Some of the major market moving events on the calendar today are the Unemployment Rate and Employment Change in UK, the release of the RBA Meeting Minutes, the Industrial Production and the NAHB Housing Market Index for the US Economy and a Fed Chair Powell Testimony. There is also a speech by BoE Governor Carney. Moderate to high volatility should be expected today in the forex market, mainly for the British Pound and the US Dollar. There is also an EU-Japan Summit.

These are the key economic events in the forex market for today:

European Session

- UK: BoE Governor Carney Speech, Average Earnings Including Bonus, Average Earnings Excluding Bonus, Claimant Count Change, Unemployment Rate, Employment Change

Time: 08:00 GMT, 08:30 GMT

Important macroeconomic data will be released today for the UK economy, the Unemployment Rate and Employment Change. Lower than expected figures for the Unemployment Rate, and the Claimant Count Rate, and higher than expected for the Employment Change are considered positive and supportive for the British Pound, reflecting a strong labor market and higher job growth which leads to economic expansion. The Claimant Count Change measures the number of people who claim unemployment benefits but are actively seeking for employment.

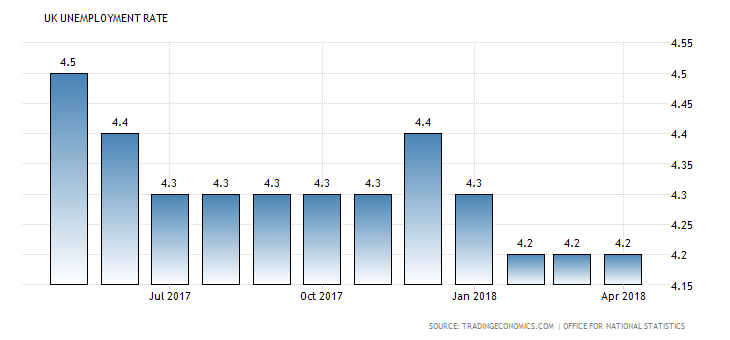

“The unemployment rate in the UK stood 4.2 percent in the three months to April of 2018, the same as in the previous period and the lowest since 1975. Figures came in line with market expectations.”, Source: Trading Economics.

As seen from the above chart the UK Unemployment Rate for the past three consecutive months has been reported at 4.2%, a 42-year low. The forecasts are for an unchanged Unemployment Rate of 4.2%, an increase for the Claimant Count Change at 2.3K, compared to the previous figure of -7.7K, an increase for the Employment Change at 150K, higher than the previous reading of 146K, and an unchanged figure for the Average Earnings Including Bonus at 2.5%.

A positive earnings growth is considered positive for the British Pound as it can lead to higher consumer spending and economic growth. Overall mixed economic data is expected for the UK economy. An economic surprise, a positive one for Employment Change may provide further support for the British Pound. The speech by BoE Governor Carney on financial stability can also move the British Pound and will be monitored by the forex market participants, as any statements and news on Brexit developments can influence the volatility of the British Pound versus other currencies.

American Session

- US: Industrial Production (YoY, MoM), Fed Chair Powell Testimony, NAHB Housing Market Index, Net Long-term TIC Flows, API Weekly Crude Oil Stock

Time: 13;15 GMT, 14:00 GMT, 20:00 GMT, 20:30 GMT

The Industrial Production shows the volume of production of US industries such as factories and manufacturing. Higher figures show economic expansion and strong economic conditions in the industrial sector, considered positive for the US Dollar. The NAHB Housing Market Index presents home sales and expected home buildings in the future, being an important economic indicator of the housing market trend.

High readings for the NAHB Housing Market Index are considered positive for the US economy and US Dollar. The Net Long-term TIC Flows are a summary of the flow of stocks, bonds, and money market funds to and from the United States. A positive figure indicates capital inflows in the US financial and capital markets, indicative of an optimistic economic outlook.

The API Weekly Crude Oil Stock report provides an overview of US petroleum demand.

If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered negative for crude oil prices.

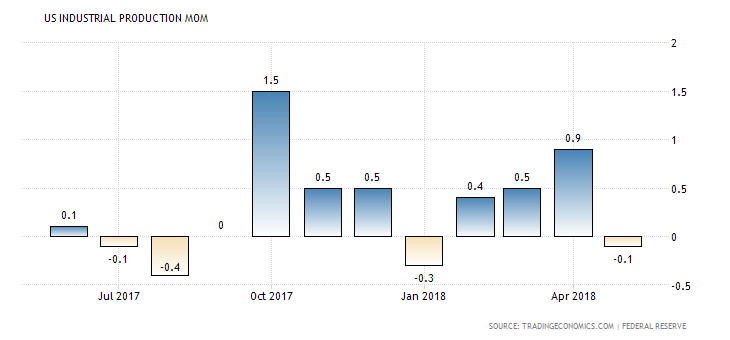

The forecasts are for an increase for the monthly US Industrial Production at 0.5%, compared to the previous reading of -0.1%, an increase for the NAHB Housing Market Index at 69, higher than the previous reading of 68 and a decline for the Net Long-term TIC Flows at 34.3B US Dollars, lower than the previous reading of 93.9B US Dollars.

“US industrial production edged down 0.1 percent month-over-month in May 2018, following an upwardly revised 0.9 percent growth in April and missing market expectations of a 0.2 percent gain. Manufacturing production fell sharply largely because truck assemblies were disrupted by a major fire at a parts supplier.”, Source: Trading Economics

As seen from the chart the monthly US Industrial Production is both very volatile and with and undefined trend. After three consecutive months of increases there was a large decline and a negative figure for the past month.

Pacific Session

- Australia: RBA Meeting Minutes

Time: 01:30 GMT

The minutes of the last RBA meeting on monetary policy will be released, providing insights on policy discussion, including different points of view and the votes of the individual members of the Committee. If the RBA is hawkish about the inflationary outlook for the economy and the economic outlook this is considered positive for the Australian Dollar, as it implies a higher possibility of a rate increase soon.