A rebound for the US Dollar yesterday showed a temporary pause in its current depreciation versus its major counterparts, this week we will have plenty of new economic data to watch and if this new momentum and possible reversal can continue to develop.

Japanese Yen

![]()

The Nikkei Japan PMI for the manufacturing sector and May 2017 was strong at 52.0 but lower than 52.7 in April 2017, showing expansion but at the same time slowing growth for the manufacturing activity in Japan, and All Industry Activity Index for the month of March 2017 confirmed this slowing growth in all sectors of the Japanese economy as it was lower than expected.

The Nikkei Japan PMI for the manufacturing sector and May 2017 was strong at 52.0 but lower than 52.7 in April 2017, showing expansion but at the same time slowing growth for the manufacturing activity in Japan, and All Industry Activity Index for the month of March 2017 confirmed this slowing growth in all sectors of the Japanese economy as it was lower than expected.

As a result the Yen depreciated versus the US Dollar and USD/JPY moved up from 110.84 to 111.86.

Swiss Franc

Falling gold prices and a lower Trade Balance Surplus for April 2017, plus lower Exports and higher Imports can be interpreted in economic theory and analysis as negative for Swiss Franc.

Falling gold prices and a lower Trade Balance Surplus for April 2017, plus lower Exports and higher Imports can be interpreted in economic theory and analysis as negative for Swiss Franc.

USD/CHF moved a little higher from 0.87 to 0.97766.

Euro

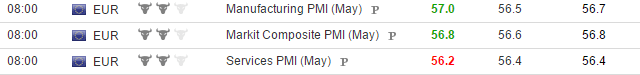

Numerous economic data for the Eurozone and for individual countries like France and Germany showed and confirmed continued growth for the Eurozone as the Markit PMI readings for Germany, France and the Eurozone were strong, especially for the manufacturing sector, while the German IFO Business Climate survey for May 2017 was also higher than expected at 114.6 versus estimate of 113.1.

Numerous economic data for the Eurozone and for individual countries like France and Germany showed and confirmed continued growth for the Eurozone as the Markit PMI readings for Germany, France and the Eurozone were strong, especially for the manufacturing sector, while the German IFO Business Climate survey for May 2017 was also higher than expected at 114.6 versus estimate of 113.1.

This higher than expected reading shows optimistic business confidence and climate both for the German economy but for the Eurozone also and a positive economic outlook.

Despite these positive news however the Euro depreciated and EUR/USD fell from 1.1268 to 1.1172.

British Pound

Some news about British Pound showing increase in Public Sector Net Borrowing for April 201y and at the same time a higher deficit in Public Finances can also be interpreted as bearish or negative for the British Pound.

Some news about British Pound showing increase in Public Sector Net Borrowing for April 201y and at the same time a higher deficit in Public Finances can also be interpreted as bearish or negative for the British Pound.

GBP/USD moved lower from 1.3036 to 1.2950.

Canadian and Australian Dollar

As oil prices rally made a temporary pause the Canadian Dollar depreciated against the US Dollar, and USD/CAD moved higher to 1.3525 from 1.3453, while the Australian Dollar kept its upward momentum and moved higher from 0.7462 to 0.7521.

US Dollar

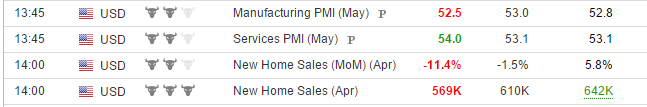

The US Markit PMI readings for the month of May 2017 showed increased expansion for the services sector, but a slowdown for the important manufacturing sector, while new Home Sales were lower than expected for the month of April 2017.

The housing sector is very important for the US economy and low readings for the housing sector are negative for the US Dollar. But even with these mixed news the US Dollar made a rebound and appreciated against almost all its major counterparts.

Key economic data for the forex market today

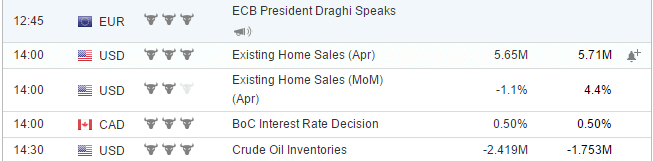

Today the economic calendar has a speech from Bank of Japan Governor, and the President of the European Central Bank, the important interest rate decision from the Bank of Canada.

US crude oil inventories and the very important US FOMC meeting minutes, which can reveal thoughts and intentions on any future US interest rate increases even next month.