You know what they say, one bad apple spoils the bunch. In this case it is the UK’s industrial production figures. The headline month to month change in production fell much further than expected, -1.3%, leaving it unchanged from the previous year and below expectations. Analysts had been expecting production to fall but by a more moderate -0.9%.

The data is not good and a symptom of recent trade imbalances. The UK trade balance widened in the same period as exports lagged imports, a sign of decreased demand for industrial goods. While bad, the news is offset by positive figures in manufacturing and housing. Manufacturing production increases by 0.3% as expected while construction spending jumped 1.6% from the previous month and well ahead of the 0.1% expected.

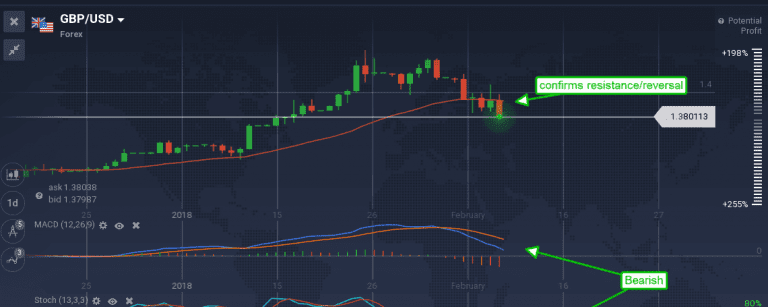

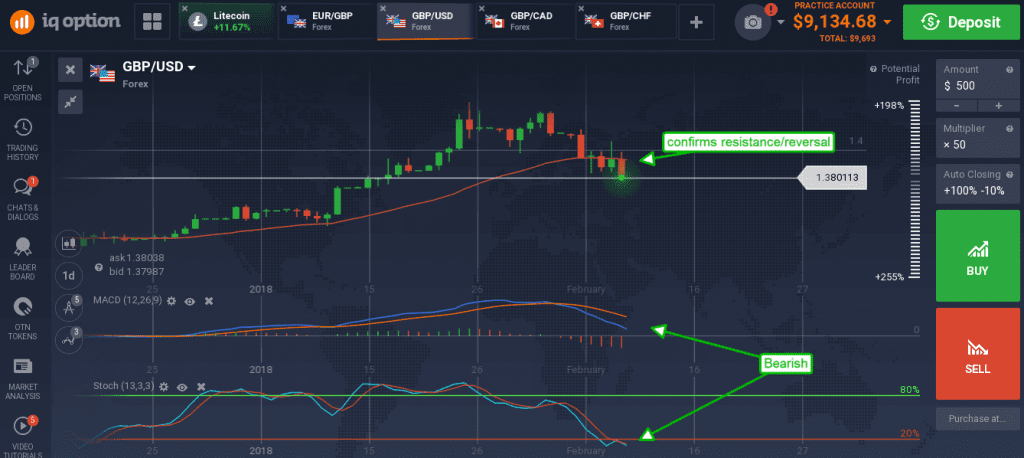

Regardless the spin the news was not enough to keep the pound moving higher versus the dollar. The GBP/USD fell on the news after trading higher in the early Friday session. The move breaks support at the short term moving average but does not indicate reversal of trend, merely a deeper test of support that what might have been expected from Thursday’s hawkish BOE statement.

The bank says that rates are likely to be increased sooner and faster over time than expected, a move that should provide support for the pound. The indicators have fallen and are pointing lower, consistent with lower prices so I would expect at least another test of support. Support is just below the short term moving average, near the 1.3800 level, a break below which would be bearish.

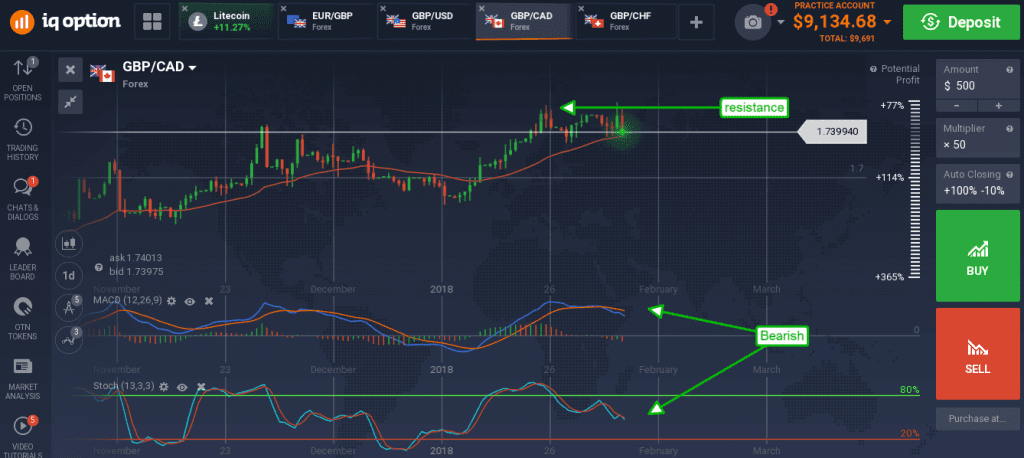

The pound also fell versus the Canadian dollar despite weak labor data. Canadian employment change figures show 88,000 newly unemployed persons versus and expected -2,000, far greater than predicted and leading to an increase in unemployment. Unemployment ticked higher to 5.9% versus the expected unchanged with a decline in participation added in as well.

The GBP/CAD created a red candle with visible upper shadow confirming resistance at the 1.7600 level. This is the 3rd confirmation of resistance and signs are growing reversal is possible. The pair is currently trading at the short term moving average which is support, a break below there would be bearish.

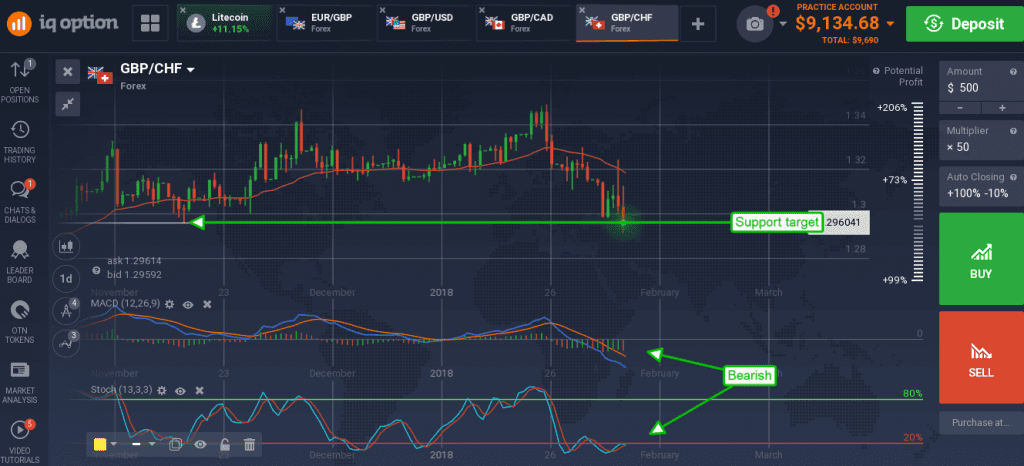

The GBP/CHF is beginning to confirm reversal. The pair has been trending lower over the past few weeks and now trading at a longer-term support target. Today’s news, including positive labor data from Switzerland, has the pair setting a new three month low and indicated lower.

Both MACD and stochastic are low in the range, ticking higher and indicative of general weakness in the market. Support was at 1.2965, downside targets are now 1.2846 and possibly lower.