The dollar began to gain strength after new data from the US shows signs of strength within the economy. The BEA’s Personal Income and Spending report, including the Fed’s favored PCE price index, was a mixed bag in terms of expectations but reveals consistently solid gains in income and spending that are driving inflation higher. Why is this so important? Because the FOMC is meeting this week and expected to give clues to the timing of the next interest rate hike.

The BEA says personal income rose at a rate of 0.4% in December. This is up from the previous 0.3% and ahead of expectations. Disposable personal income gained 0.3%. At the same time personal spending, AKA personal consumption expenditures, came in at 0.4% and slightly below expectations. Even so the number is strong, follows an increase of 0.8% and supported by steady increases in earnings.

The more important figure, the PCE Price Index, came in at 0.1% and as expected. At the core level, ex-food and energy, inflation rose 0.2%. Year over inflation rose 1.7% on the headline and 1.5% at the core level, both below the Fed’s 2% target but both up from earlier in the year and evidence of a sustained uptick in inflation.

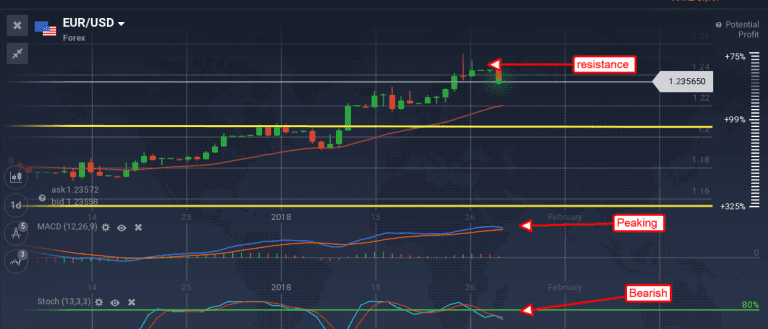

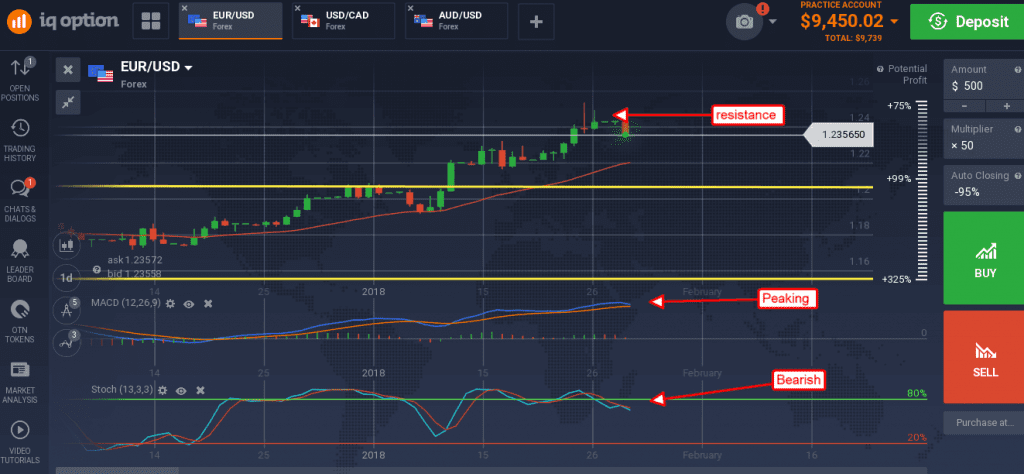

The EUR/USD had already been under pressure as ECB driven support continues to wane. The news sent the pair down to test and break support at the 1.2365 level, a level important for near term direction. With the FOMC and US data dominating the news this week, and that data expected to be positive and/or hawkish for the Fed, it looks like the pair is heading lower. The indicators are consistent with a peak and consolidation but not yet a correction, so caution is still due. A firm break below support would be bearish with targets near 1.2300 and 1.2200.

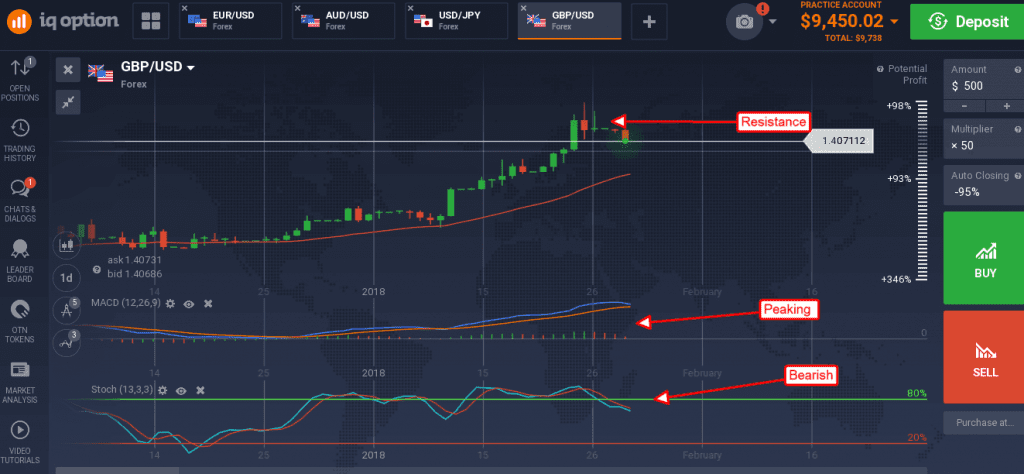

The dollar gained versus the pound further confirming a resistance level first indicated last week. The indicators are both bearish and pointing lower so a further move to the downside should be expected. The first target for support is near 1.4000, a break of which would be bearish. At that point a move down to the moving average and below is likely. The questions now are how good the US data will be, what the FOMC will say, and of course the BOE meeting next week.

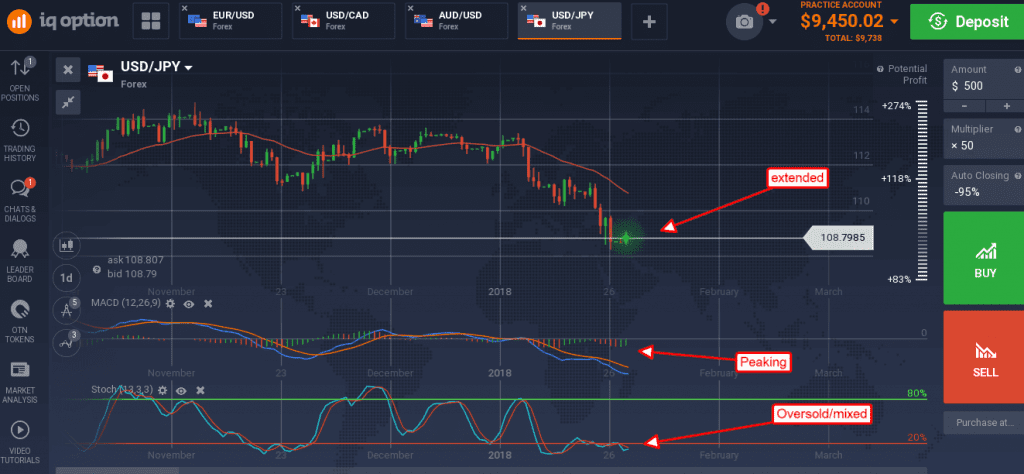

The dollar gained versus the yen, but the gains were small. The pair still has a fair amount of downside momentum that may take it to longer term support near 108.00. Regardless, the pair looks extended near the bottom of a range with hawkish outlook for the dollar and positive economics expected for the US.

A bounce from support would be bullish and likely carry the pair back to the top of the range longer term, upside target would be 114.00.