simulated with two expected down facing waves on September and December

Watch:

- Tuesday’s ZEW Economic Sentiment that is expected to increase

- Wednesday is a Bank Holiday

- Thursday’s Trade Balance, Friday’s Current Account and Friday’s inflation readings that I want them to confirm expectations for my long EUR/USD scenario to stay valid. Trade Balance bellow 16.5B€, Current Account bellow 23.2B€ and core CPI bellow 1.1% may send EUR lower.

- Next Monetary Meeting of ECB on 13th of September.

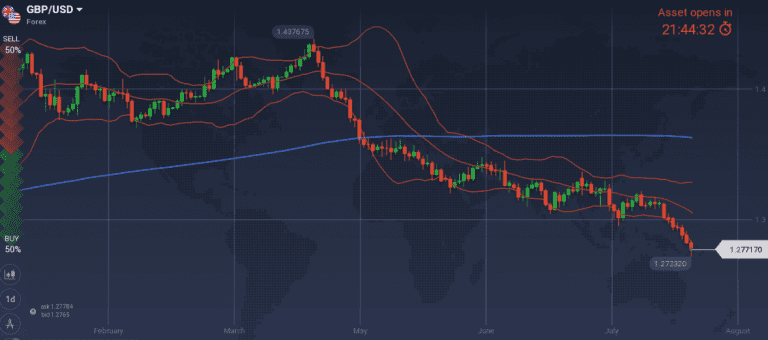

GBP

Week began with Liam Fox (UK’s trade secretary) arguing for the likelihood of a no deal scenario, adding to Mark Carney’s (Governor of BOE) last week’s reply during the monetary press conference, that the range of Brexit outcomes is wide.

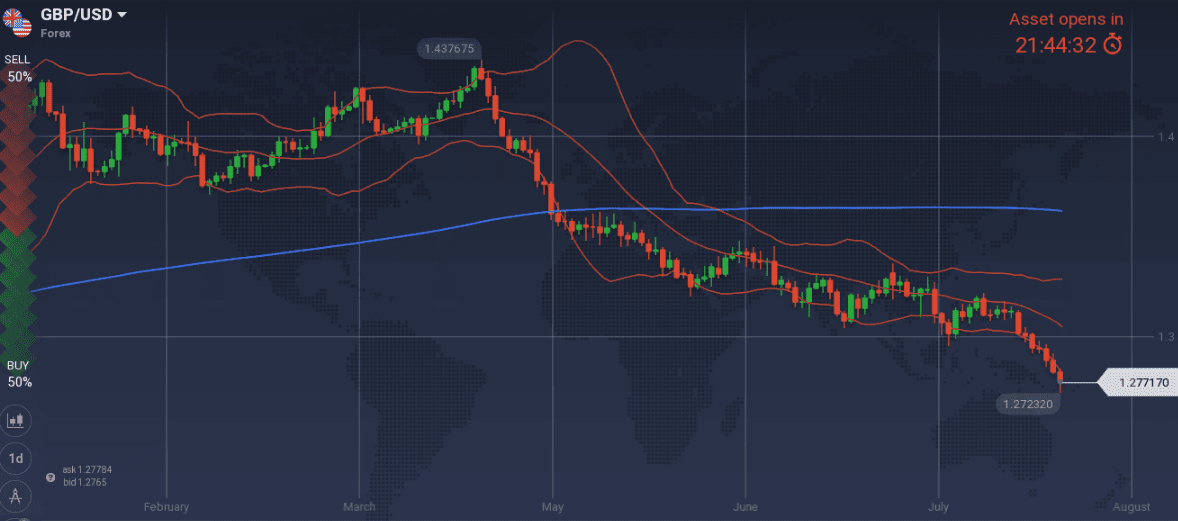

I stand my ground that UK will find a productive way to finalize its relations with EU and that current GBP levels will prove low.

I am re-entering long GBP/USD at 1.2550 level, targeting 1.3800.

Snapshot improved:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.75%

- GDP increased to 1.3% growth (1.4% OPEC’s estimates vs 1.75% BOE’s expectations), 10y Bond yields at 1.24% (-9bps w/w)

- Unemployment at 4.2% (BOE expects to fall further in Q2)

Strengths:

- the bad weather narrative for Q1 still makes sense.

- despite last week’s indications that favor the hard Brexit scenario, I keep my view that markets are overpricing the probability of a hard Brexit.

- Macro picture is improving (GDP, construction activity and housing market)

Weaknesses:

- latest M4, retail sales and average earnings

- latest Manufacturing and Services PMI that were decreasing

Watch:

- Wednesday’s inflation readings. An increased 2.5% reading could well be a reason to send GBP higher

- Next Monetary Meeting on 13th of September.