Today the main focus on the forex market will be on the inflation rate in UK, the business and consumer confidence in Australia and the Gross Domestic Product Growth in Japan. Moderate to high volatility and price action is expected for the British Pound, the Australian Dollar and the Japanese Yen. Also there could be some volatility for the USD/CAD currency pair as early in the morning there will be a release of oil market report from the International Energy Agency.

These are the main economic events in the forex market today:

European Session

- IEA Oil Market Report, UK Inflation Rate, Core Inflation Rate

Time: 09:00 GMT, 09:30 GMT

The oil market report released by the International Energy Agency can move the oil prices as there will be insights on the demand/supply levels and their forecasts. Recently US crude oil fell below $59 a barrel for the first time in 2018, as a result of a rising production in the US and a strong US Dollar. The oil prices fell almost 10% in the past week so the recent oil market report may add some bounce in the oil prices, or could support the recent selloff in the event global supply is predicted to exceed significantly the global demand.

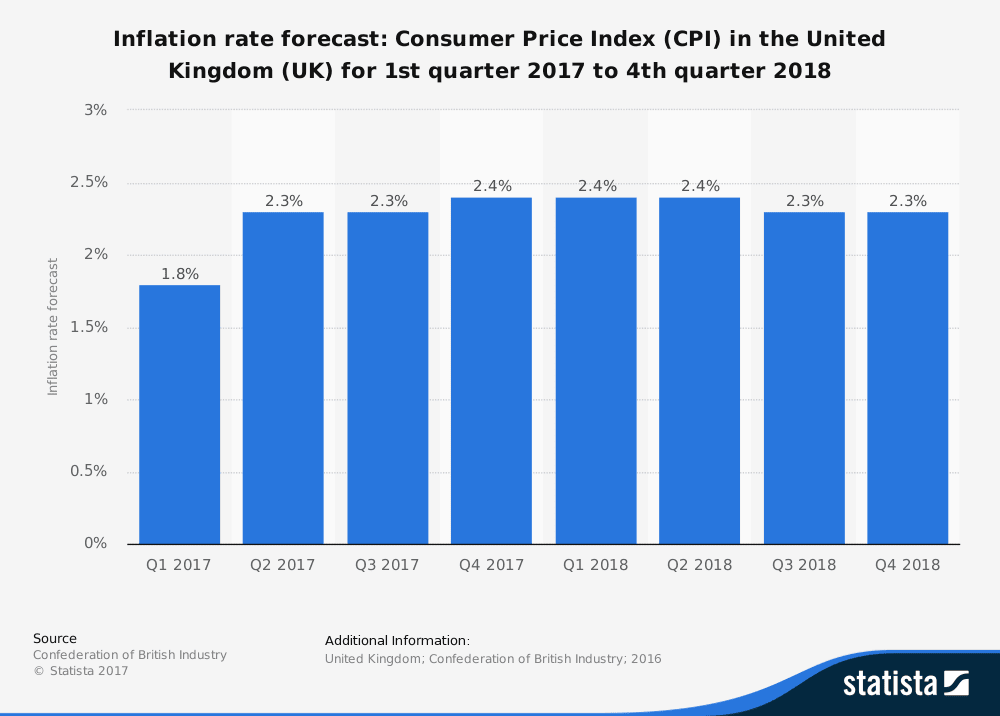

The UK inflation figure will be monitored closely by the forex market as recently the Bank of England made some supportive statements about the future interest rate path and the GDP growth rate. In the event that the inflation rate in UK is higher than expected or a consistent uptrend is evident then the British Pound may appreciate against other currencies, increasing the odds of near-term interest rate increases by the Bank of England. However the expectation is for a decline on the yearly inflation at 2.9%, lower than the previous figure of 3.0%, and on a monthly basis the inflation rate is expected to decline having a reading of -0.6%, lower than the previous reading of 0.4%. Furthermore the Core Inflation Rate which is more conservative and indicative of the real inflationary pressures in the economy is expected to show only a marginal increase and a reading of 2.6% on a yearly basis, higher than the previous reading of 2.5%.

As seen from the chart the prediction for the inflation rate in UK is for stable to lower readings in the 2018. This combined with Brexit talks can influence the interest rate path followed by the Bank of England in 2018, but with this almost stable inflationary pressures in the economy, it is hard to justify several interest rate hikes by the Bank of England in 2018. One interest rate increase is widely expected, but more than one increases have for now a low probability of occurring, unless there is a dramatic upward shift in the CPI in UK during the following months.

American Session

- API Crude Oil Stock Change

Time: 21:30 GMT

The American Petroleum Institute report on the US petroleum demand can influence the oil prices and the USD/CAD currency pair. For example if a decline in oil inventories is less than expected, this indicates a weaker demand and should be negative for oil prices.

Pacific Session

- Australia NAB Business Confidence, Westpac Consumer Confidence

Time: 00:30 GMT, 23:30 GMT

Two important leading indicator for the Australian economy will be released and higher than expected or rising figures should be supportive for the Australian Dollar indicating more optimism for the business and economic conditions. Increased consumer and business confidence readings can influence positively the consumer spending, wages, inflation, unemployment, capital spending and also have a positive effect on the economic growth.

Asian Session

- Japan Gross Domestic Product, Machine Tool Orders

Time: 06:00 GMT, 23:50 GMT

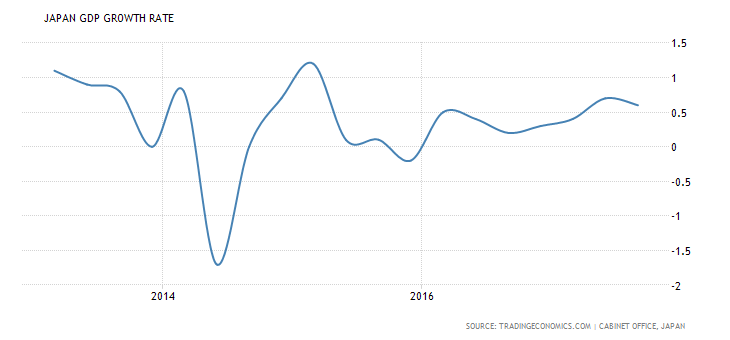

The machine tool orders reflect the state of the manufacturing sector with higher than expected or rising figures being positive for the Japanese Yen, indicating increased business capital spending and probably increased employment numbers and business confidence in the economy. Also increased figures for the Gross Domestic Product should be positive and supportive for the Japanese Yen indicating a robust and expanding economy. The forecast for the fourth quarter annualized figure is 1.0%, lower than the previous figure of 2.5%, while also for the quarter-over-quarter figure the expectation is for a decline and a reading of 0.2%, less than the previous reading of 0.6%.As seen from the graph and the 5-year GDP growth rate in Japan, the recent trend is a slight uptrend over time, and the anticipated lower than expected figure may due to seasonality reasons, such as extreme weather conditions.

If the surprise is a negative one with a lower than expected actual figure, then there could be selling pressure for the Japanese Yen, while in the event of a positive surprise the Yen should appreciate against other currencies.