The escalations in the trade wars, with the announcement of new US tariffs on Chinese goods, the anticipated response from China, and Brexit deal optimism are in the spotlight in the forex market today, but there are noteworthy economic indicators, such as the Inflation Rate in UK, the Swiss Economic Forecasts, the BoJ Interest Rate Decision and the GDP Growth Rate in New Zealand. Moderate to high volatility should be expected today mostly for the British Pound, Swiss Franc and the Japanese Yen.

These are the key economic events today in the forex market, time is GMT:

European Session

Switzerland: SECO Economic Forecasts, UK: BoE Haldane Speech, Inflation Rate (YoY, MoM), Core Inflation Rate YoY, Eurozone: Construction Output YoY, ECB Draghi Speech, Russia: Unemployment Rate, Germany: Bundesbank Wuermeling Speech

Time: 05:45, 08:00, 08:30, 09:00, 13:00, 14:00, 15:00

The Economic Forecasts provide important information and forecasts of major GDP components, considered to be a measure of market activity reflecting the pace of economic expansion for the Swiss economy. Normally, a high reading or a better than expected number is seen as positive for the Swiss Franc.

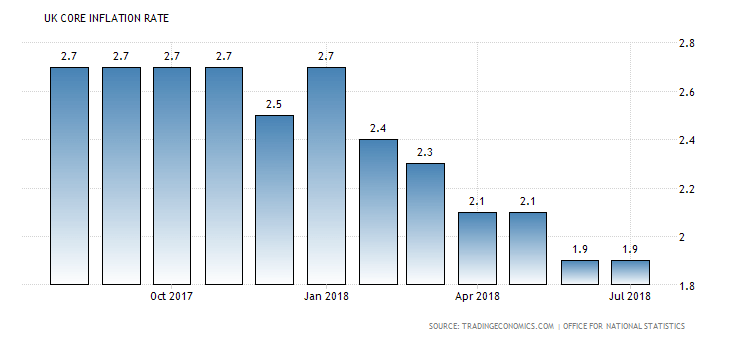

For the UK economy the Core Inflation Rate measures the inflationary pressures in the broader economy comparing and tracking changes in the retail prices of a representative shopping basket of goods and services. It excludes the seasonally volatile products such as food and energy and is considered a more accurate and conservative calculation of the Inflation Rate. Generally, a high reading is seen as positive for the British Pound. A decrease to 1.8% from 1.9% is expected for the yearly Core Inflation Rate in UK. Also, a decrease to 2.4% from 2.5% for the yearly Inflation Rate and an increase to 0.5% from 0.0% for the monthly Inflation Rate are expected. Some mixed economic data, but the focus should be on the reading of the Core Inflation Rate which shows that there are not any severe inflationary pressures in the UK economy at present, which may influence negatively the British Pound as there is no motive for the BoE to apply a tighter monetary policy and increase the key interest rate.

“The UK annual core inflation rate, which excludes prices of energy, food, alcohol and tobacco, stood at 1.9 percent in July 2018, the lowest since March 2017.”, Source: Trading Economics.

As seen from the above chart the UK Core Inflation Rate has been in a downtrend for the past 12-months and at a recent lowest level for the same period.

For the Eurozone the Construction Output report shows the strength of the construction industry. Usually, a high reading is positive for the Euro reflecting a robust construction sector, pointing to a growing economy and reflecting consumer and business optimism. The Construction Output can be also used as a business cycle indicator, as the housing market is closely tied to changes in economic growth and economic cycles as well. A decrease to 1.7% from 2.6% is expected for the yearly Construction Output in the Eurozone.

A lower than expected reading for the Unemployment Rate in Russia is considered positive for the Russian Ruble, as a lower value reflects on a strong labor market, adding to consumer spending, economic growth and the possibility of a rate hike by central banks. An unchanged reading of 4.7% is expected.

American Session

US: Housing Starts, Housing Starts MoM, Current Account, Building Permits, Building Permits MoM, EIA Crude Oil Stocks Change, EIA Gasoline Stocks Change

Time: 12:30, 14:30

The Current Account is a net flow of current transactions, including goods, services, and interest payments into and out of the US. A current account surplus indicates capital inflows in the US economy and is considered positive for the US Dollar. Higher than expected figures for the Housing Starts and Building Permits are also considered to be positive and supportive for the US Dollar reflecting a robust US housing market, providing insight into consumer activity as real estate is often leading economic developments due to the various economic and business cycles. The US Current Account is expected to show a narrower deficit of -103.5B US Dollars from -124.1b US Dollars, the Housing Starts are expected to increase to 1.235M from 1.168M, and the Building Permits are expected to decrease marginally to 1.31M from 1.311M.

The Energy Information Administration’s (EIA) Crude Oil Inventories report measures the weekly change in the number of barrels of commercial crude oil held by US firms. If the increase in crude inventories is more than expected, then it implies a weaker than expected demand and is considered negative for crude prices. The same can be said if a decline in inventories is less than expected and in general any economic surprises often tend to create increased volatility for crude oil prices and the USD/CAD currency pair.

Pacific Session

Australia: Westpac Leading Index, RBA Assistant Governor Kent Speech, New Zealand: Gross Domestic Product (YoY, QoQ) (Q2)

Time: 00:30, 01:30, 22:45

The Westpac Leading Index tracks economic activity focusing on various economic indicators to provide an indication of how the economy will perform. In general, higher than expected readings are considered positive for the Australian Dollar. For the economy of New Zealand, the Gross Domestic Product is a measure of the total value of all goods and services produced by New Zealand, a broad measure of New Zealand economic activity. Higher than expected figures are considered positive for the New Zealand Dollar reflecting economic expansion. Some mixed economic data is expected with a decrease for the yearly GDP reading to 2.5% from 2.7% and an increase for the quarterly GDP figure to 0.8% from 0.5%.

Asian Session

Japan: BoJ Interest Rate Decision

Time: 03:00

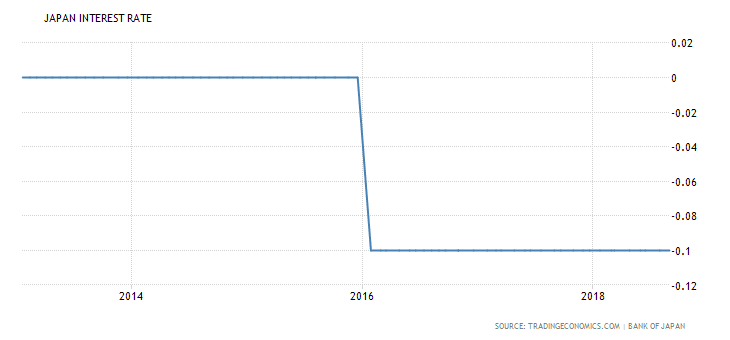

If the BoJ is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive for the Japanese Yen. Also, if the BoJ has a dovish or less optimistic view on the Japanese economy and keeps the ongoing interest rate or cuts the interest rate it is negative for the Japanese Yen. In many cases the forex market discounts the actual outcome and focused mainly on the Monetary Policy Statement for indications of a potential monetary policy change.

“The Bank of Japan vowed to keep rate extremely low for extended period of time and opted for flexible bond buying at its July 2018 meeting. At the same time, policymakers left its key short-term interest rate unchanged at -0.1 percent and kept its 10-year government bond yield target around 0 percent.”, Source: Trading Economics.

An unchanged key interest rate of -0.1% is expected which should have a neutral effect on the Japanese Yen.