External or unexpected factors other than fundamental or macroeconomic events and releases, news influence the forex market, something we witnessed with the large sell-off for US stock market and other global stock markets on Monday 5th February 2018. As major concerns are now evident about the future interest rates in US, the inflation rate and a possible slowdown of economic growth, the forex market participants may move to safe-haven assets such as the US Dollar, the Japanese Yen and the Swiss Franc.

This negative investor sentiment may be short-lived though, yet it may lead to strong trends, which have little correlation with the actual fundamental news. For the US Dollar it will be interesting to monitor the yield of the 10-year Government Bond, which acts as a benchmark and its correlation with the US Dollar value, the oil and gold prices as well as commodities are also influenced by the general investor sentiment and risk appetite. For today the main economic event is the monetary policy decision by the Reserve Bank of New Zealand.

These are the main economic events for today to focus on the forex market:

European Session

- Germany Industrial Production, France Balance of Trade, ECB Non-Monetary Policy Meeting, Italy Retail Sales

Time: 07:00 GMT, 07:45 GMT, 08:00 GMT, 09:00 GMT

The German Industrial Production measures the change in output in various industrial sectors, and rising or better than expected readings are positive for the German economy and the Euro, signaling increased business activity and expansion for the industrial sector. Factory orders are correlated with consumer spending and economic growth, so higher readings are positive for the Euro. The forecast is for a decline on a monthly basis with a reading of -0.5%, lower than the previous reading of 3.4%.

The Euro can also be influenced by the balance of trade In France and the retail sales in Italy, and finally the monthly ECB non-monetary policy meeting with references to decisions such as external economic relations, market infrastructure and payments. A surplus for the balance of trade in France and rising retail sales in Italy should be supportive and positive for the Euro. The expectations are for a trade deficit for the economy of France with a reading of -4.9 Billion Euros, lower than the previous reading of -5.7 Billion Euros and a decline for the retail sales on a monthly basis in Italy.

- Russia Inflation Rate and Foreign Exchange Reserves

Time: 13:00 GMT

The inflation rate in Russia on a yearly basis is expected to decline having a reading of 2.3%, lower than the previous reading of 2.5%, a neutral to negative reading for the Russian Ruble as it signals the lack of strong inflationary pressures in the economy, and no pressure also at the Bank of Russia to increase the interest rates to fight inflation. The foreign exchange reserves are monitored for their trends because they can be effective to change the monetary policy at any given time.

American Session

- US Mortgage Applications, Canada Building Permits, US Crude Oil Inventories

Time: 12:00 GMT, 13:30 GMT, 15:30 GMT

Moderate to high volatility is expected for the USD/CAD currency pair as there will important economic releases about the housing market in US and Canada, and later on the weekly crude oil inventories. Rising figures of mortgage applications and building permits indicate a healthy housing market, and growth in the construction sector, both of which are positive factors for the US and the Canadian Dollar. The US crude oi inventories can influence the crude oil prices especially in the event of large positive or negative surprises. For example if the increase in crude inventories is more than expected, it implies weaker demand and is considered negative for crude oil prices.

Pacific Session

- Reserve Bank of New Zealand Monetary Policy Decision

Time: 20:00 GMT

The second monetary policy decision this week, after the Reserve Bank of Australia can move the New Zealand Dollar, although the forecast is for an unchanged key interest rate at 1.75%. Statements on economic conditions, inflation rate, economic growth by the central bank, can have an impact on the value of New Zealand Dollar, while a positive surprise and interest rate increase should be positive and add to the appreciation of the New Zealand Dollar against other currencies.

Asian Session

- Japan Labor Cash Earnings, Coincident Index, Leading Index, Trade Balance

Time: 00:00 GMT, 05:00 GMT, 23:50 GMT

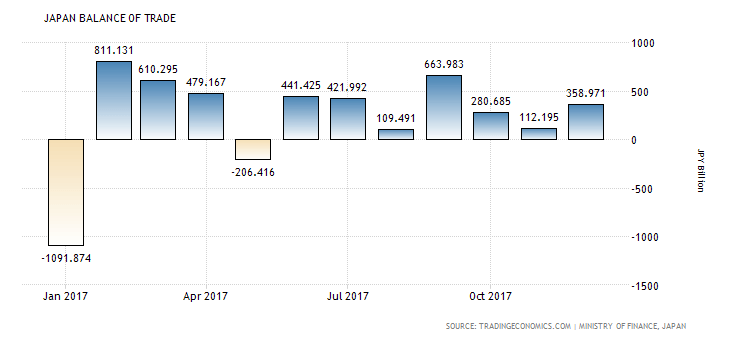

A series of important fundamental events for the Japanese economy, with the forecasts being for a decline for the yearly labor cash earnings, an increase for the Coincident Index and an increase of the trade balance surplus. As the Coincident Index measures the economic activity in Japan and business conditions as well, rising figures are positive for the Japanese Yen reflecting expansion for several sectors, such as the industrial one. The increase in the trade balance surplus also is positive for the Japanese Yen, indicating strong demand for assets and goods denominated in Japanese Yen and also inflows of capital in the Japanese economy.