An important round of US economic data was positive and helped stall the dollar’s slide. While none was robust all show growth within the economy and upward pressure on prices. The most important piece is the Producer Price Index, up 10 of the past 12 months and rising at a pace above the Fed’s 2% target.

The headline PPI came in at 0.4% MoM and 2.7% YoY. These figures are both expansionary from the previous month and slightly above expectation. The previous month saw prices unchanged while November saw them advance 0.4%. At the core level prices increased by 0.4% MoM and 2.2% YoY, also both above expectations. The news is dollar strong in that it firms FOMC outlook but may not significantly move the dollar. Wednesday’s action shows that traders are moving to risk on assets as global economies improve.

Other data from the US includes the Empire Manufacturing Index, the Philly Fed’s MBOS and Industrial Production. Industrial Production and Empire State both missed expectations, Industrial Production falling 0.1% versus an expected gain of 0.2% and Empire State falling to 13.1 from the previous 17.7 showing a slowdown in growth but growth nonetheless. The Philly Fed’s MBOS was a bit different though, rising to 25.8, above expectation and expanding from the previous month on gains in activity, orders and employment.

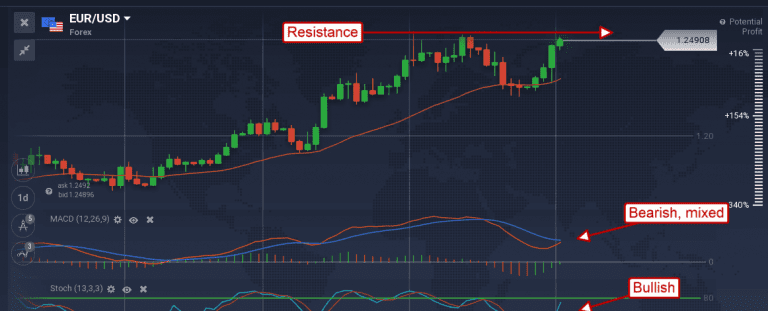

The US dollar firmed a bit on the news but did not affect a major reversal. It did cap gains in the EUR/USD and may indicate the recently entered trading range will continue. Thursday’s early action shows a candle with visible upper shadow crossing the 1.2500 level. This level has been resistance twice before in the past 2 months and has the pair trending sideways. The indicators are consistent with a move higher but do not show strength. A move up would need to break the 1.2540 level to be bullish. If resistance confirms a move to support may come, lower target is 1.2350 and 1.2200.

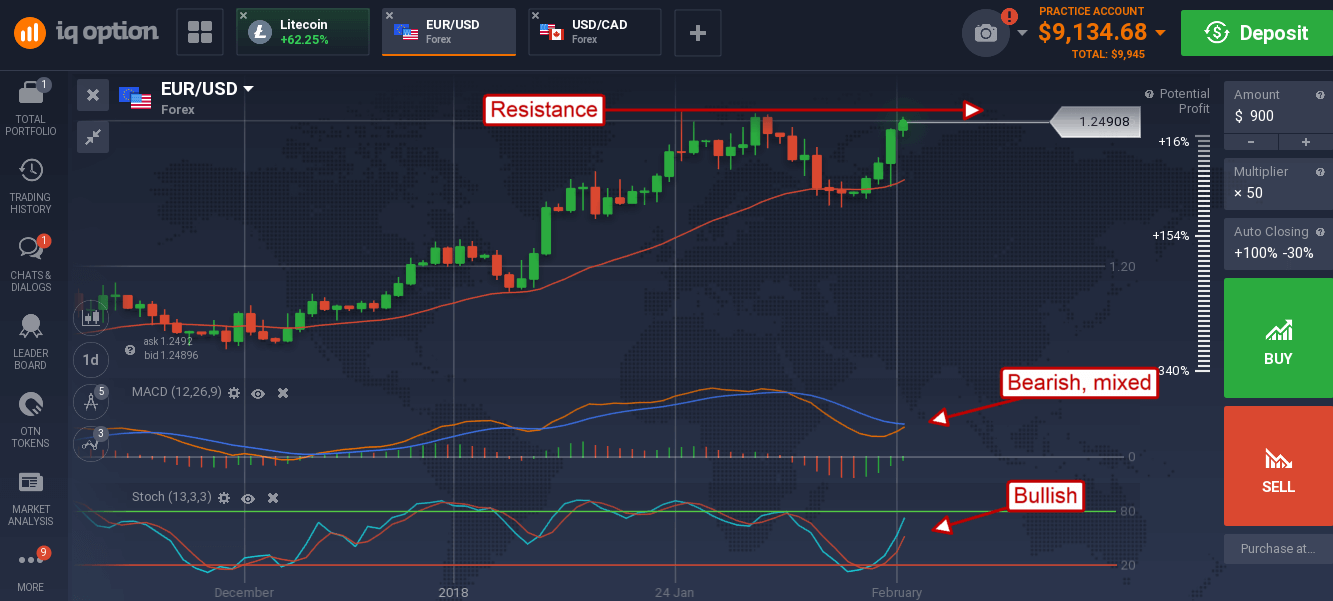

The USD was able to firm against the Canadian dollar even as employment data in the far north shows strength. Canadian ADP Employment change showed a surge in new employment, up nearly 11,000, that reverses losses in the previous month. The news was not, however, enough to strengthen the loony.

The USD/CAD tried to move lower in early trading but bounced from support at the short term moving average. This move is consistent with a continuation of the recent rally but not yet confirmed by the indicators. Momentum remains bullish but has declined while stochastic retreats into neutral territory. This set up is consistent with a trend following entry but requires bullish crossovers to confirm.

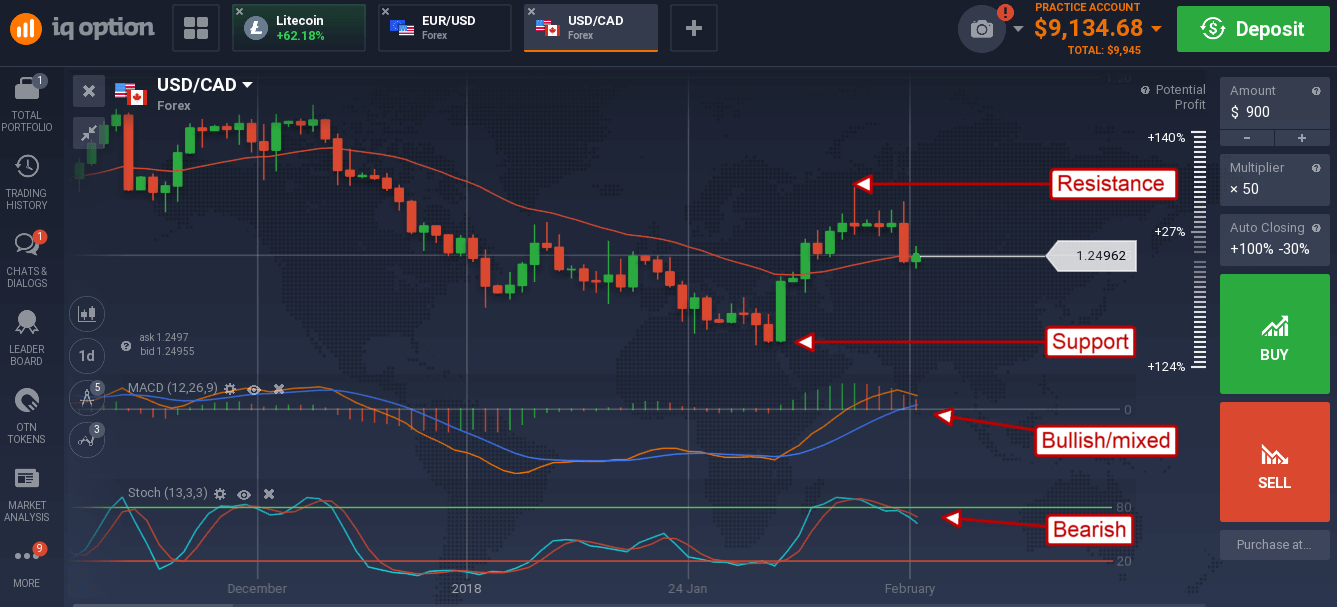

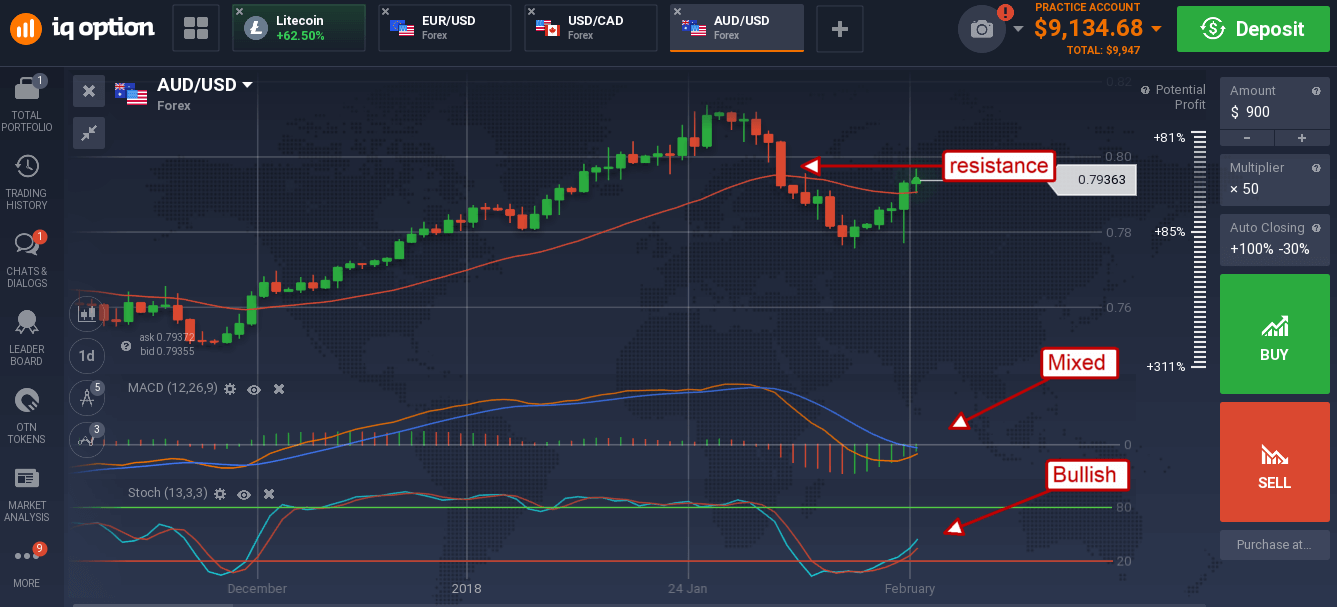

The US dollar wobbled versus the Aussie dollar in early Thursday trading. The pair moved up on positive employment data from Australia, but those gains were capped and given up in the wake of US data. It formed a small shooting star-type candle in the first half of the day, indicative of resistance, and a possible confirmation of a reversal that began a month or so ago.

Resistance now appears to be 0.7950, a break above which would be bullish. A fall from this level would confirm the resistance, a break below the moving average would be bearish.