The euro has been on a tear over the past three weeks and it looked like that may have come to an end. The EU’s single currency got a lift from comments within the minutes from the ECB’s last meeting but hopes spurred by those minutes were dashed by today’s policy statement. The bank let slip it was ready, or about ready, to begin altering the public’s view of its policy stance and traders took that to mean the bank was altering its policy stance. The reality within the statement is far different, the catch is that Mario Draghi‘s comments at the press conference reinvigorated expectations the bank was on track to begin tightening.

The ECB has decided to leave its target interest rates unchanged. The deposit facility rate will remain at -0.4% while the overnight rate will hold steady at 0.0%. The bank says that rates will remain low, at current levels, far into the future. Their exact words are “well past the horizon” for asset purchases.

Asset purchases are going to remain at the current level of 30 billion euros until September 30th at least. They indicated they will take asset purchases beyond the September date, or increase them, if needed. The governing council further underscored their support for the economy by stating purchases would remain in effect until it sees a “sustained adjustment in the path of inflation”. When they do decide to end purchases, if they do, the bank will continue to reinvest proceeds long into the future.

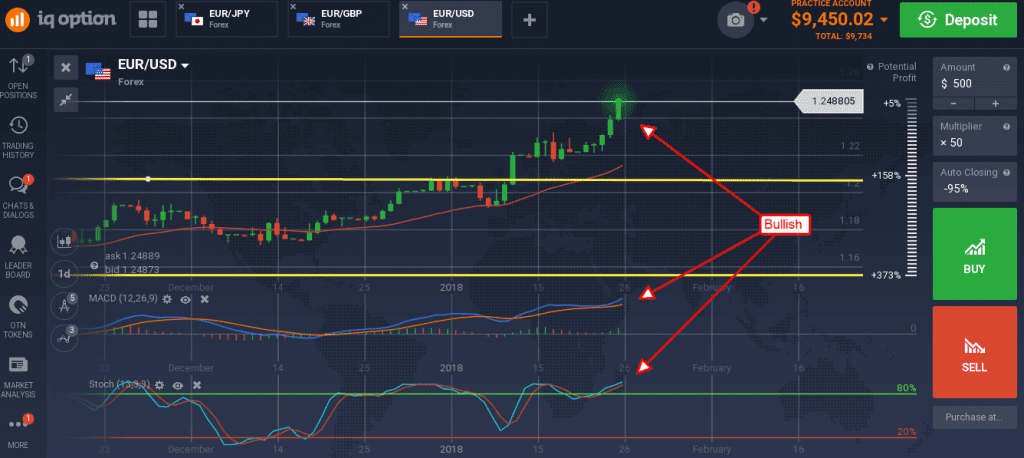

The EUR/USD came under pressure with the release of the news but bounced back to new highs along with Mr. Draghi’s first comments. The indicators remain bullish and consistent with higher prices although both are extremely overbought in the longer term. The pair may hold steady at or near current levels until tomorrow when the US 4th quarter GDP 1st estimate is released but don’t count on it. Targets are now above 1.2500.

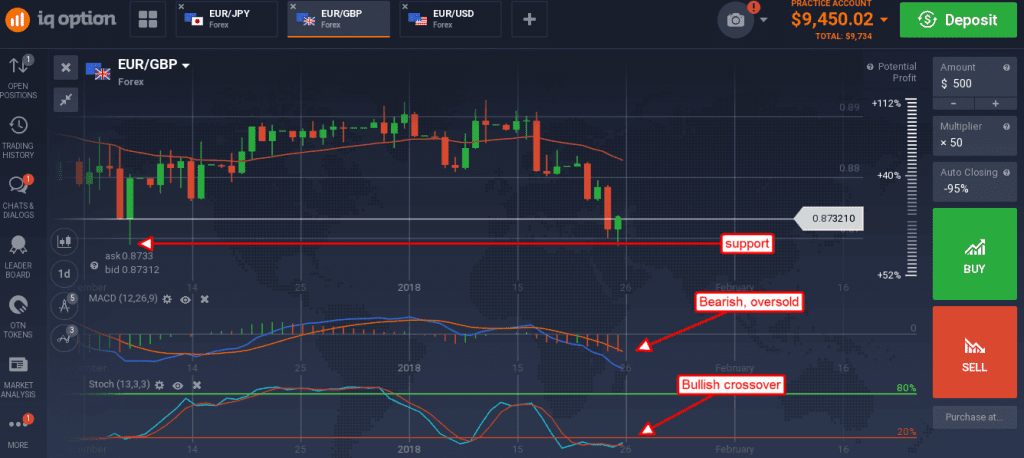

The euro gave up some ground versus the pound, but it bounced back with Draghi’s support. It is now bouncing from support at the long term 7 month low of 0.8690 and possibly heading higher. The indicators are both rolling over into bullish crossovers and consistent with higher prices. A move up would be bullish with targets at 0.8800 and 0.8900. Data over the next week may help this move, if not look to the BOE meeting in two weeks as a significant catalyst.

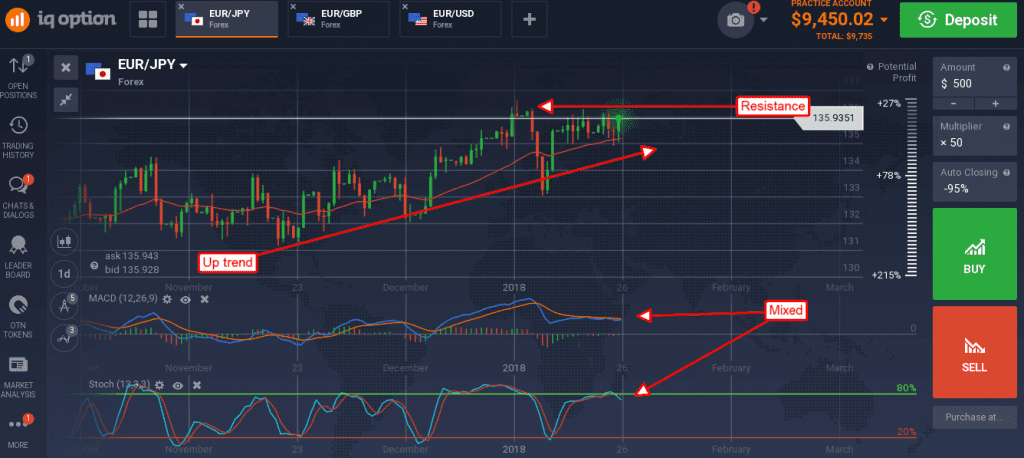

The euro fell against the yen and then bounced in a move that appears to be confirming support. The candles are not overly strong but do carry bullish implications. The indicators are a bit flat and mixed but set up to fire bullish trend following entries with a move higher.

A move higher may find resistance at 136.00, a break above there would be bullish.