Economic data related to the economies of Japan, Sweden, France, Italy, and the weekly US Crude Oil Inventories are some of the important economic events in the forex market for today, but the most important economic event today is the Reserve Bank of New Zealand Interest Rate Decision. The market reaction upon the news release may be either increased volatility or a neutral move, which will depend to a large degree on whether there will be any economic surprise or not.

Key economic events for today, which can move the forex market:

European Session

- France: Industrial Production Mom, Sweden: Inflation Rate MoM, CPIF YoY, Italy: Retail Sales MoM

Time: 06:45 GMT, 07:30 GMT, 08:00 GMT

Increased figures or better than expected readings for the Industrial Production in France and the Retail Sales in Italy should be supportive and positive for the Euro, being in a downtrend recently, especially against the US Dollar. The forecasts are for a monthly figure of 0.4% for the Industrial Production in France, lower than the previous figure of 1.2% and a monthly figure of 0.1% for the Retail Sales in Italy, lower than the previous figure of 0.4%. Both figures if true will indicate weakness in the local economies, which is considered negative for the Euro area and may influence negatively the Euro.

The Swedish Krona may find support with higher than expected figures for the Inflation Rate and Consumer Price Index at Constant Interest Rates (CPIF). The existence of inflationary pressures in the economy will be considered positive as it will increase the probabilities of future interest rate increases by the Central bank in Sweden. The forecasts are for a monthly Inflation Rate of 0.4%, higher than the previous figure of 0.3%, but a figure of 1.9% for the yearly CPIF, lower than the previous figure of 2.0%. A mixed economic data for the Inflation Rate in Sweden may have a neutral effect on the Swedish Krona.

American Session

- US: Core PPI MoM, PPI MoM, Wholesale Inventories MoM, EIA Crude Oil Stocks Change, Fed Bostic Speech

Time: 12:30 GMT, 14:00 GMT, 14:30 GMT, 17;15 GMT

The Core Producer Price Index (PPI) measures the change in the selling price of goods and services sold by producers, excluding food and energy both considered to be volatile, while the PPI measures price change from the perspective of the seller, and both are important economic indicators about the inflation rate in US. Higher than expected figures will indicate inflationary pressures in the broader economy and can be supportive for the US Dollar. A lower than expected figure for the Wholesale Inventories will be positive for the US Dollar, reflecting a strong demand for goods and increased consumer spending which can have appositive impact on the economic growth. The US Crude Oil Stocks Change can move the oil prices and the USD/CAD currency pair if there are any significant economic surprises, either positive or negative.

Pacific Session

- New Zealand: Reserve Bank of New Zealand Interest Rate Decision, Australia: Westpac Consumer Confidence Index

Time: 21:00 GMT, 00:30 GMT

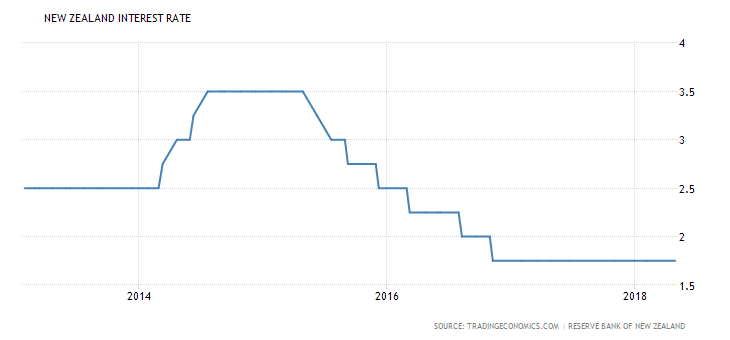

The 5-year trend for the key Interest Rate in New Zealand shows that the current level of 1.75% for the key Interest Rate is at the low range as of November of 2016. Any positive economic surprise may have a positive effect on the New Zealand Dollar, as any positive outlook on economic conditions, economic growth and inflation, which may suggest a shift in monetary policy is possible soon.

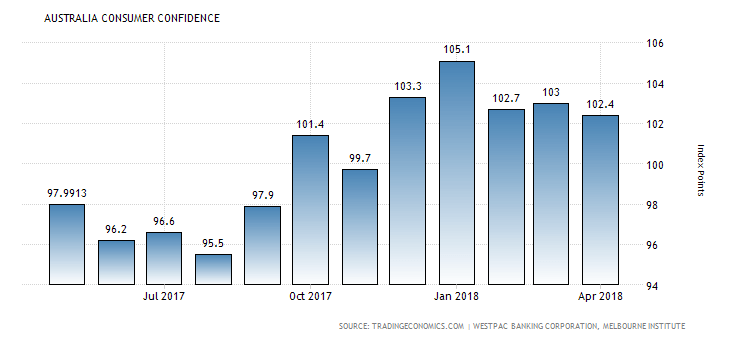

The Consumer Confidence Index in Australia is expected to increase at 102.8, higher than the previous figure of 102.4, which should be positive for the Australian Dollar. Higher readings of Consumer Confidence can lead to higher levels of consumer spending and economic growth, measured by the GDP level.

As seen from the chart, the Consumer Confidence in Australia has peaked in January of 2018, and remains relatively stable for the past three months.