A light economic calendar today in the forex market has economic data to be announced related to the US Economy with the House Price Index and the Consumer Confidence Index, with the forex market participants probably focusing on the FOMC Rate Decision tomorrow. Elsewhere there is the announcement of the French Business Confidence and a BoJ Governor Kuroda Speech. The Us Dollar may start exhibiting increased volatility as traders may start pre-positioning orders in anticipation of the FOMC rate decision.

These are the key economic events for today in the forex market, time is GMT:

European Session

France: Business Confidence, BoE Vlieghe Speech

Time: 09:45, 11:40

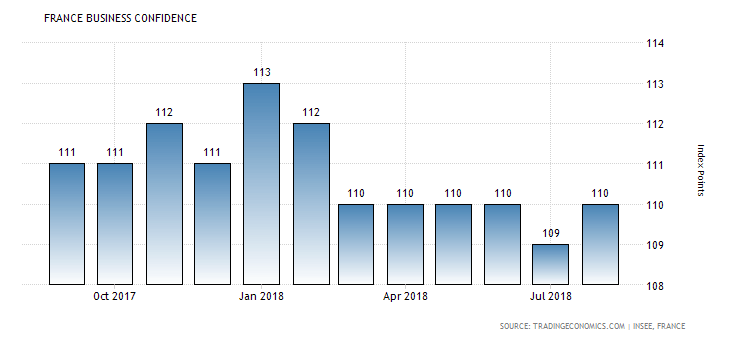

The Business Confidence in France measures the current business condition indicating the performance of the overall French economy from a short-term perspective. Positive economic growth may anticipate positive movements for the Euro as high Business Confidence readings can have positive effects on economic indicators such as employment and capital spending, which can stimulate the economy. A marginal decline to 109 from 110 is expected.

“The French industrial sentiment indicator edged up to 110 in August 2018 from an upwardly revised of 109 in the previous month. The latest reading came in comfortably above market expectations of 108, as the balance of industrialists’ opinion on past activity increased sharply (19 vs 10 in July). In addition, the balance of opinion on overall order books picked up slightly (-3 vs -4) while that on export order books has been declining since May (-3 vs -2). Expectations regarding general production improved (11 vs 10) while those concerning personal production deteriorated (18 vs 23). As regards employment, the balance of opinion on both expected workforce (2 vs 1) and past workforce (2 vs 3) were virtually stable.”, Source: Trading Economics.

The French Business Confidence for the past 12-months has been reported in a narrow range of high-low price of 113-109.

The British Pound has not any market-moving economic data released today but a speech by a senior central bank official can move the currency with any statements on economic projections as also the latest Brexit news.

American Session

US: S&P/Case-Shiller Home Price Index (YoY, MoM), House Price Index (MoM), Consumer Confidence Index, API Crude Oil Stock Change

Time: 13:00, 14:00, 20:30

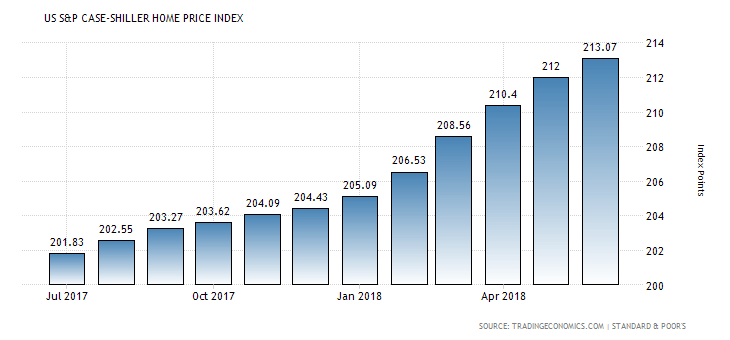

The House Price Index and the S&P/Case-Shiller Home Price Indices (YoY, MoM) provide important information about the health of the US housing market. Higher than expected readings are considered positive for the US Dollar reflecting a robust housing market. The forecasts are for unchanged readings for the monthly House Price Index and the monthly S&P/Case-Shiller Home Price Index at 0.2% and 0.5% respectively and a marginal decline for the yearly S&P/Case-Shiller Home Price Index to 6.2% from 6.3%. A strong housing market is monitored for inflationary pressures in the broader economy and for any signs of potential weakness in the economic cycles.

“The S&P CoreLogic Case-Shiller 20-City Composite Home Price Index in the US rose 6.3 percent year-on-year in June of 2018, following a 6.5 percent increase in May and below market expectations of 6.5 percent. Las Vegas recorded the biggest increase (10.3 percent), followed by Seattle (12.8 percent) and San Francisco (10.7 percent). Meanwhile, the national index, covering all nine US census divisions rose 6.2 percent in June, lower than 6.4 percent in the previous month.”, Source: Trading Economics.

From the above chart we note that the S&P/Case-Shiller Home Price Index which examines changes in the value of the residential real estate market in 20 regions across the US, has been in an uptrend for the past 12-months, reaching the highest valued of 213.07 for the last reported period.

The Conference Board (CB) Consumer Confidence measures the level of consumer confidence in economic activity, being a leading indicator as it can predict consumer spending, a key driver for overall economic activity. Higher readings indicate higher consumer optimism, which is positive for the US Dollar. A decline to 132.0 from 133.4 is expected which may influence negatively the US Dollar.

The weekly API Crude Oil Stock Change Report provides information about the inventory levels of US crude oil, gasoline and distillates stocks., an overview of US petroleum demand. If the increase in crude inventories is more than expected, this implies a weaker than expected demand and is considered negative for crude oil prices. If a decline in inventories is more than expected this indicated a greater than expected demand and is positive for crude oil prices.

Pacific Session

New Zealand: Trade Balance (YoY, MoM)

Time: 22:45

The Trade Balance is the difference between the value of country’s exports and imports. A positive balance means that exports exceed imports. A positive Trade Balance illustrates high competitiveness of country’s economy indicating capital inflows in the country and high demand for goods and services denominated in the New Zealand Dollar, a positive factor for the New Zealand Dollar.

Asian Session

Japan: BoJ Governor Kuroda Speech

Time: 05:35

A speech by the Governor of Bank of Japan is important and should be monitored for any updated on economic projections and statements about the economic growth, inflation rate and any potential shift in the monetary policy, factors which can influence the Japanese Yen.