Today the forex market economic calendar is relatively light with some important economic events, related to the economies of Eurozone, Italy, France, Spain, and the US. In view of Easter Holiday, the price action and volatility should remain in low to moderate levels this weeks, as liquidity will probably be reduced later on this week.

These are the main economic events for today in the forex market to focus on:

European Session

- Inflation Rate Spain, Italy Business Confidence and Consumer Confidence, Eurozone Services Sentiment, Eurozone Industrial Sentiment, Eurozone Business Confidence, Eurozone Economic Sentiment, France Unemployment Benefit Claims, Spain Business Confidence

Time: 07:00 GMT, 08:00 GMT, 09:00 GMT, 10:15 GMT

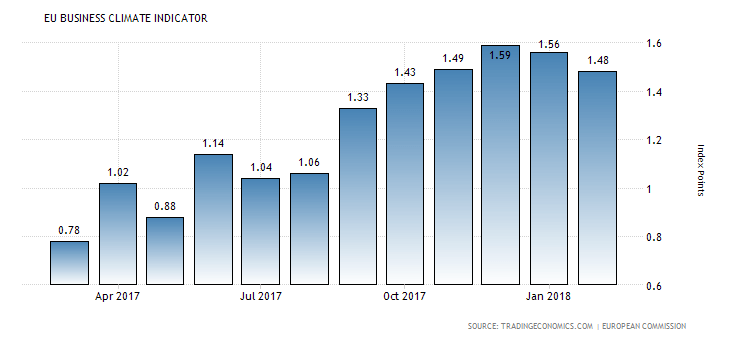

Higher than expected or rising figures for the Inflation Rate in Spain, and Business Confidence, Consumer Confidence in Italy, Spain and the Eurozone will be considered positive and supportive for the Euro reflecting inflationary pressures and mostly increased optimism about the economic outlook. The forecasts are for an increase of the Inflation Rate in Spain with a figure of 1.5%, higher than the previous figure of 1.1%, and a decline for the Business Confidence in the Eurozone, with a figure of 1.40, less than the previous figure of 1.48.

As seen from the chart the Business Confidence in the Euro Area is in an uptrend as of August 2017, but seems to have peaked during December 2017, and in 2018 it has been in a decline. Increased Business Confidence is associated with increased business spending, a robust economy, having also a positive impact on the unemployment, as with optimism for the business outlook, businesses will tend in general to employ more labor force.

American Session

- S&P/Case-Shiller Home Price Index, CB Consumer Confidence, Fed Bostic Speech, API Crude Oil Stock Change

Time: 13:00 GMT, 14:00 GMT, 18:30 GMT

Higher than expected figures for the Home Price Index will be positive for the US Dollar, reflecting a strong housing market and inflationary pressures in the economy. The Consumer Confidence released by the Conference Board captures the level of confidence that individuals have in economic activity, in general a high level of consumer confidence stimulates economic expansion and is considered positive for the US Dollar. The forecast is for a reading of 131.2, higher than the previous reading of 130.8. The Index is at highest level since 2000, and it should provide support for the US Dollar, as increased consumer confidence leads to higher consumer spending and economic growth.

Pacific Session

- Australia New Home Sales, RBA Governor Kent Speech

Time: 00:00 GMT, 00:45 GMT

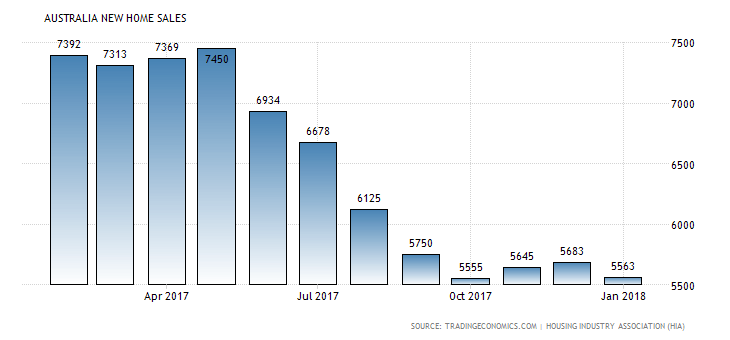

As seen from the chart the Australia New Home Sales are in a steep decline as of May 2017, which is considered negative for the Australia Dollar, as it reflects a weak housing market.

A weak housing market for New Home Sales is associated with lower consumer spending, and could be an early sign of an economic slowdown.