Today in the forex market economic calendar there are two Interest Rate Decisions, one from the Riksbank in Sweden and one from the Reserve Bank of Australia. Other key economic data to be released is the Construction PMI in UK, the Retail Sales in the Eurozone, the Factory Orders in US, the API Crude Oil Stock Change and the Canadian Manufacturing PMI. Moderate to high volatility should be expected today in the forex market with liquidity expected to decline significantly at least in the American Session due to the forthcoming 4th of July Public Holiday and celebration in US.

These are the key economic events today in the forex market to focus on:

European Session

- Spain: Unemployment Change, Consumer Confidence, Sweden: Riksbank Rate Decision, Monetary Policy Report, UK: Construction PMI, Eurozone: Retail Sales (YoY, MoM), ECB Praet Speech

Time: 07:00 GMT, 07:30 GMT, 08:00 GMT, 08:30 GMT, 09:00 GMT, 16:00 GMT

Higher than expected figures for the Retail Sales in the Eurozone and the Consumer Confidence in Spain and lower than expected readings for the Unemployment Change in Spain are considered positive and supportive for the Euro, indicating strong consumers spending which leads to higher economic growth and a strong labor market, a leading indicator of the broader economy.

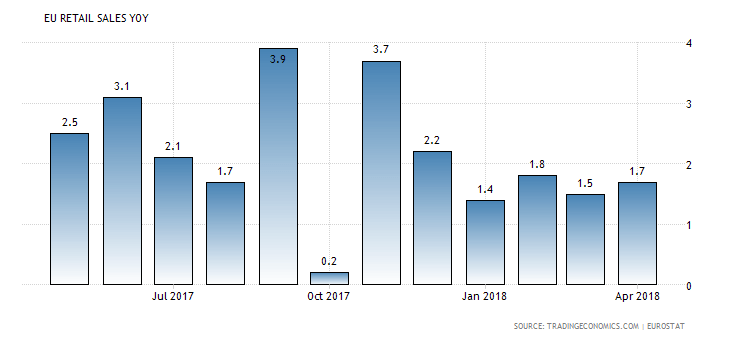

As seen from the below chart “The Eurozone’s retail trade increased 1.7 percent year-on-year in April 2018, following an upwardly revised 1.5 percent rise in March.”, Source: Trading Economics.

The Retail Sales in the Euro Area so far in 2018 are at lower levels, compared to the previous year 2017, which may lead to lower economic growth in 2018 if this trend continues in the rest of the year.

The forecasts are for unchanged monthly Retail Sales in the Eurozone at 0.1%, lower yearly Retail Sales at 1.5%, compared to the previous reading of 1.7% and a figure of -101K for the Unemployment Change in Spain, higher than the previous reading of -83.7K, but being negative indicating an expansion in the labor market.

The Risksbank Interest Rate Decision can move the Sweden Krona if the central bank of Sweden appears to be hawkish about the inflationary outlook of the economy and rises the interest rates. The central bank expects to begin slowly raising the repo rate in the middle of 2018. A negative interest rate in the economy implies that the cost of money is very cheap, and while this can add positively to the economic growth, it poses risks for the economy especially for the debt levels of the consumers and businesses, which should be kept in logical levels to avoid any possible financial bubbles in the economy, especially in the housing market. The forecast is for an unchanged key Interest Rate at -0.5%.

For UK, a higher than expected figure for the Construction PMI is seen as positive for the British Pound, reflecting an expansion in the construction sector, with the forecast being for a figure of 52.4, a marginal decline compared to the previous reading of 52.5.

American Session

- Canada: Markit Manufacturing PMI, US: Factory Orders MoM, API Crude Oil Stock Change, IBD/TIPP Economic Optimism MoM

Time: 13;30 GMT, 14:00 GMT, 20:30 GMT

For Canada an index reading above 50.0 for the Markit Manufacturing PMI indicates an overall increase in the manufacturing sector, considered positive for the Canadian Dollar. The forecast is for a figure of 55.4, lower than the previous figure of 56.2. For the economy of US higher than expected readings for the Factory Orders and the IBD/TIPP Economic Optimism Index are considered positive for the US Dollar, measuring the total orders of durable and non-durable goods, the level of short-term optimism for the economic outlook providing insights on inflation and growth in the manufacturing sector. The forecasts are for a figure of 0.0% for the monthly Factory Orders, higher than the previous reading of -0.8%, and for a higher figure of 54.2 for the Economic Optimism Index, compared to the previous reading of 53.9.

The weekly API Crude Oil Stock Change Report provides important information and an overview of US petroleum demand. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- Australia: Building Permits (MoM, YoY), RBA Interest Rate Decision

Time: 01:30 GMT, 04:30 GMT

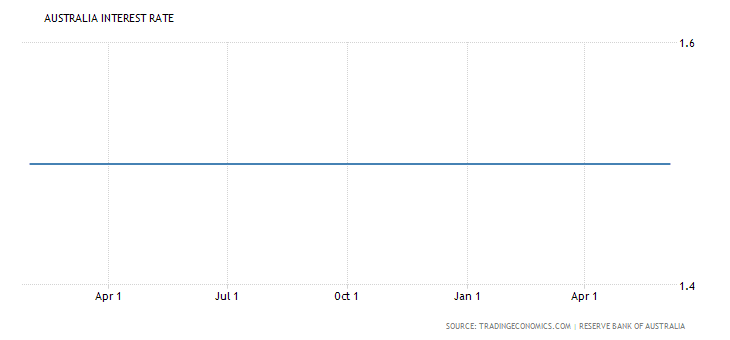

“The Reserve Bank of Australia left the cash rate unchanged at a record low of 1.5 percent at its June meeting, as widely expected. Policymakers said the Australian economy is projected to grow a bit above 3 percent in 2018 and 2019, supported by positive business conditions and rising non-mining investment; while inflation is likely to remain low for some time.” Source: Trading Economics.

An economic surprise and an interest rate hike by the RBA, or statements being hawkish for the inflationary outlook and the economic outlook most probably will be supportive and positive for the Australian Dollar.

The forecast is for an unchanged key interest rate at 1.5%. Also, higher than expected readings for the Building Permits are considered positive for the Australian Dollar, showing strong conditions in the construction sector. Both monthly and yearly Building Permits are expected to increase.