The US 2nd quarter GDP revision came in better than expected, but it isn’t the data you need to be watching this week. While it is good, and points to steady gains in inflation, the GDP data is rear looking and will have little long-term effect on markets. The data you need to watch will be Thursday’s read on Personal Income & Spending, a more current read on the economy including the FOMC’s favored PCE Price Index.

US GDP was revised up by a tenth to 4.2% in the 2nd quarter. This is up a tenth from the previous estimate and up 0.2% from the consensus expectation. The strength is due to increases in investment and inventory but were offset by a small decline in personal consumption. Personal consumption edged down a hair but remains strong and driving prices higher. The 2nd quarter GDP PCE Price Index edged up a tenth to 1.9%, ordinarily a bullish signal for the dollar, but that was expected and consistent with last month’s read on the core PCE.

The reason why tomorrow’s PCE Price Index release is so important, other than being a current read on inflation, is because of Jerome Powell’s comments last week. The Fed chief has led the market to believe a slower pace of rate hikes may be at hand and traders will be looking to find confirmation of that in the data. Economists are estimating PCE prices will move up a tenth to 2.0% annually, anything less will be bearish for the dollar.

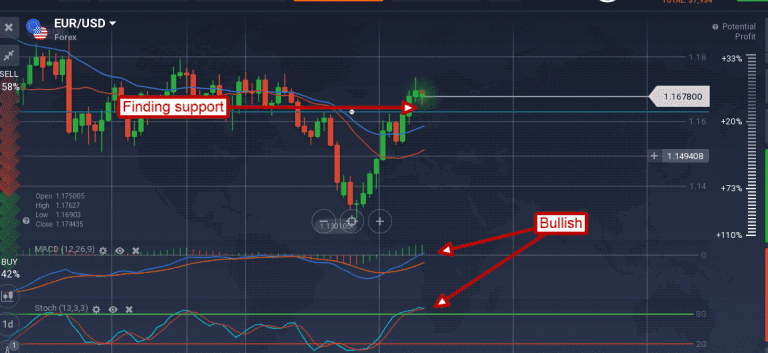

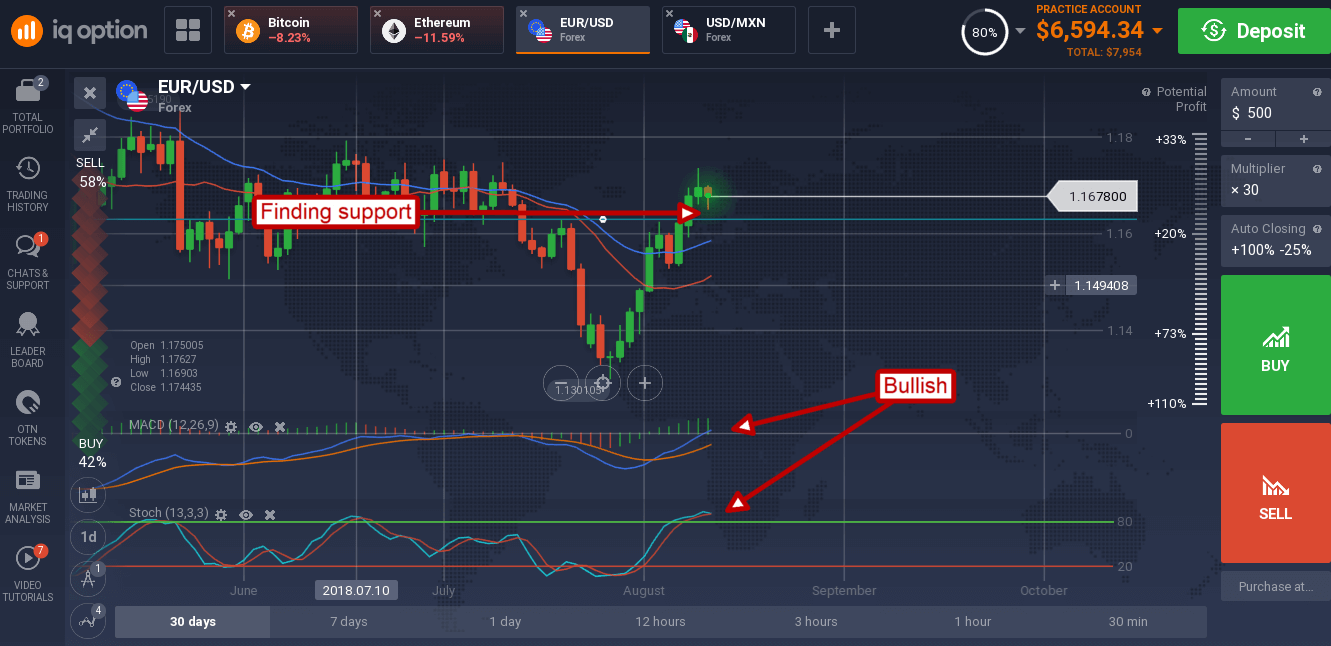

The EUR/USD had been trading lower in the early Wednesday session but found support following the release of the GDP revision. The pair is testing for support at the now-broken resistance line of 1.16675 and may move sideways overnight and into Thursday morning. The indicators remains bullish but show signs of topping that may lead to reversal if tomorrow’s data is hotter than expected. A move down may find support at 1.16250 or just below that at the short-term moving average. A move up, supported by the data, will be bullish for the pair and could take it up past 1.1800.

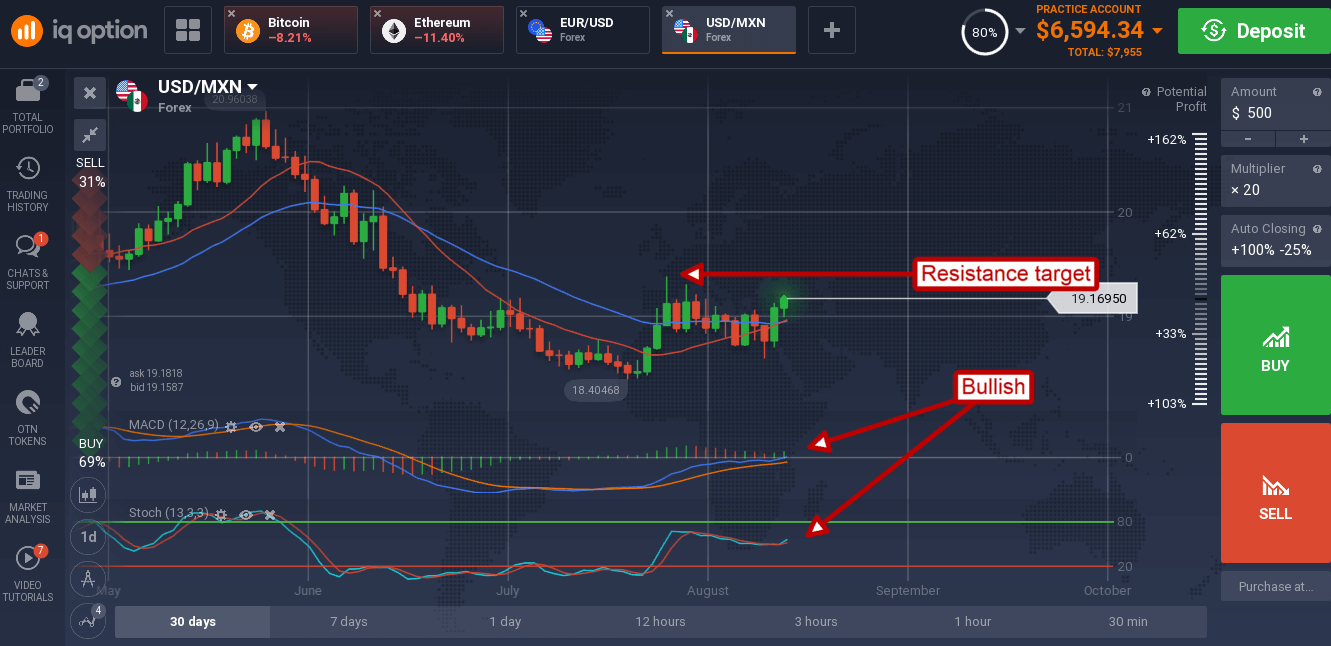

The USD has reasserted itself versus the Mexican peso and looks like it could make a significant move higher. The pair gained about 0.50% in early Wednesday trading and is supported by a strong bullish crossover in the indicators.

A move up would be bullish and in line with the new trend, if it moves above resistance at 19.40 a move up to 20.00 is very likely.