The Inflation Rate in Australia, the IFO figures for the German economy, the New Home Sales in US and the weekly EIA Crude Oil Stocks Change are the main economic events in the forex market for today, with moderate to high volatility expected for the Australian Dollar, the Euro and the US Dollar. One day before the ECB Interest Rate Decision the IFO figures have the potential to move the Euro indicating important information about the economic conditions and expectations in Germany, the largest economy in the Euro area.

Key economic events in the forex market today:

European Session

- Germany: IFO Business Climate, IFO Current Assessment, IFO Expectations, Switzerland: ZEW Survey Expectations

Time: 08:00 GMT

The German IFO figures reflect current conditions and business expectations for the next six months. Higher than expected figures indicate a more optimistic future economic outlook which can stimulate economic growth, considered positive for the Euro.

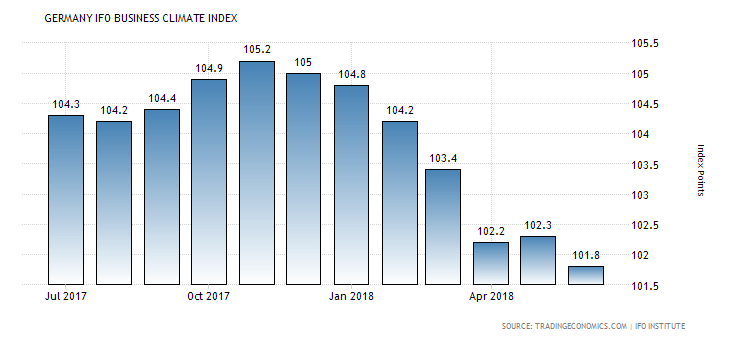

“The Ifo Business Climate Index for Germany fell to 101.8 in June of 2018 from an upwardly revised 102.3 in May and compared to market expectations of 101.7. It is the lowest reading since May of 2017, due to a decline in the business conditions index (105.1 from 106.1) while the gauge of future expectations was flat at 98.6. Sentiment worsened among all sectors: manufacturers (23.8 from 24.1); service providers (25.9 from 27.1), traders (11.3 from 14.5) and constructors (19.4 from 20.4). “, Source: Trading Economics.

As seen from the chart, the Germany IFO Business Climate Index has been trending lower as of January 2018, the highest value so far in 2018. A weak trend for the business expectations and current conditions in Germany are reflected in current weakness of the Euro versus the US Dollar. The forecasts are for lower IFO figures for all German related economic data, the Business Climate, the Current Assessment and the Expectations, which may influence negatively the Euro. The IFO Business Climate for reference is expected to decline at 101.5, lower than the previous figure of 101.8.

The ZEW Survey Expectations Index presents business conditions, and employment conditions in Switzerland, with high readings considered positive for the Swiss Franc, reflecting a six-month economic outlook for Switzerland. A level above zero indicates optimism, an important indicator of economic health.

American Session

- US: New Home Sales MoM, EIA Crude Oil Stocks Change

Time: 14:00 GMT, 14:30 GMT

The number of New Home Sales in US is an important measure of housing market conditions, with the housing market being a leading indicator of the overall state of the economy. A robust housing market can stimulate economic growth based on the level of consumer spending on goods and services related. Therefore, high readings for New Home Sales are considered positive for the US Dollar. The forecast is for a lower figure, expected at 0.670M, lower than the previous figure of 0.689M.

The EIA Crude Oil Stocks Change measures the weekly change in the number of barrels of commercial crude oil held by US firms, with level of inventories influencing the price of petroleum products, a key driver for inflation. If the increase in crude inventories is more than expected, this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- Australia: Inflation Rate Q2 (YoY, MoM)

Time: 01:30 GMT

An increase for the second quarter of the Inflation Rate in Australia is considered positive for the Australian Dollar, indicating inflationary pressures in the economy which may weigh on the RBA decision to shift its monetary policy, increasing the key interest rate to fight inflation.

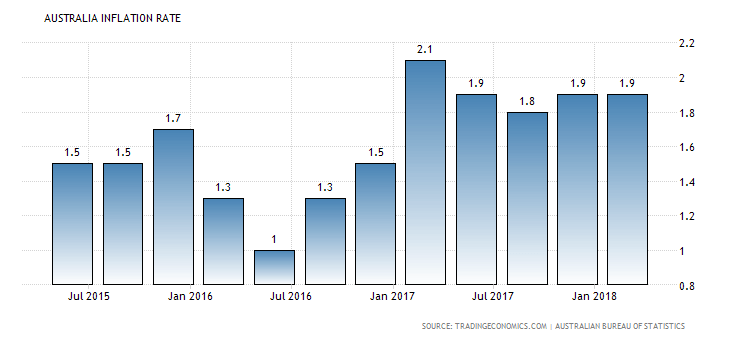

“Consumer prices in Australia rose by 1.9 percent through the year to the March quarter of 2018, the same as in the previous quarter and compared with market consensus of 2 percent. Cost of housing and transport increased at a softer pace while prices of food rebounded. On a quarterly basis, consumer prices went up 0.4 percent, following a 0.6 percent gain in the previous period while markets estimated 0.5 percent. “, Source: Trading Economics.

The forecasts are for an increase of the yearly Inflation Rate for the second quarter at 2.2%, higher than the previous figure of 1.9%, and for an increase of the quarterly Inflation Rate at 0.5%, marginally higher than the previous figure of 0.4%. The Inflation Rate in general for Australia in 2018 is trending higher compared to the previous year, and this trend may be an early indicator of future higher interest rates, which should be supportive for the Australian Dollar.