In the economic calendar for today some of the main economic data to monitor is the S&P/Case-Shiller Home Price Inex and the US Consumer Confidence Index, the Balance of Trade for Switzerland, the Consumer Confidence figures in Italy and France, and the Retail Sales in Japan. The expected volatility for today is moderate to high, and increased liquidity after the Public Holiday yesterday in the US may prove to be supportive for higher price action in the forex market.

Key economic events for today in the forex market to focus on:

European Session

- Switzerland: Balance of Trade, France: Consumer Confidence, Italy: Consumer Confidence, Business Confidence, Eurozone: ECB Mersch Speech, ECB Lautenschlager Speech

Time: 06:00 GMT, 06:45 GMT, 08:00 GMT, 10:30 GMT, 14:30 GMT

A higher than expected or increasing trade surplus for the Swiss economy is considered positive and supportive for the Swiss Franc, reflecting increased demand for goods and services denominated in the local currency, and capital inflows in the country, which may lead to the appreciation of the currency versus other currencies. The forecast is for an increase of the trade surplus in Switzerland, a figure of 2.23B Swiss Francs is expected, higher than the previous figure of 1.8B Swiss Francs.

For the Euro higher than expected figures for the Consumer Confidence in France and Italy, and a higher figure for the Business Confidence in Italy are considered positive, reflecting optimism for current economic conditions and having positive effects on economic growth as higher consumer spending is expected.

The forecast is for a decline of the Consumer Confidence figures, and an increase of the Business Confidence, some mixed data for the Euro. Two Speeches from ECB officials are also important to monitor for their statements on economic conditions, which have the potential to influence the Euro.

American Session

- US: S&P/ Case-Shiller Home Price Index, CB Consumer Confidence, Dallas Fed Manufacturing Index, Fed Bullard Speech

Time: 04:40 GMT, 13:00 GMT, 14:00 GMT, 14:30 GMT

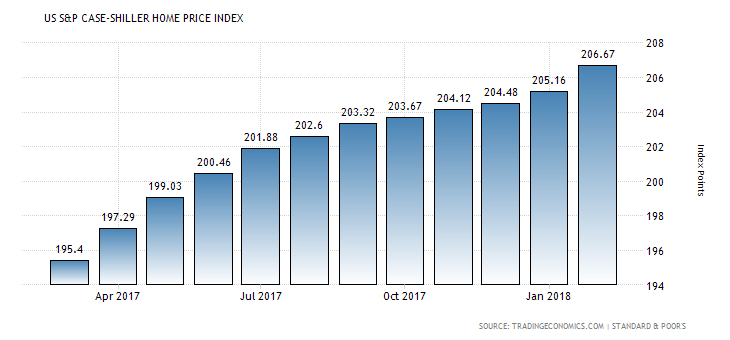

Higher than expected figures for the S&P/ Case-Shiller Home Price Index, CB Consumer Confidence, and the Dallas Fed Manufacturing Index are considered positive and supportive for the US Dollar, reflecting a strong housing market, optimism about the state of Dallas factory activity and optimism about the broader economy, which can lead to higher economic growth if consumer spending is increased.

As seen from the chart the S&P/ Case-Shiller Home Price Index has been rising as of April 2017, reflecting a strong housing market and inflationary pressures in the economy. The forecast is for a yearly change of 6.4% for the Index, lower than the previous rate of 6.8%.

The Consumer Confidence Index is expected to decline at the figure of 128.0, lower than the previous figure of 128.7, and the Dallas Fed manufacturing Index is expected to increase at the figure of 23.3, higher than the previous figure of 21.8. Mixed economic data is expected for the US Dollar.

Pacific Session

- New Zealand: RBNZ Financial Stability Report, Building Permits

Time: 21:00 GMT, 22;45 GMT

The Financial Stability Report, released by Reserve Bank of New Zealand, is published every six months and is important and should be monitored as it reflects a report on the efficienc, stability and risks of the New Zealand financial system. Higher than expected or increasing figures for the Building Permits are considered positive for the New Zealand economy and the local currency, being a leading indicator of the housing market. A strong housing market is highly correlated with a strong economy in general.

Asian Session

- Japan: Retail Sales

Time: 23:50 GMT

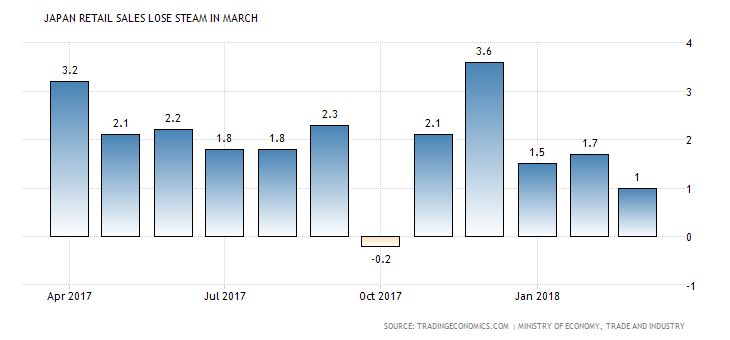

Higher than expected or rising Retail Sales are considered positive and supportive for the Japanese economy and the Yen.

As shown below in the chart, “Retail sales in Japan rose by 1.0 percent year-on-year in March of 2018, after an upwardly revised 1.7 percent gain in the previous month while markets expected a 1.7 percent rise.”, Source: Trading Economics.

In general, we notice that for the past 12-months the Retail Sales in 2018 so far, are weaker than in 2017, increasing a t a slower pace, a negative fundamental factor for the Japanese economy, as Consumer Spending is a key important indicator for the Japanese economy and its economic growth.