The monetary policy decision by the RBA is most probably the key economic event for today, which may move the Australian Dollar. The Australian Dollar appreciated yesterday against the US Dollar as the Retail Sales in Australia and the Corporate Profits beat estimates. There are several PMI figures to be released related to the economies of Italy, UK, US, Spain, Japan and the Retail Sales in the Eurozone, which may move the Euro depending on a strong economic surprise.

These are the key economic events in the forex market today to focus on:

European Session

- Spain: Markit Services PMI, Italy: Markit/ADACI Services PMI, UK: Markit/CIPS Services PMI, BoE Cunliffe Speech, Eurozone: Retail Sales (MoM, YoY), ECB President Draghi Speech, Russia: Inflation Rate YoY, Germany: Bundesbank Weidmann Speech

Time: 07:15 GMT, 07:45 GMT, 08:30 GMT, 09:00 GMT, 10:00 GMT, 13:00 GMT, 14:00 GMT, 17:30 GMT

Several PMI figures related to the economies of Italy, Spain, UK will be released, which are an indicator of the economic situation in the services sector. Readings above the 50.0 level signal expansion for the sector, while readings under the 50.0 level show contraction. The forecasts are for an increase for the Spain market Services PMI at 56.1, higher than the previous figure of 55.6, an increase for the Italy Markit/ADACI Services PMI at 52.9, higher than the previous figure of 52.6 and an increase for the UK Markit/CIPS Services PMI at 53.0, higher than the previous figure of 52.8.

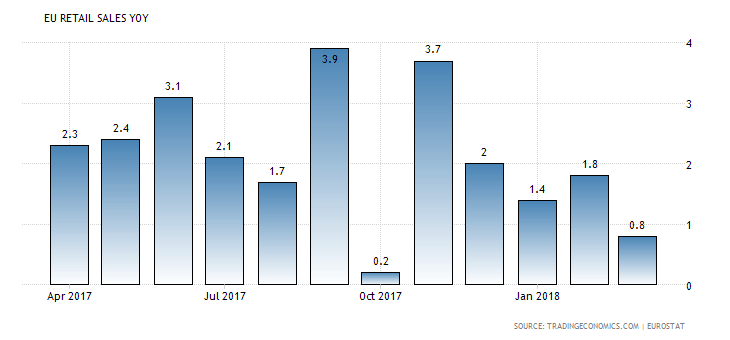

The Euro may find support and strengthen against other currencies if the Euro Area Retail Sales are better than expected. As seen from the chart the Euro Area Retail Sales in 2018 are lower compared to the figures in 2017. Increased Retail Sales translate into higher consumer spending and higher economic growth, a positive effect for the Euro.

The forecast is for an increase of the yearly Euro Area Retail Sales at 1.7%, higher than the previous figure of 0.8%.

There are two important Speeches which must be monitored, and both have the potential to move the Euro, a Bundesbank Weidmann Speech and an ECB President Draghi Speech. The yearly Inflation Rate in Russia is expected to increase at 2.5%, higher than the previous rate of 2.4%, which should be positive for the Russian Ruble, indicating inflationary pressures in the economy and increased odds of a tightening monetary policy implemented by the Central Bank of Russia.

American Session

- US: Markit Composite PMI Final, Markit Services PMI Final, IBD/TIPP Economic Optimism, JOLTs Job Openings, ISM Non-Manufacturing Employment, ISM Non-Manufacturing PMI, API Crude Oil Stock Change

Time: 13:45 GMT, 14:00 GMT, 20:30 GMT

Better than expected and rising figures for the Markit Composite PMI Final, Markit Services PMI Final, IBD/TIPP Economic Optimism, and JOLTs Job Openings are considered positive and supportive for the US Dollar, reflecting expansion in the services and composite sectors, increases optimism for the current economic conditions and a strong labor market, after the recent Non-farm Payrolls strong economic data. The forecasts are for an increase of the Economic Optimism Index and the ISM Non-Manufacturing PMI. The weekly API Crude Oil Stock Change provide an overview of the US petroleum demand and can influence the oil prices and the USD/CAD currency pair. If the increase in crude oil inventories is more than expected, this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- Australia: RBA Interest Rate Decision, RBA Assistant Governor Bullock Speech

Time: 04:30 GMT, 23:00 GMT

If the RBA is in general hawkish about the inflationary outlook of the economy and rises the interest rates, this is considered positive and should be supportive for the Australian Dollar, after the better than expected Retail Sales figure. As seen from the chart and the 5-year trend of the key interest rate in Australia has remained for almost two years at the current level of 1.5%. The forecast is for an unchanged key interest rate at 1.5%, but any statements implying that monetary policy may change in the future or any positive economic surprise may add additional volatility for the Australian Dollar, with the chances being most probably for an appreciation of the currency versus other currencies.

Asian Session

- Japan: Markit Services PMI

Time: 00:30 GMT

The Markit Services PMI Index reflects business conditions in the services sector in Japan. Readings above the 50.0 level indicate expansion in the sector being positive and supportive for the currency. Higher readings are considered positive for the Yen. The forecast is for a decline and a figure of 51.9, lower than the previous reading of 52.5.