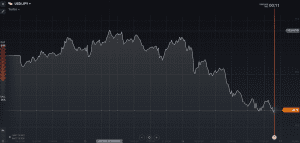

US political uncertainty caused a major US Dollar sell-off, combined with increased oil prices and commodities prices. It is the sentiment now that drives probably the forex market and any increased perception of risk uncertainty sends safe-haven currencies like the Japanese Yen and Swiss Franc appreciate.

US Dollar

Yesterday was another day that the US Dollar was under severe selling pressure being depreciated against all its major counterparts.

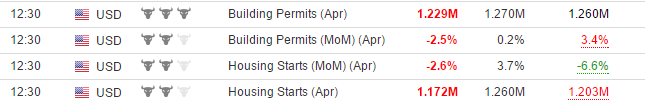

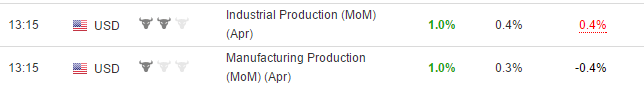

A mixed economic data did not stop the US Dollar from selling pressure as Housing Starts and Building Permits for the month of April 2017 were both weaker than expected and the housing sector is a very important financial indicator for the US economy. Industrial and Manufacturing Production however were both stronger than expected and so did Capacity Utilization showing growth of the economy.

However the negative sentiment for the US Dollar due to political reasons was dominant and so the sell-off of the US Dollar was intense. The US Dollar depreciated against all its major counterparts:

Euro

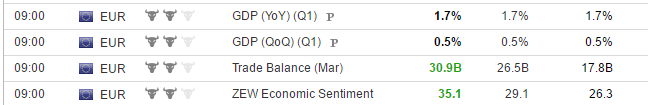

The Italian GDP for 1st quarter 2017 came exactly as expected and so did the Euro-Zone GDP.

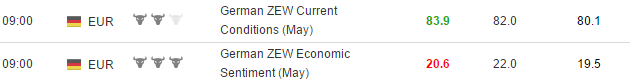

A lower than expected German ZEW Survey sentiment showing some weakness about the forecast of the German economy was completely ignored by the market.

A higher than expected Euro-Zone Trade Balance showing an increased trade surplus acted as further support for the appreciation of the Euro especially compared to the US Dollar. Overall the positive economic data from the Euro-Zone showed some robust growth and acts for now as strong support for the Euro causing its appreciation.

A higher than expected Euro-Zone Trade Balance showing an increased trade surplus acted as further support for the appreciation of the Euro especially compared to the US Dollar. Overall the positive economic data from the Euro-Zone showed some robust growth and acts for now as strong support for the Euro causing its appreciation.

British Pound

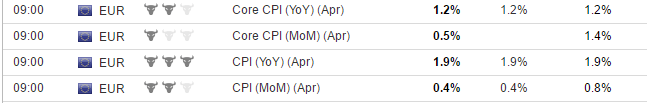

With Brexit or no Brexit the UK economy shows inflationary effects and the higher than expected reading of the Consumer Price Index pushed the GBP/USD higher.

With Brexit or no Brexit the UK economy shows inflationary effects and the higher than expected reading of the Consumer Price Index pushed the GBP/USD higher.

A strong inflation reading could ask pressure for the Bank of England to raise its interest rate in the near future.

Japanese Yen

Despite weaker than expected readings for Machine Orders for the month of March 2017, which could be interpreted as negative for the Japanese economy, the Yen rallied versus the US Dollar and this move can be attributed to the safe-haven characteristic of Yen in times of great uncertainty.

Despite weaker than expected readings for Machine Orders for the month of March 2017, which could be interpreted as negative for the Japanese economy, the Yen rallied versus the US Dollar and this move can be attributed to the safe-haven characteristic of Yen in times of great uncertainty.

Key factors to focus on forex market today

Plenty of economic news today with the releases of US Crude inventories which can cause volatility for USD/CAD, Euro-Zone Consumer Price Index and several economic readings about the Japanese economy.

Interesting to watch if the US Dollar sell-off will pause and possibly reverse or continue.