Τhe Eurozone and the UK Consumer Price Index, and the Bank of Canada Interest Rate Decision are the most important economic events for today, which can move the forex market. There is also the release of the Beige Book by the Federal Reserve which may influence the US Dollar. Moderate to high volatility should be expected for the Euro, the British Pound, the Canadian Dollar and the US Dollar.

Key economic events for today:

European Session

- UK Inflation Rate, Core Inflation Rate, Eurozone Inflation Rate Final and Core Inflation Rate, Eurozone Construction Output, Russia Unemployment Rate

Time: 08:30 GMT, 09:00 GMT, 13:00 GMT

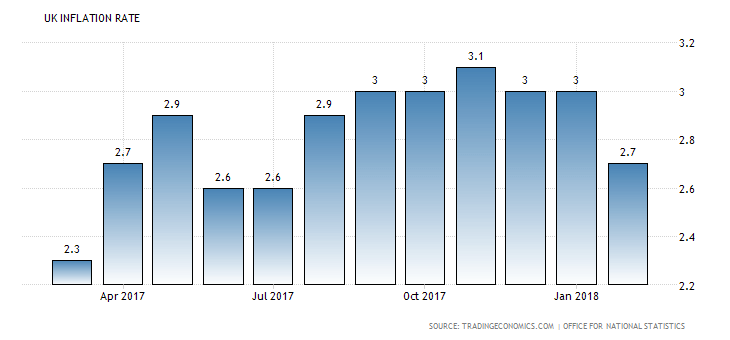

The Inflation Rate in UK is expected to remain unchanged year-over-year at 2.7%, but the Core Consumer Price Index (CPI), which measures the changes in the price of goods and services, excluding food and energy is expected year-over-year to increase at 2.5%, higher than the previous figure of 2.4%. Higher than expected or rising figures for the Inflation Rate in UK are considered positive for the British Pound, indicating inflationary pressures in the economy and increasing the probabilities of higher future interest rates by the BoE to fight the inflation.

As seen from the chart the Inflation Rate in UK for the past 12-months is between 2.3%-3.1%. The rate of inflation in UK fell to 2.7% in February 2018 from 3% in the previous month. This was the lowest rate since July last year.

In the Eurozone the Inflation Rate year-over-year is expected to increase at the rate of 1.4%, higher than the previous rate of 1.1%, but the Construction Output year-over-year is expected to decline at the rate of 2.3%, lower than the previous rate of 3.7%. The Core Inflation Rate in the Eurozone is expected to remain unchanged year-over-year at 1%. Higher Inflation Rates in the Eurozone are considered positive for the Euro, for the same fundamental reasons as for the economy in UK, but the fact that the Core Inflation is expected to show no increase, indicates that for now there are not any significant inflationary pressures in the Eurozone. The ECB may not have a solid reason to change its monetary policy any time soon, which is considered negative for the Euro. The Unemployment Rate in Russia is expected to remain unchanged at the rate of 5%, which should have a neutral effect on the Russian Ruble.

American Session

- Fed Dudley Speech, Bank of Canada Interest Rate Decision, EIA Crude Oil Stocks Change and Gasoline Stocks Change, Fed’s Beige Book, Fed Dudley Speech, Fed Quarles Speech

Time: 12:30 GMT, 14:00GMT, 14:30 GMT, 18:00 GMT, 19:00 GMT, 20:30 GMT

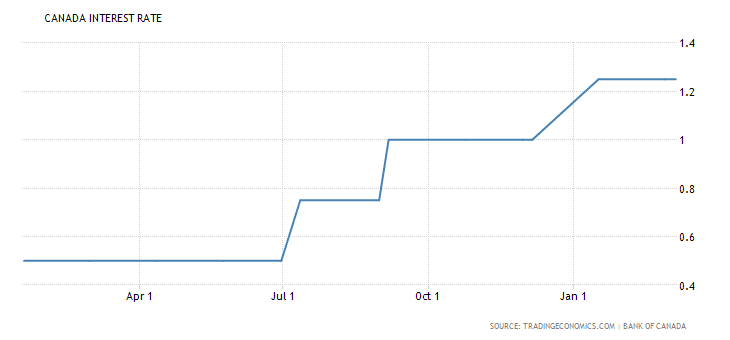

The key economic event for today is probably the Bank of Canada Interest Rate Decision, with the expectation of an unchanged key interest rate at 1.25%. Any positive economic surprise may add significant volatility for the Canadian Dollar. As seen from the chart, the key interest rate in Canada has been increased several times for the past 12-months.

“The Bank of Canada held its overnight rate at 1.25 percent on March 7th, 2018, following a 25bps hike in the previous meeting, saying that while the economic outlook is expected to warrant higher interest rates over time, some continued monetary policy accommodation will likely be needed to support growth and inflation”, Source: tradingeconomics.com

The Beige Book by the Fed may move the US Dollar as it will provide insights on current economic conditions for the US economy. The weekly EIA Crude Oil Stocks Change may also move the Oil prices and the USD/CAD currency pair. If the increase in crude inventories is more than expected, this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- New Zealand Consumer Price Index

Time: 22:45 GMT

The forecast is for a figure of 1.1% year-over-year for the first quarter, lower than the previous figure of 1.6%. On a quarter-over-quarter basis the expectation is for an increase and a figure of 0.5%, higher than the previous figure of 0.1%. Increased figures for the Consumer Price Index are considered positive for the New Zealand Dollar. A sustained rise of the inflation may weigh on the Reserve Bank of New Zealand to tighten its monetary policy with higher future interest rates.