The big drop of almost 5% in oil prices and positive US economic data helped the US Dollar move higher against other major currencies. British Pound moved lower after disappointing growth in GDP for 1st quarter 2017.

Canadian Dollar

We mentioned yesterday that OPEC meeting could have a reversal for oil prices and our forecast was correct.

There was intense selling pressure for oil prices, a fall of almost 5% due to the fact that there was an agreement to extend the production cut for 9 more months until March 2018, but without increasing the actual amount of production cut, at 1.8 million barrels per day.

There was intense selling pressure for oil prices, a fall of almost 5% due to the fact that there was an agreement to extend the production cut for 9 more months until March 2018, but without increasing the actual amount of production cut, at 1.8 million barrels per day.

The USD/CAD as a result moved higher from the low price of 1.3385 to 1.3494.

British Pound

A lower than expected GDP growth for 1st quarter 2017 both on a monthly and a yearly basis led to a fall for British Pound as it moved from 1.3013 to 1.2928. As the Election Day on 8th June 2017 is approaching, the British Pound is vulnerable to price volatility based on economic news and data but also on political factors, such as polls predictions.

A lower than expected GDP growth for 1st quarter 2017 both on a monthly and a yearly basis led to a fall for British Pound as it moved from 1.3013 to 1.2928. As the Election Day on 8th June 2017 is approaching, the British Pound is vulnerable to price volatility based on economic news and data but also on political factors, such as polls predictions.

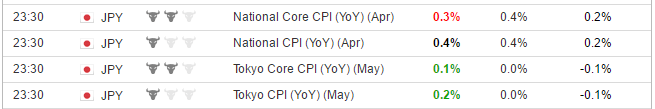

Japanese Yen

The monthly CPI index came exactly as expected at 0.4% showing not any signs of inflation for now and not any rush for the Bank of Japan to change its monetary policy.

The monthly CPI index came exactly as expected at 0.4% showing not any signs of inflation for now and not any rush for the Bank of Japan to change its monetary policy.

The USD/JPY moved higher from 111.46 to 111.95.

US Dollar

The US Dollar moved higher against other major currencies. The Advance Goods Trade balance for the month of April 2017 showed again a deficit, its reading was -67.4 billion versus the forecast of -64.5 billion, which is not positive for the US Dollar as it shows that there are more imports than exports some less demand for the currency.

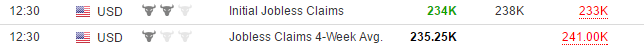

The main positive news were better than expected US weekly Initial Jobless Claims and Continuing Claims, showing a strong and growing labor market in the past months.

For the Australian Dollar we mentioned yesterday in our analysis that the downgrade of China’s credit rating was not positive news, so a lot of this depreciation could be attributed to this factor.

For the Australian Dollar we mentioned yesterday in our analysis that the downgrade of China’s credit rating was not positive news, so a lot of this depreciation could be attributed to this factor.

Important economic data for Friday 26th May 2017

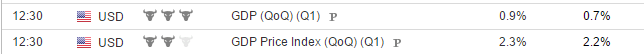

The economic calendar today is about important US data, the 1st quarter GDP growth, Durable Goods Orders for April, and the University of Michigan Confidence survey.

All this data can continue support the appreciation of the US Dollar and possibly form a reversal for its recent depreciation and falling trend if the readings are strong and better than expected forecasts. The labor market shows strong signs of economic growth, but this growth needs to be supported by other fundamental factors to have more confidence that indeed recent weakness in the US economy as per Fed’s statement was transitory.