A US dollar rally that never materialize and a Canadian dollar strength due to increasing oil prices were the main trends for last Friday 5th May 2017.

US dollar

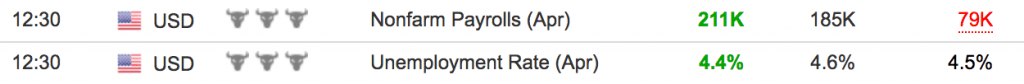

The change for Non-farm payrolls for the month of April 2017 was 211,000 versus an estimate of 185,000, a strong sign that US economy is growing at least for the labor market and there are employment and potential inflation pressures.

Change in Private Payrolls was also good with a reading of 194,000 versus estimate of 190,000. The unemployment rate for the US economy fell to 4.4% versus estimate of 4.6%.

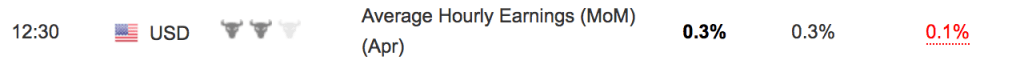

The Average Hourly Earnings for the month of April 2017 came at 0.3% versus estimate of 0.3% on a month-over-month period while on a year-over-year basis the Average Hourly Earnings were lower than expected as the reading for was 2.5% versus estimate of 2.7%.

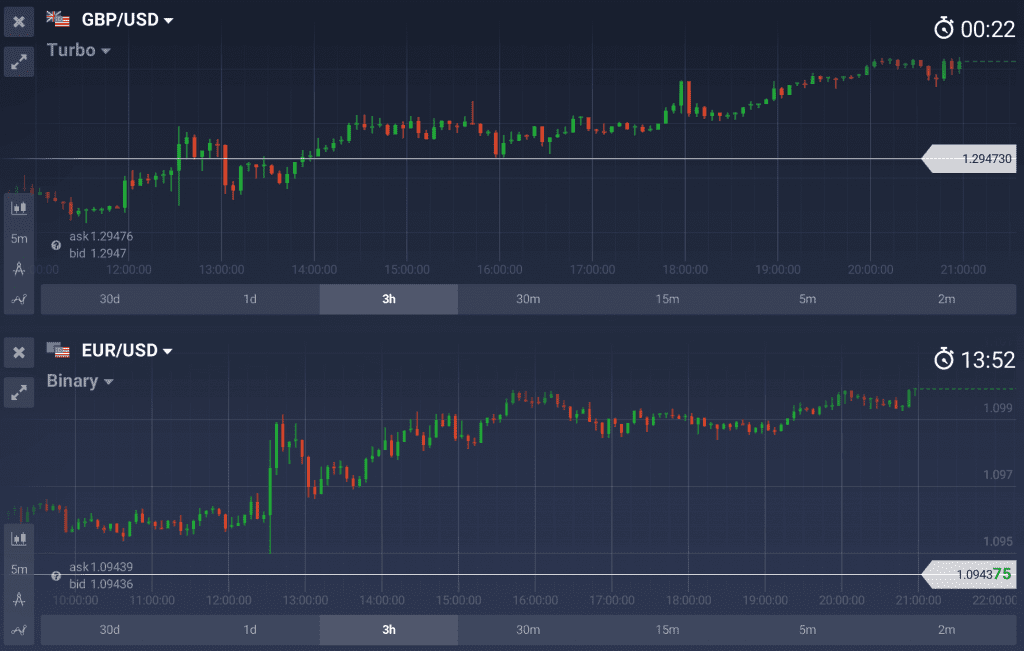

Overall these fundamental news show a strong labor market for the US economy and an increased possibility of an interest rate hike next month. As these news were positive the US dollar did not rally or strengthen as it did in the past. The EUR/USD pair after the release of the US economic news moved initially down, but soon recovered and ended the day higher at 1.0990, the GBP/USD also moved higher and ended at 1.2987.

Both the Euro and British Pound continue to appear very strong against the US dollar and this week this trend could change as the forex market will focus on the outcome of French elections and perhaps more on the fundamentals than just on sentiment.

Canadian dollar

As mentioned the oil prices are for now a very important key driver for the Canadian dollar and USD/CAD pair. Indeed on Friday 5th May 2017 we had a nice rally for the oil prices and the USD/CAD fell all day from 1.3788 to 1.3637, plus the pair did not react almost at all to the release of important US Non-farm payrolls.

Japanese Yen and Swiss Franc

The Japanese Yen and the Swiss Franc for the moment appear to be in a range-bound trend for the moment related to the US dollar as investing sentiment and an attitude for taking more or less risk plus gold price after the outcome of French election could move USD/JPY and USD/CHF this week.

Australian dollar

The Australian dollar appears still weak and is also in a range-bound mode with US dollar. The AUD/USD had also a little reaction to the important US dollar news on Friday but still ended higher the day from 0.7360 to 0.7426. The Australian dollar is looking for important factors to define a new trend, and these could be any strong demand for commodities.

Now that we know the outcome of the French election, there are a few important notes to make. Firstly the forex market will focus more on the fundamentals rather than just the positive sentiment that moved the Euro higher the past weeks. Also the importance of strong US labor market may not have any positive effect for the US dollar on Friday 5th May 2017, but this does not mean that this week we could not see a strength of the US dollar as a strong labor market can signal increased probability of an interest rate hike next month by the Fed, a positive factor the US dollar.