The forex market economic calendar today has a focus on US economic data, with a focus on key fundamental events and emphasis on US GDP Growth Rate. The US Dollar after the most recent interest rate increase by the Fed is searching for a trend, and the GDP Growth Rate could be a catalyst for that. Increased volatility is expected mostly today for the US Dollar, and the Euro.

These are the main economic events for today to focus on:

European Session

- Germany GfK Consumer Confidence, France Consumer Confidence

Time: 06:00 GMT, 06:45 GMT

Increased figures for Consumer Confidence in Germany and France are positive and supportive for the Euro, signaling potential increased consumer spending and higher economic growth, measured by the GDP levels.

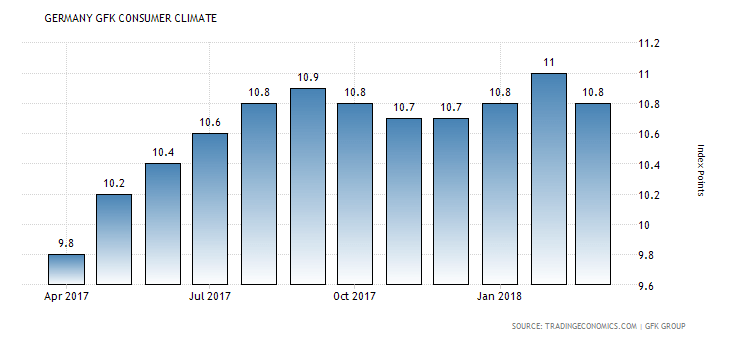

The chart shows that the Consumer Climate in Germany seems stable with levels at the 10.4.-11.00 range for the past 8-9 months. The forecast is for a figure of 10.7, marginal lower than the previous figure of 10.8. The GfK Consumer Climate Indicator for Germany slipped to 10.8 points going into March 2018 from an over 16-year high of 11 in February. For France the forecast is for an unchanged Consumer Confidence and a figure of 100.0, which can be considered a neutral reading.

American Session

- US GDP Growth Rate QoQ Final, GDP Price index Final, Corporate Profits, PCE Prices and Core PCE Prices, Wholesale Inventories, Pending Home Sales, Advance Goods trade Balance, EIA Crude Oil Stocks Change and Gasoline Stocks Change, Fed Bostic Speech

Time: 12:30 GMT, 14:00 GMT, 14:30 GMT, 16:00 GMT

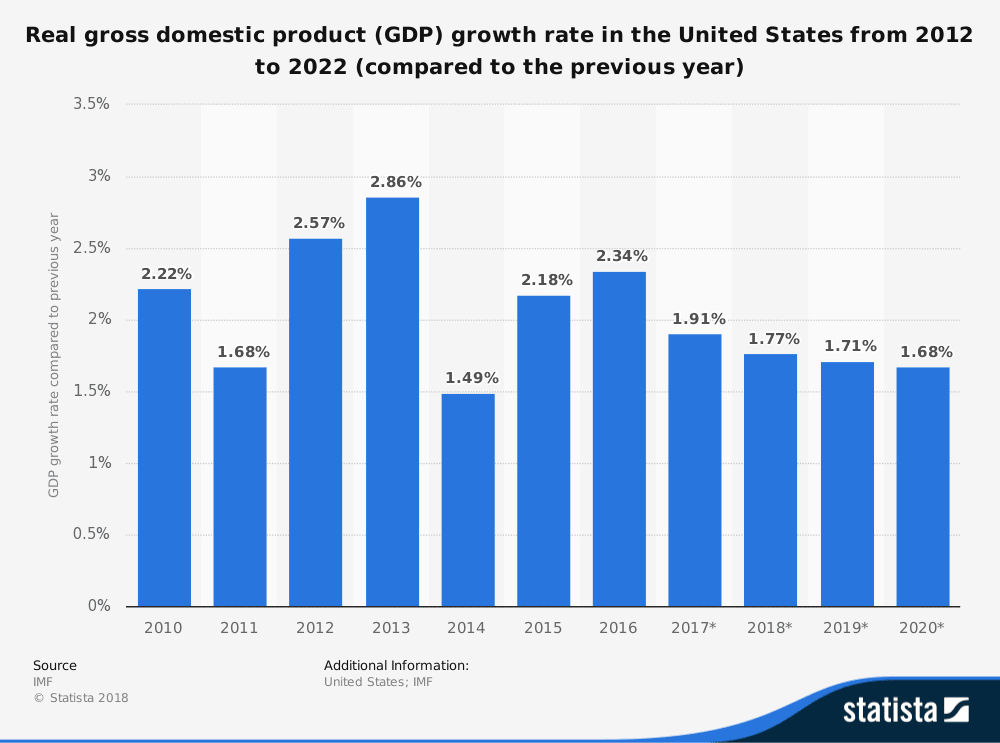

Higher than expected or increased GDP Growth Rate will be positive and supportive for the US Dollar, as the GDP indicates the rate at which the economy is growing or decreasing. The forecast is for a figure of 2.7% annualized for the 4th quarter, less than the previous figure of 3.2%. The chart shows the forecast for the US Real GDP Growth Rate in the near future.

The statistic shows the growth rate of the real gross domestic product (GDP) in the United States from 2012 to 2016, with projections up until 2022. GDP refers to the total market value of all goods and services that are produced within a country per year. It is an important indicator of the economic strength of a country. Real GDP is adjusted for price changes and is therefore regarded as a key indicator for economic growth. In 2016, the growth of the real gross domestic product in the United States was around 2.34 percent compared to the previous year. A marginal decline in the US Real GDP is expected over the next two years.

The GDP Price Index released by the Bureau of Economic Analysis, Department of Commerce measures the change in the prices of goods and services, and is an indicator of inflationary pressures in the economy. Higher readings indicate inflationary pressures, which are positive for the US Dollar as the Fed may increase the key interest rate in the future. Same can be said for PCE Prices, Personal Consumption Expenditures, measuring also change in prices in consumer goods and services. Lower readings for Wholesale Inventories and higher figures for Pending Home Sales are positive for the US Dollar, indicating strong demand for goods, and a robust housing market. The weekly Crude Oil Stocks Change can move the oil prices and the USD/CAD currency pair. If the increase in crude inventories is more than expected, this implies a weaker demand and is considered negative for crude prices.

Asian Session

- Japan Retail Sales

Time: 23:50 GMT

Increased Retail Sales Figures are positive and supportive for the Japanese economy and the Yen, leading to higher consumer spending and economic growth. The forecast is for a figure of 1.8% on a yearly basis, higher than the previous figure of 1.6%.