Last week’s forecasts were not triggered, despite pointing to the correct direction. Long USD, short EUR/JPY, short EUR/USD was the correct thing to do, but the advised entry levels were missed by more than 25pips. I have offered no view for AUD and GBP, and the short USD/CAD trade is 8 pips in the red.

Major last week’s events:

- Tariffs’ front: The additional round of tariffs of $200bn worth of Chinese products are set to be announced in the next 3 weeks, following the end of public hearing procedure.

- NAFTA: Negotiations between USA and Canada continue and could finalize by the end of September. Issues to be resolved are: (a) Canadian dairy industry and subsidies given, (b) Chapter 19 on how disputes are settled, (c) Canadian companies’ access to US government contracts, (d) ending of steel and aluminum tariffs, (e)5year or 16-year expiration date of the deal.

- US Transformation: An anonymous letter against Trump produced by someone in the White House offered some headlines during the week

- Turkey-Russia-Iran: Officials met in Iran to talk on Syria. Note that Turkey and Russia are supporting opposing sides.

- Turkey: A side effect of TRY drop was a rally in the Occupied Northern Cyprus, where Turkish Cypriots protested the rising cost of living

- China: New tax breaks were promised to bank so that they could increase the loans.

- Cryptos: Total market cap at 204B$, -12% w/w, -75% from the 800B$ peak. Goldman Sachs is pulling back from establishing a crypto trading desk and Kraken (crypto exchange) announced the firing of 57 Employees (equal to 10% of its client service team office in California). I would go long ETH at 204$ for a quick 20% gain

Major next week’s events:

- 10-year anniversary since the collapse of Lehman Brothers

- Wednesday’s release of OPEC’s monthly report. I am expecting an oil rally

- Thursday’s Monetary meeting of the ECB, the BOE (Bank of England), and the Central Bank of Turkey. I would short USD/TRY with a sell stop order 800pips below the market price, targeting 5.81

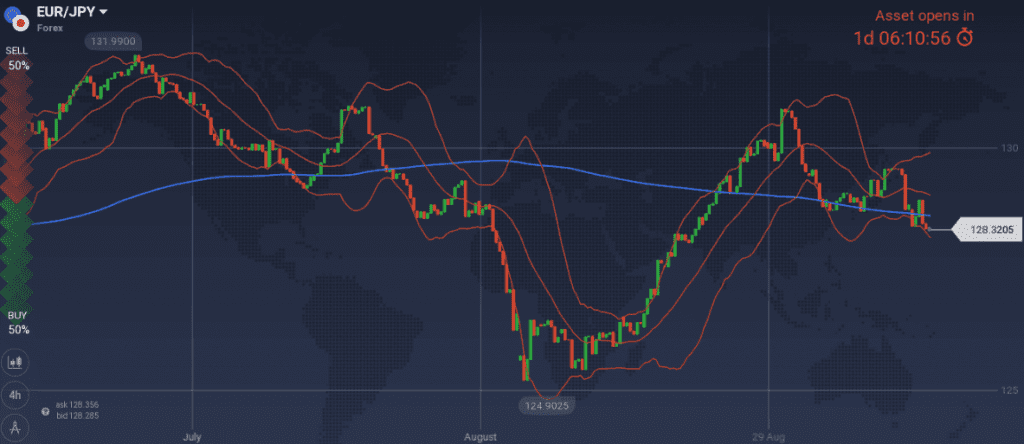

JPY

I keep my short EUR/JPY bias and would re-enter short at 130.23 and 131.32 levels.

Snapshot unchanged:

- Core CPI (=BOJ’s compass) at 0.8% (vs 2.0% target and BOJ’s members’ expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.00% annual, 0.5% q/q, 10Y Government bonds yield at 0.11% (+0bps w/w) vs BOJ’s target of 0.00±20% level

- Unemployment increase to 2.5%

Strengths of JPY:

- QQE will stay, up until core CPI reads 2.0% in a stable manner. The scheduled VAT hike in Oct’19, rules out any possible monetary policy change, before 2020.

- Increasing retail sales, improved GDP reading (new reading expected this week) , increased Manufacturing PMI, impressive capital spending reading

- I cannot offer a reasoning, but the result of all physical disasters happening in Japan, is a strengthened JPY.

Weaknesses of JPY:

- decreased Services PMI and trade balance. New readings of monetary base, bank lending and machine orders, that disappointing during the previous month, are expected this week

- increased unemployment reading

Watch:

- Monday’s Current Account and GDP q/q reading.

- Tuesday’s M2 and Wednesday’s Manufacturing Index. Both are expected higher favoring JPY

- Next Monetary Meeting on 19 September

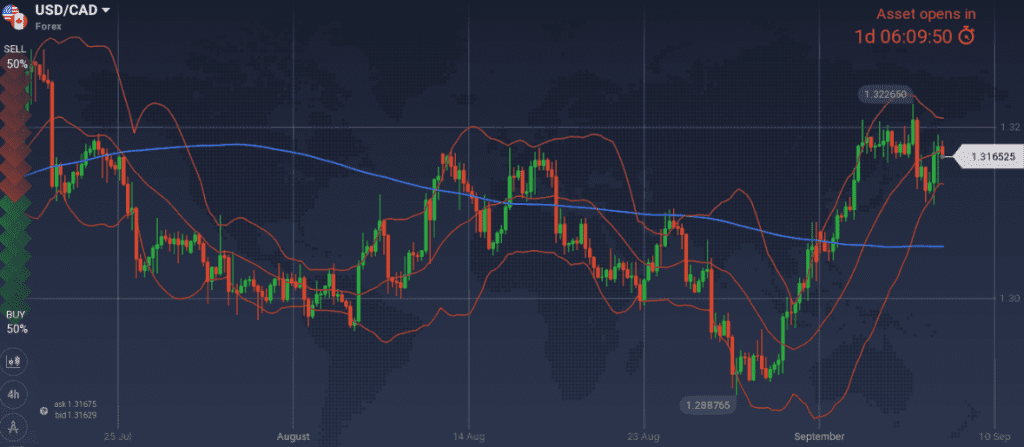

CAD

I am confident with my short USD/CAD position and could re-enter at 1.3192.

Bank of Canada did not raise rates, but a hike is possible on October’s meeting. For now, the high inflation was attributed to the temporal airfare increase and not to excess demand pressures. A bad outcome of Nafta negotiations would be translated to a -0.66% GDP adjustment, but the likely positive outcome has an upside potential.

Snapshot deteriorated.

- Inflation at 3.0% (vs 2.5% target, BOC expects 2.0% within 1Q19), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 1.9% (vs. BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.29% (+6bps w/w).

- Unemployment increased to 6.0%

Strengths of USD/CAD, weakness of CAD:

- latest disappointing GDP m/m and unemployment reading

- housing market, wholesale sales and retail sales readings

Weaknesses of USD/CAD, strengths of CAD:

- I am expecting a new oil rally following Wednesday’s OPEC report.

- NAFTA negotiations are proceeding. I am expecting a CAD rally once a deal is reached

Watch:

- Any news on NAFTA negotiations

- Wednesday’s OPEC report.

- Next Monetary Meeting on 24 October

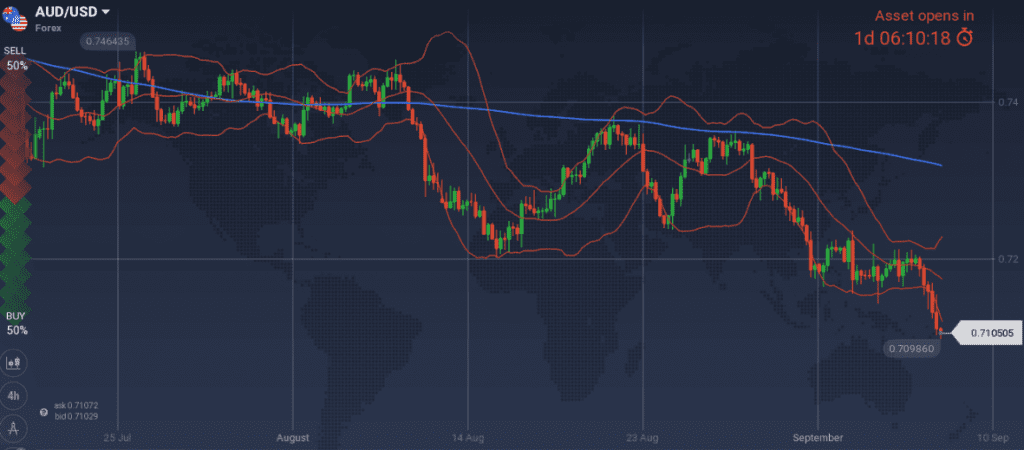

AUD

I will enter long AUD/USD at 0.7000 level

RBA (Australian Central Bank) left interest rates unchanged and noted that the dynamics of housing market has changed as it has become a buyers’ market.

Snapshot unchanged:

- Inflation at 2.1% (expected at 1.75% later in 2018 and then higher in 2019), RBA ‘s rate at 1.50% (no hike so far)

- GDP increased to 3.4% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.55% (+3 bps w/w)

- Unemployment at 5.3% (expected to reach 5.0% by 2020)

Strengths:

- AUD has become extremely undervalued at current 0.7100 level and a rebound is likely

- Australian political drama is over

- GDP is increasing

Weaknesses:

- market participants expect the RBA’s rate to remain unchanged for a considerable period

- decreased trade balance, current account and company operating profits

- decreasing capital expenditure, building approvals and home sales

Watch:

- Tuesday’s re-opening of Australian Parliament

- Wednesday’s consumer’s sentiment

- Thursday’s Unemployment rate

- Next Monetary Meeting on 2 October

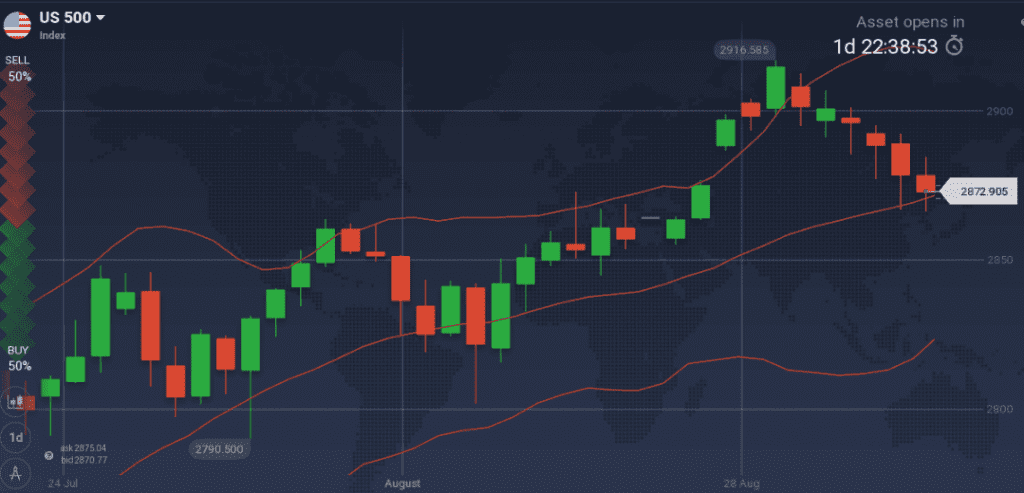

USD

I keep my long USD bias

Snapshot unchanged:

- Core PCE (=FED’s inflation compass) at 2.0%, FED ‘s rate at 1.95% (IOER) and expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP increased to 2.9%y/y (reached OPEC expectations for 2018), 4.2% q/q, 10y Bond yields at 2.89% (+4 bps w/w)

- Unemployment at 3.9% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- inflation is contained (labor cost data decreased & Trump canceled a 2.1% wage raise for federal employees) and at the same time the Fed cannot postpone the rate hiking, given its forward guidance is described as a policy tool and given that markets are currently pricing 99.8% probability of a rate hike on September and 77.6% probability of an additional rate hike on December.

- strong macros (GDP, Manufacturing PMI, Non-manufacturing PMI, Service PMI)

- two new narratives capable of boosting US markets for another semester are in the making (a) indexing inflation so that long term capital gains are taxed lower (b) publishing earnings every 6 months instead of every 3 months can bring creative accounting.

Weaknesses of USD:

- 10y Government Bond yields remain below 3.0%.

Watch:

- Tuesday’s Wholesale Inventories. A number above 0.7% may trigger US-equity sell off and strengthening of USD

- Wednesday’s 10y Government Bond Auction &Thursday’s inflation readings

- Friday’s business inventories m/m. A number above 0.4% may trigger US-equity sell off and USD strengthening

- Next Monetary Meeting on 26 September, when a new hike is expected.

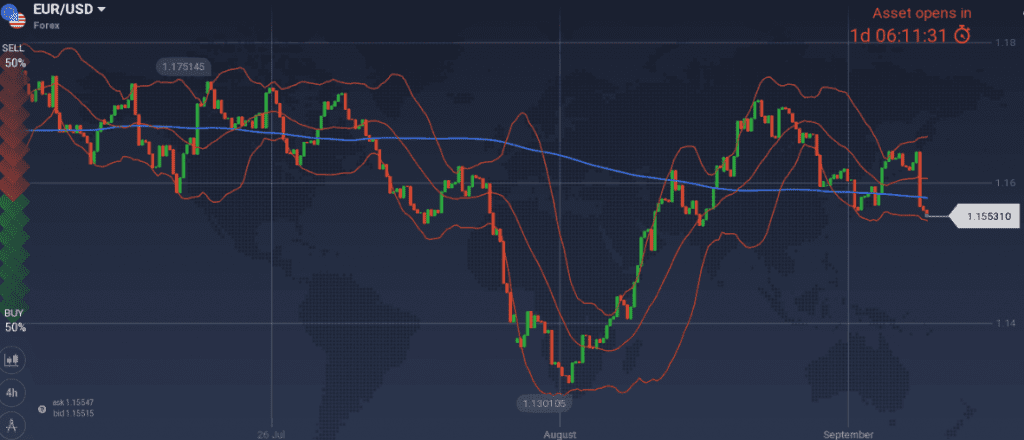

EUR

I am shorting EUR/USD at 1.1720, as current 1.1550 level does not offer enough room for trading.

Snapshot was mixed:

- Annual CPI at 2.0%, core CPI (=ECB’s compass) at 1.0%, ECB ‘s rate at 0.00%

- GDP decreased to 2.1% growth (OPEC reduced expectations to 2.0%), 10y Bond yields of EFSF at -0.37% (-4bps w/w), 10y German Bond yields at 0.37% (+4bps w/w), 10y Italian Bond yield at 2.82% (-42bps w/w), 10y Greek Bonds yields at 4.30 (-10bps w/w, at the third week following bailout protection)

- Unemployment at 8.2%

Strengths of EUR/USD:

- decreasing bond yields of European periphery, decreasing unemployment

- service and manufacturing PMI levels are stable and above the 50 thresholds

Weaknesses of EUR/USD:

- we are 40 days away from Bavarian elections and the announcement of Italian’s government budget.

- the different stages of monetary policy between EU and US, can only be simulated with two expected dips of EUR/USD, in late September and mid-December

- a possible decline of US equities would fuel a risk off environment, where EUR is generally falling

- decreased M3 and retail sales readings

Watch:

- Monday’s Investor’s Confidence and Tuesday’s Economic Sentiment

- Thursday’s ECB’s Monetary Meeting. No policy change is expected, and my focus would be on the press conference

GBP

Avoiding forecasts for GBP is the correct thing to do. On the 29th of August it was the “Brexit deal within our sights Minister Raab said” headline that moved GBP within minutes. On the 5th of September it was the “Germany and UK drop key Brexit ask, easing the path to deal” Bloomberg headline that moved GBP.

Both failed to have a long-lived effect on GBP, so I would advise to use any other similar headline to exit from any long GBP trades.

Snapshot unchanged:

- Inflation at 2.5% (vs 2.0% target), BOE ‘s rate at 0.75%

- GDP at 1.3% growth (vs 1.75% BOE’s expectations and 1.3% decreased OPEC’s expectations), 10y Bond yields at 1.46% (+3bps w/w)

- Unemployment at 4.0%

Strengths:

- the bad weather narrative for the abnormally low GDP number of Q1 still makes sense.

- Macro picture is improving: GDP, unemployment, construction activity and housing market. New numbers for GDP and unemployment are coming during the week.

- positive macro releases: Services PMI, Consumer Confidence, M4, consumer’s inflation expectations increased

Weaknesses:

- a no deal with EU is possible. In this case UK would be able to be competitive to EU regulatory wise but would lose tax revenues from the decrease of financial activity in the City.

- the no deal scenario has already been characterized as bad outcome by Mark Corney (Governor of BOE) and has been quantified to be equal to a £80bn in public finance by Philip Hammond (Head of Treasury)

- Negative macro releases: decreased average earnings, industrial order expectations, manufacturing and construction PMI

Watch:

- UK politics

- Monday’s GDP m/m, manufacturing production m/m, industrial production m/m

- Tuesday’s unemployment rate

- Thursday’s BOE’s monetary meeting. No policy change is expected