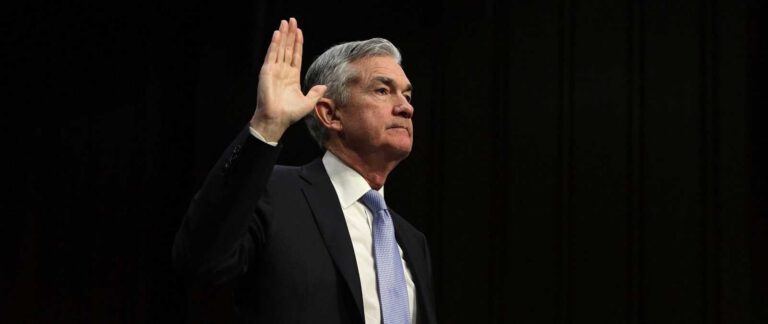

The Fed’s new chief, Jerome Powell, in testimony before congress, double down on interest hikes. He stood firmly by the FOMC’s inflation targets, restated the need for gradual rate hikes and sent the equities market in a tailspin. Forex markets were less moved by the news although there is mounting evidence the US could see two rate hikes by June and four by the end of the year.

Wednesday’s data includes the 2nd estimate for 4th quarter US GDP. The figure came in as expected and unchanged from the previous read but not without some changes to internal data. The GDP price index, a broad gauge of inflation, fell by a tenth in this estimate but did not alter the long-term inflation outlook.

According to the CME’s Fed Watch Tool, a measure of implied odds for interest rate hikes based on the Fed’s Funds Futures rates, the odds of an accelerated pace of rate hikes is growing. The tool shows an 88% chance of a single hike over the next two meetings and a 75% chance of another hike by June. The March/May odds moved up on Powell’s testimony but only a little. The odds of two hikes by June rose more than 10% overnight and up from 50% over the last month in response to signs of economic acceleration.

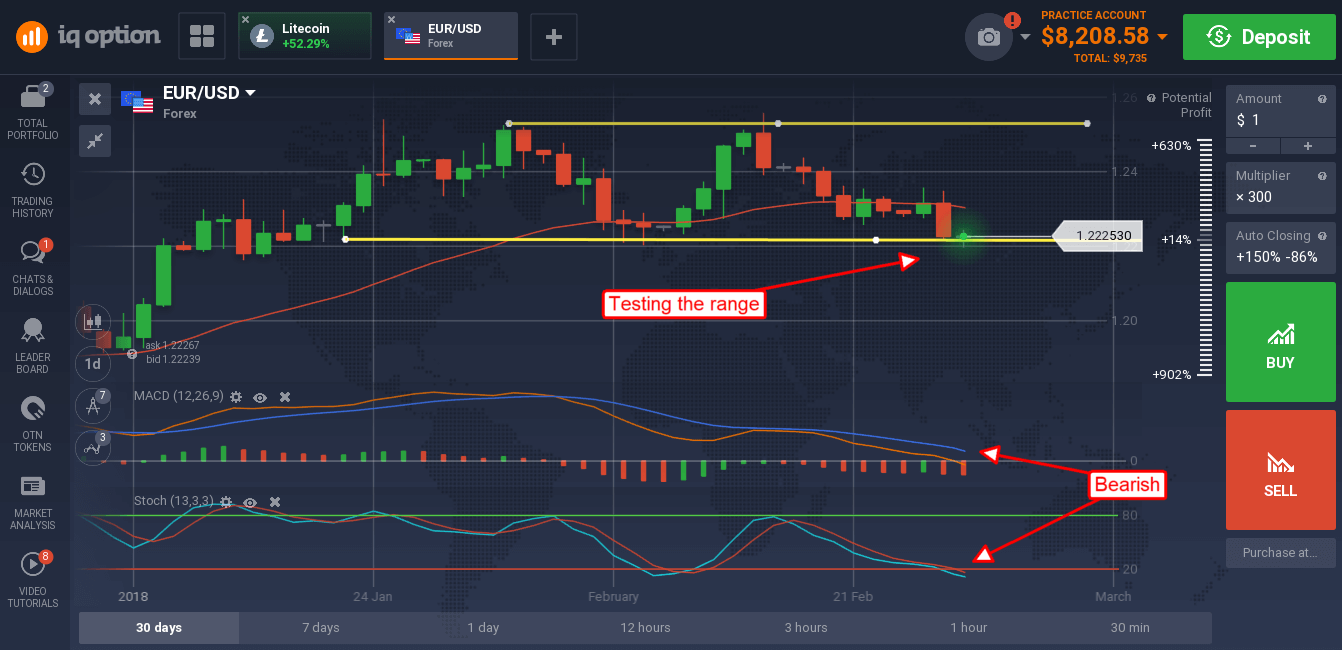

The news has sent the EUR/USD down to test support at the bottom of its near-term trading range. It is setting up for a possible reversal as FOMC policy outlook strengthens and ECB outlook weakens. Data from the EU suggests the consumer climate and consumer level inflation are holding steady, as expected, but do not suggest accelerated inflation growth. Comments from Mario Draghi suggest it may be some time before we do see that acceleration. He said in a speech on Monday that the ECB may have misjudged the amount of economic slack remaining in the EU economy.

Support for the pair is now just above 1.22000. The indicators are bearish and pointing lower in support of lower prices on the daily charts. This means there is a good chance support will be tested over the next couple of days with a chance of moving lower.

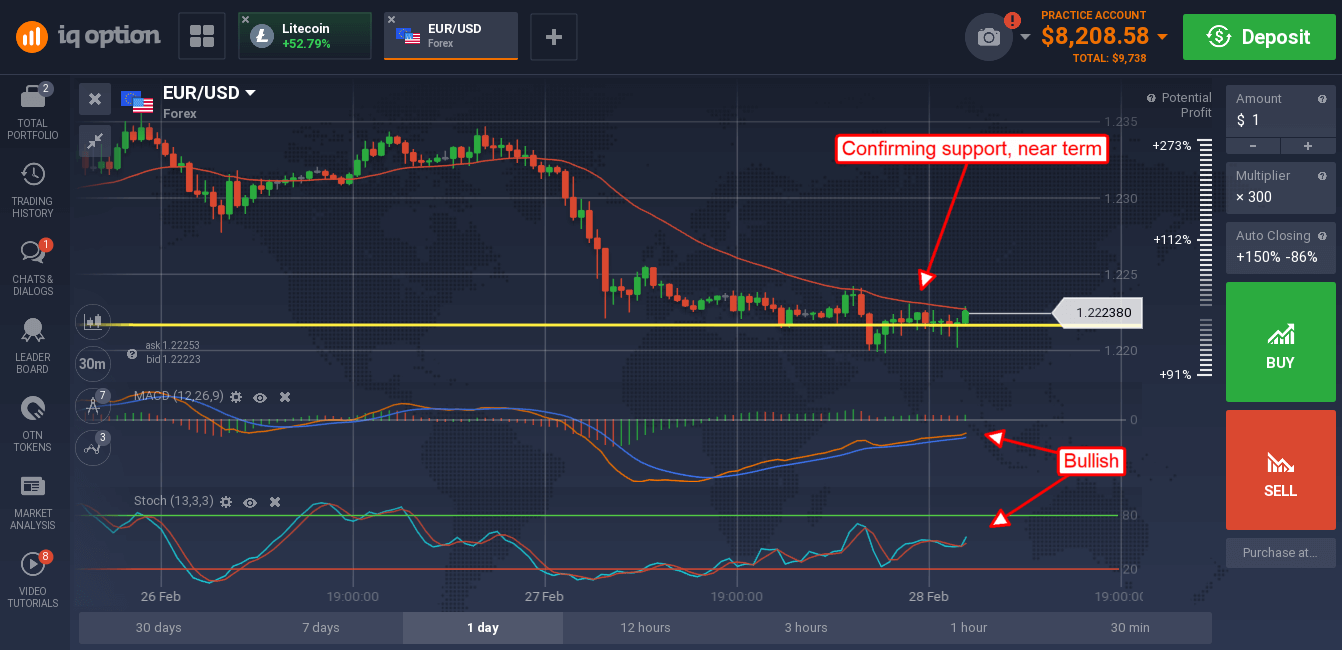

The 30 minutes charts show that support is holding, at least for now, a break below this level would be very bearish confirming a double top that has formed over the past few weeks. A move lower may go as low 1.1600 but is likely to hit support targets near 1.2000 and 1.1800. A bounce from this level would confirm support within the range.

There is still quite a bit of data due out this week and any of it could spark volatility in the EUR/USD. On the EU side of the equation there is PPI, unemployment and PMI. On the US side there is personal income and spending, core PCE prices, PMI, ISM, car sales, employment data and the Fed’s Beige Book.