Today there is a very light economic calendar in the forex market, with low to moderate expected volatility and price action for the major currency pairs. There is a speech by the Boc Governor Poloz, which could move the Canadian Dollar. In the next two days very important economic events, such as the ECB Interest Rate Decision and economic data about the US economy will probably provide more trading opportunities based on the actual outcome versus the forecast, especially if there will be any economic surprises.

Key economic events for today in the forex market:

European Session

- France: Consumer Confidence, Unemployment Benefit Claims, Switzerland: ZEW Survey Expectations

Time: 06:45 GMT, 08:00 GMT, 10:00 GMT

Lower than expected or declining figures for Unemployment Benefit Claims are considered positive and supportive for the Euro, signaling a strong labor market in France. Unemployment Benefit Claims measures the number of people that filed for unemployment benefits for the first time. An increasing figure signals for a deteriorating labor market. The Consumer Confidence index tracks the consumers’ insights regarding financial conditions, future state of economic and buying conditions, with levels above 100 indicating that there is optimism for the economic outlook.

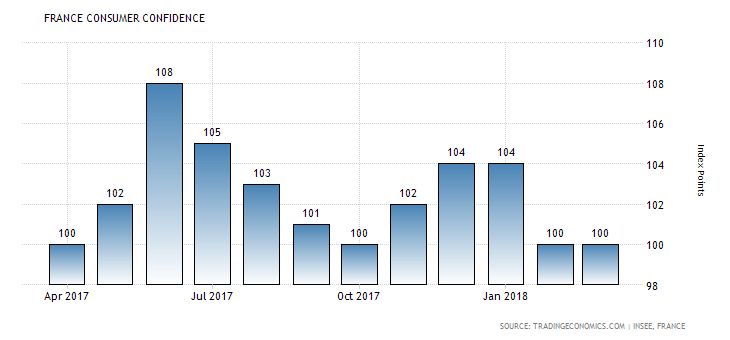

As seen from the chart the Consumer Confidence in France was unchanged at the level of 100.0 for the past two consecutive months, and the forecast is again for a level of 100.0 The Consumer Confidence in France for the past 12-months has peaked during the summer of 2017, increased in the late month of 2017, but in 2018 so far it has been in a decline and a stable trend, below the top level of 104.0 in January 2018.

Increased figures of Consumer Confidence are positive for the economy of France and the Euro, indicating increased optimism about the economy, and possibly increased consumer spending, which can have a positive impact on the economic growth. The ZEW Survey Expectations published by the Centre for European Economic Research presents business conditions, and employment conditions, with increased figures being positive and supportive for the Swiss economy and the Swiss Franc, reflecting increased optimism on business conditions.

American Session

- US: EIA Crude Oil Stocks Change, Canada: Boc Governor Poloz Speech

Time: 14:30 GMT, 20:15 GMT

The weekly change in the number of barrels of commercial crude oil held by US firms can influence the USD/CAD currency pair, and same influence may have the Speech by the Bank of Canada Governor Poloz later. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered bearish for crude oil prices.

Asian Session

- Japan: All Industry Activity Index

Time: 04:30 GMT

The All Industry Activity Index measures the monthly change in overall production by all sectors of the Japanese economy, with increased figures being positive for the Japanese economy and overall growth. The forecast is for a monthly figure of 0.4%, higher than the previous figure of -1.8%, showing economic expansion, which should be supportive for the Japanese Yen.