After a trading session yesterday with lower than usual liquidity due to the Labour Day Holiday, today higher volatility and price action is expected mainly for the Euro and the US Dollar, and the EUR/USD currency pair, with a very rich economic calendar in the forex market. There is also important economic data for Japan, Switzerland and Australia. The main economic event is the Fed Interest Rate Decision, and the forex market will focus on that for any signs supporting the recent US Dollar strength and appreciation versus other currencies.

Key economic events for today:

European Session

- Switzerland: Consumer Confidence, Retail Sales, SVME Manufacturing PMI, Spain: Markit Manufacturing PMI, Italy: Markit/ADACI Manufacturing PMI, GDP Growth Rate QoQ, Unemployment Rate, Germany: Markit Manufacturing PMI Final, Bundensbank Weidmann Speech, UK: Construction PMI, Eurozone: Markit Manufacturing PMI Final, ECB Non-Monetary Policy Meeting, Unemployment Rate, GDP Growth Rate

Time: 05:45 GMT, 07:15 GMT, 07:30 GMT, 07:45 GMT, 07:55 GMT, 08:00 GMT, 08:30 GMT, 09:00 GMT, 16:00 GMT

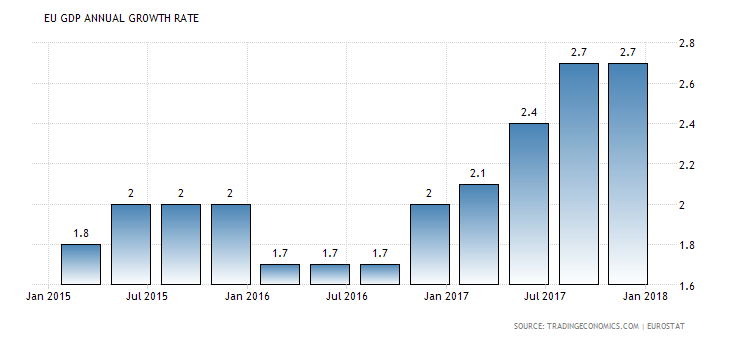

A very rich economic calendar in the European Session with a focus on the date related to the Eurozone, mainly the Unemployment Rate and the GDP Growth Rate quarterly and yearly. As seen from the chart the GDP Annual Growth Rate in the Eurozone has been in a strong uptrend as of January 2017 and has been consistently over the level of 2.0%.

“The gross domestic product in the Euro Area rose by 2.7 percent year-on-year in the fourth quarter of 2017, unrevised from the second estimate and the same pace as in the previous period. Over the whole year 2017, GDP growth stood at 2.3 percent, slightly below earlier estimates of 2.5 percent and compared to 1.8 percent in 2016.”, Source: Trading Economics.

Higher than expected or increasing figures for the GDP Growth Rate in the Eurozone are positive for the Euro. The forecast is for a GDP Growth Rate QoQ of 0.4%, lower than the previous figure of 0.6%, and a GDP Growth Rate YoY of 2.5%, lower than the previous figure of 2.7%. The Unemployment Rate is expected to remain unchanged at 8.5% in the Eurozone, while the Markit Manufacturing PMI Final is expected to decline having a figure of 56.0, lower than the previous figure of 56.6. All this economic data with lower expected figures may influence negatively the Euro, reflecting slower economic expansion. Lower than expected figures for the GDP Growth Rate in Italy, and the Markit Manufacturing PMI Final in Germany and in Spain, may also influence negatively the Euro, reflecting slower economic expansion for the GDP in Italy and the manufacturing sector in Germany and Spain.

The Swiss Franc may appreciate versus other currencies as higher figures are expected for the Consumer Confidence and the Retail Sales Year-over-Year, indicating increased consumer spending which is often correlated with higher economic growth. A higher than expected figure for the Construction PMI in UK, with a figure of 50.5 versus the previous figure of 47.0 should be supportive and positive for the British Pound, indicating expansion and increased business conditions in the Construction Sector.

American Session

- US: ADP Employment Change, EIA Crude Oil Stocks Change and Gasoline Stocks Change, Fed Interest Rate Decision

Time: 12:15 GMT, 14:30 GMT, 18:00 GMT

The weekly EIA crude Oil Stocks Change may influence significantly the crude oil prices and the USD/CAD currency pair. If the increase in crude inventories is more than expected, this implies a weaker than expected demand and is considered bearish for crude oil prices. Any economic surprise, positive or negative may also add increased volatility for oil prices and the USD/CAD currency pair. Higher than expected figures for the ADP Employment Change are positive for the US Dollar, indicating a strong labor market with new hires from private businesses. The forecast is for a reading of 225K for the ADP Employment Change, lower than the previous figure of 241K.

The main economic event for today is the Fed Interest Rate Decision. As seen from the chart the Fed has increased aggressively the key interest rate in the past 12-months, being at the lower/upper range of 1.50%-1.75%. The forecast is for the key interest rate to remain unchanged, but as the Fed has seen a stronger economy and higher inflation as per last FOMC meeting, the focus will be on the statements on economic outlook, to weigh on the gradual tightening and future path of interest rate hikes.

Pacific Session

- Australia: AIG Services Index

Time: 23:30 GMT

The Australia Performance Services Index is expected to decline having a figure of 54.8, lower than the previous figure of 56.9. This lower figure indicating slower performance in the services sector, may weigh negatively on the Australian Dollar.

Asian Session

- Japan: Consumer Confidence

Time: 05:00 GMT

The Consumer Confidence in Japan is anticipated to decline having a reading of 43.8, lower than the previous reading of 44.3. Increased readings for Consumer Confidence are considered positive for the local economy and the currency, as they probably lead in most cases to higher consumer spending and higher economic growth, measured by the GDP Growth Rate. This expected decline may influence negatively the Japanese Yen.