The focus today on the forex market economic calendar is mainly on US economic data, the CPI figure and the FOMC Meeting Minutes, which have the potential to move the US Dollar. There is also a plethora of economic data related to the economy of UK, Italy, Russia, and Australia. Moderate to high volatility and price action is expected mainly for the US Dollar and the British Pound.

These are the main economic events to focus on today as they can move the forex market:

European Session

-

ECB Non-Monetary Policy Meeting, Italy Retail Sales, UK Industrial Production, Manufacturing Production, Construction Output, Balance of Trade, ECB Draghi Speech, Russia Balance of Trade

Time: 08:00 GMT, 08:30 GMT, 11:00 GMT, 13:00 GMT

The ECB Non-Monetary Policy Meeting focuses on external economic relations, market infrastructure and payments, law, supervision of banks, corporate governance and other issues, while its decisions may indirectly influence the euro. Higher than expected or rising figures for the Retail Sales in Italy will be positive for the Euro, indicating increased consumer spending, a key economic driver of the GDP growth rate.

The forecast is for an increase of the Retail Sales in Italy monthly, with a figure of 0.3%, higher than the previous figure of -0.5%. Higher than expected or rising figures for the Manufacturing Production, Industrial Production and Construction Output in the UK, will be positive for the British Pound reflecting increased economic and business activity for the mentioned sectors. The forecast is for an increase in the Industrial Production and Manufacturing Production on a yearly basis, but also for a decline for the Construction Output again on a yearly basis. There is also the important release of the Balance of Trade for the UK.

As seen from the chart there is a trade deficit for the past 12 months. A trade surplus is considered positive for the British Pound, as it reflects capital inflows in the economy of UK and higher exports than imports, therefore increased demand for the currency. The forecast is for a trade deficit of -2.6 Billion British Pounds, narrower than the previous figure of -3.074 Billion British Pounds. Overall some mixed economic data is expected for the economy of UK.

The forex market will place attention to the ECB’s President Mario Draghi Speech for any updates commentary on current economic conditions in the Eurozone. There is also the economic release of the Trade of balance for Russia, with an expectation of a trade surplus and a figure of 14.0 Billion US Dollars, lower than the previous figure of 16.991 Billion US Dollars, which should be positive for the Russian Ruble.

American Session

- US Inflation Rate, Core Inflation Rate, EIA Crude Oil Stocks Change and Gasoline Stocks Change, FOMC Minutes

Time: 12:30 GMT, 14:30 GMT, 18:00 GMT

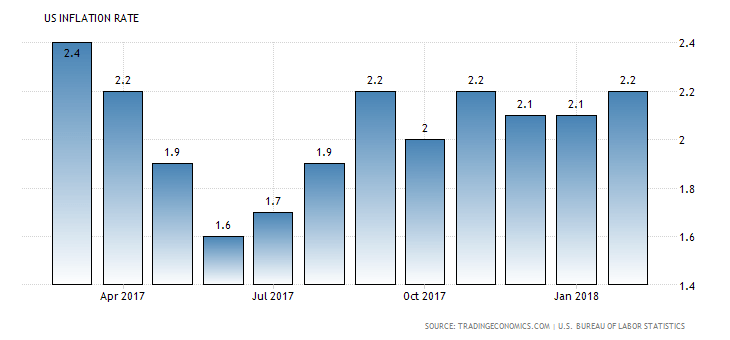

The most important economic event for today is most probably the US Inflation Rate figure, which can move significantly the US Dollar. A higher than expected or increasing figure for the Inflation Rate will be supportive and positive for the US Dollar reflecting increased inflationary pressures in the economy, supporting the Fed to increase the key interest rate soon to fight inflation. As seen from the chart, the Inflation Rate in the US is in a range of 2.0%-2.2% as of October 2017. The forecast is for a figure of 2.2%, same as per previous figure, but the Core Inflation Rate, a more conservative measurement of Inflation Rate is expected to increase at 1.9%, higher than the previous figure of 1.8%

Any positive economic surprise in the form of higher than expected figures for the US Inflation Rate should be positive for the US Dollar. The weekly Crude Oil Stocks Change van move the oil prices and the USD/CAD currency pair. If the increase in crude inventories is more than expected, then this suggests a weaker than expected demand and is considered negative for crude oil prices. The FOMC Minutes will also be important for the US Dollar, as the forex market will weigh on them for any indication of monetary policy shift, or arguments in favor or higher interest rates in the future based on current economic conditions.

Pacific Session

- Australia Westpac Consumer Confidence Index

Time: 00:30 GMT

The Index measures the level of consumer confidence, with rising figures being positive for the Australian Dollar, as Consumer Confidence can be considered a leading indicator for the consumer spending and the broader economy.