The inflation Rate in Australia and the US Consumer Confidence Index are the key economic events for today in the forex market. There is also important economic data related to the economies of Germany, Switzerland and the UK. Moderate to high volatility and price action is expected mostly for the Australian and the US Dollar, plus the Euro.

Key economic events for today in the forex market to focus on:

European Session

- Switzerland: Balance of Trade, France: Business Confidence, UK: BoE Deputy Governor Woods Speech, CBI Industrial Trends Orders, CBI Business Optimism Index, Germany: Ifo Current Conditions, Ifo Expectations and Ifo Business Climate, Italy: Business Confidence, Consumer Confidence

Time: 06:00 GMT, 06:45 GMT, 07:00 GMT, 08:00 GMT, 10:00 GMT

Higher than expected or increasing figures for the surplus in the Balance of Trade of Switzerland is positive and supportive for the Swiss Franc. A trade surplus reflects capital inflows in the local economy and increased demand for goods and services denominated in Swiss Francs, which could lead to the appreciation of the currency in the future. The forecast for the trade surplus in Switzerland is for a reading of 2.9Billion Swiss Francs, which is lower than the previous figure of 3.2 Billion Swiss Francs.

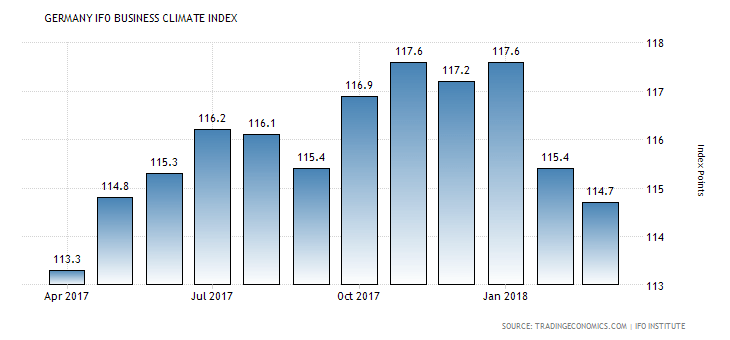

The main economic event which can move significantly the Euro is the release of the Ifo Business Climate in Germany. The German Ifo Business Climate Index measures the current German business climate and measures expectations for the next six months, with increased readings being positive for the economy of Germany and the Euro. As seen from the chart, the Ifo Business Climate Index in Germany has been in a decline in 2018 for the past two consecutive months.

All the Ifo readings can be considered as early indicators of economic developments in Germany, based on surveys of manufacturers, retailers, builders. Increasing Ifo readings reflect optimism on the current and short-term future economic outlook in Germany, being supportive for the Euro. The forecast is for an Ifo Business Climate reading of 105.0, lower than the previous reading of 114.7, an Ifo Current Conditions reading of 109.5, lower than the previous reading of 125.9, and an Ifo Expectations reading of 101.5, lower than the previous reading of 104.4. With all Ifo readings expected to decline, the Euro may face selling pressure and depreciate against other currencies.

Increased readings for the Business and Consumer Confidence in Italy, and Business Confidence in France are considered positive for the Euro, as they can have a positive effect on consumer spending, employment, investments in capital and economic growth measured by the GDP level. Also, higher than expected readings for the CBI Industrial Trends Orders and the CBI Business Optimism Index in UK are considered positive for the British Pound, reflecting a strong economic activity in the Industrial Sector and optimism for the prospects and growth in the Business Sector. The forecast is for a mixed economic data, an increase for the CBI Industrial Trends Orders in UK and a decline for the CBI Business Optimism Index.

American Session

- US: CB Consumer Confidence, S&P/Case-Shiller Home Price Index, New Home Sales, API Crude Oil Stocks Change

Time: 13:00 GMT, 14:00 GMT, 20:30 GMT

The API Crude Oil Stocks Change provides an overview of US petroleum demand. If the increase in crude inventories is more than expected, this implies a weaker than expected demand and is considered negative for crude oil prices. The S&P/Case-Shiller House Price Index measures the change in the selling price of single-family homes and can provide important information combined with the reading of the New Home Sales about the state of the housing market in the US economy. Increasing figures for both the S&P/Case-Shiller House Price Index and New Home Sales are positive for the UD Dollar, reflecting a robust housing market. On a year-over-year basis the S&P/Case-Shiller House Price Index is expected to show a reading of 6.2%, lower than the previous reading of 6.4%. The New Home Sales are expected to increase monthly at 0.615Million, lower than the previous monthly figure of 0.618Million in March 2018.

Pacific Session

- Australia: Inflation Rate YoY and QoQ Q1

Time: 01:30 GMT

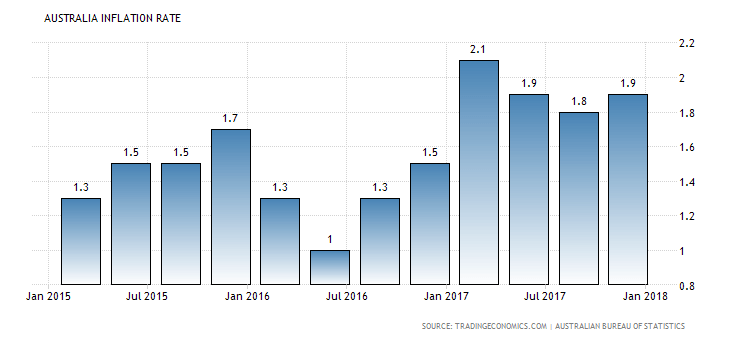

The Inflation Rate in Australia as seen from the chart has been in a range 0f 1.3%-2.1% for the past 12-months. Increased figures are considered positive for the Australian Dollar, indicating sustainable inflationary pressures in the economy, which may weigh on the Reserve Bank of Australia to increase the key interest rate to fight inflation.

For the first quarter of 2018 the forecast is for a yearly Inflation Rate of 2%, higher than the previous rate of 1.9%, and a quarterly figure of 0.5%, lower than the previous figure of 0.6%. Any positive economic surprise may add increased volatility and price action for the Australian Dollar.