Important economic data related to the economies of Eurozone, US, Japan, UK and Australia can move the forex market today, as liquidity is returning to the normal levels after the Easter Holiday. Moderate to high volatility is expected for the Euro as there is the release of the Inflation and Unemployment Rate in the Eurozone.

These are the main economic events for today to focus on:

European Session

- UK Construction PMI, Eurozone Inflation Rate, Core Inflation Rate and Unemployment Rate

Time: 08:30 GMT, 09:00 GMT

The consumer price inflation in the Euro Area came in at 1.1 percent year-on-year in February 2018, slightly below the preliminary estimate of 1.2 percent and 1.3 percent reported in the previous month. It was the lowest inflation rate since December 2016. As seen from the chart the Inflation Rate in the Eurozone is declining as of July 2017, when it reached the level of 1.5%.

Higher than expected or rising figures for the inflation rate in the Eurozone are positive for the Euro, as is a lower than expected or declining Unemployment Rate. The absence of strong inflationary pressures in the Eurozone makes the possibility of a monetary policy shift by the ECB a very low one, with the expectation for the key interest rate in the Eurozone to remain unchanged, at least for 2018.

The forecast is for an increase of the Inflation Rate on a yearly basis with a figure of 1.4%, higher than the previous figure of 1.1%, and the Unemployment Rate in the Eurozone is expected to marginally decline to 8.5%, lower than the previous figure of 8.6%. This data may provide support for the Euro. In UK the Construction PMI is expected to decline to the 50.8 level, lower than the previous level of 51.4. As higher readings are considered positive indicating an expansion for the Construction Sector, this decline is considered negative for the British Pound.

American Session

- ADP Employment Change, Markit Composite PMI Final, Markit Services PMI Final, Fed Bullard Speech, ISM Non-Manufacturing PMI, Factory Orders, EIA Crude Oil Stocks Change and Gasoline Stocks Change, Fed Mester Speech

Time: 12:15 GMT, 13:45 GMT, 14:00 GMT, 14:30 GMT, 15:00 GMT

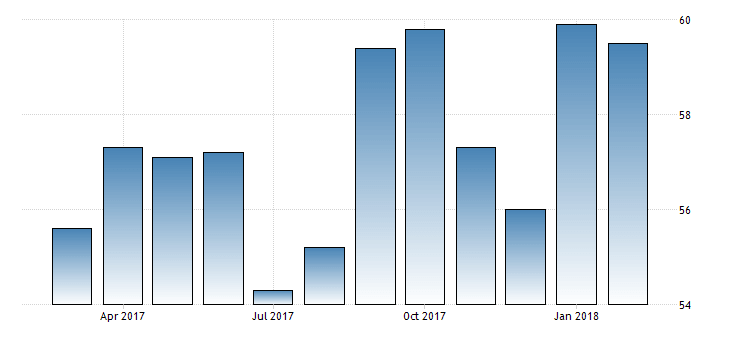

The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index (PMI) is an important indicator of the economic condition for the non-manufacturing sector. Figures above the 50 level indicates the non-manufacturing sector economy is generally expanding and is positive for the US Dollar and the US economy. The forecast is for a figure of 58.5, less than the previous figure of 59.5. The chart from tradingeconomics.com shows that the ISM Non-Manufacturing PMI index for the United States edged down to 59.5 in February of 2018 from an over 12-year high of 59.9 in January, but a monitoring of the trend is required for any potential slowdown.

The ADP Employment Change which measures the private sector Employment Change is expected to have a figure of 200K, less than the previous figure of 235K, a few days before the anticipated Non-farm Payrolls on Friday 6th April 2018. Higher figures for the ADP Employment Change are positive for the US Dollar reflecting a robust labor market, which is correlated with economic growth due to the consumer spending economic factor.

The Factory Orders provide insights on the state of the Manufacturing Sector, with higher figures being positive for the US Dollar, signaling strong economic and business conditions. The forecast is for an increase of US Factory Orders on a monthly basis, with a figure of 1.3%, higher than the previous figure of -1.4%. The EIA Crude Oil Stocks Change weekly report can move the oil prices and the USD/CAD currency pair. As an example if the increase in crude inventories is more than expected, this implies weaker than expected demand and is considered negative for crude oil prices.

Asian Session

- Japan Nikkei PMI Services

Time: 00:30 GMT

Again higher than expected or rising figures for the PMI Services Index will be positive for the Japanese Yen signaling expansion for the Services Sector. The forecast is for a figure of 51.6, a marginal decline compared to the previous figure of 51.7, which may have a neutral effect on the Japanese Yen.

Pacific Session

- Australia Retail Sales, Building Permits, AiG Performance of Services Index

Time: 01:30 GMT, 23:50 GMT

Higher readings for all fundamental factors will be positive and supportive for the Australian Dollar, signaling a robust Construction Sector, increased consumer spending and increased economic activity in the Services Sector. The forecast is for an increase of the Retail Sales, and a decline for the Building Permits, mixed economic data.