Three central bank interest rate decisions exist today in the forex market economic calendar, which should provide increased volatility and price action for the British Pound, Swiss Franc and the Norwegian Krone. There is important labor market data and the Philadelphia Fed Manufacturing Survey for the US economy, the Consumer Confidence Flash in the Eurozone, and the Inflation Rate in Japan. A lot of important economic data to be released today, which should move the forex market. Any economic surprises positive or negative may add further volatility.

Key economic events in the forex market today:

European Session

- Switzerland: SNB Financial Stability Report, Balance of Trade, SNB Interest Rate Decision, France: Business Confidence, Eurozone: Eurogroup Meeting, ECB Nouy Speech, Consumer Confidence Flash, Norway: Norges Bank Monetary Policy Report, Norges Bank Interest Rate Decision, Spain: Balance of Trade, Germany: Bundesbank Weidmann Speech, UK: BoE Quantitative Easing, BoE Interest Rate Decision, BoE Governor Carney Speech

Time: 04:30 GMT, 06:00 GMT, 06:45 GMT, 08:00 GMT, 09:45 GMT,11:00 GMT, 12;45 GMT, 14:00 GMT

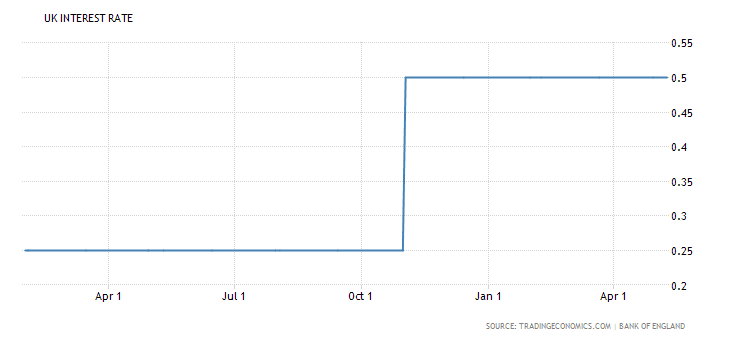

All three central banks, Bank of England, Swiss National Bank and Norges Bank are expected to leave the key interest rates unchanged at 0.5%, -0.75% and 0.5% respectively. If the central banks appear to be hawkish about the inflationary and growth outlook of their economy and raise the interest rates, this is considered positive and supportive for the local currencies.

“The Bank of England voted by seven to two to keep the Bank Rate at 0.5 percent on May 10th, due to a sharp slowdown in GDP growth in the first quarter. Still, policymakers noted that wage growth and domestic cost pressures are firming gradually while CPI inflation is projected to fall back slightly more quickly than previously estimated. The bank also said that the recent weakness in data had been consistent with a temporary soft patch, suggesting an August rate hike is still on the table.”, Source: Trading Economics.

Any change in the Quantitative Easing program may also influence the British Pound.

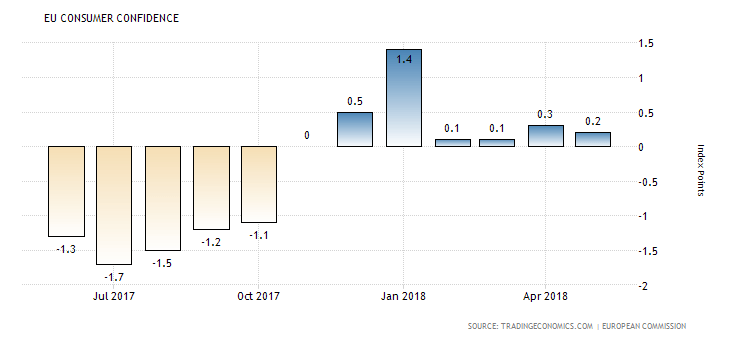

The Euro may move as there is a Eurogroup Meeting with discussion on economic and monetary affairs, and the release of the Business Confidence in France, The Balance of Trade in Spain and the Eurozone Consumer Confidence Flash. Higher than expected readings for all these economic data are considered supportive and positive for the Euro. They anticipate positive economic growth and the level of consumer confidence in economic activity.

As seen from the chart the Eurozone Consumer Confidence has turned positive in 2018 from negative in 2017. A high level of consumer confidence stimulates economic expansion. The forecast is for a reading of -0.1, lower than the previous reading of 0.2.

The Speeches by senior central bank officials should be monitored having the potential to influence the Euro and the British Pound based on comments related to the economic conditions and projections, and the level of optimism expressed in the language used.

American Session

- US: Continuing Jobless Claims, Initial Jobless Claims, Philadelphia Fed Manufacturing Survey, Housing Price Index

Time: 12:30 GMT, 13:00 GMT

Lower than expected readings for the Continuing and Initial Jobless Claims and higher than expected figures for the Philadelphia Fed Manufacturing Survey and Housing Price Index are considered positive for the US Dollar reflecting a strong labor market, inflationary pressures in the housing market, and strong economic trends for the manufacturing sector. The forecasts are for higher readings for the Continuing and Initial Jobless Claims, a lower reading for the Philadelphia Fed Manufacturing Survey at 29.0, lower than the previous reading of 34.0 and a higher reading for the monthly Housing Price Index with a rate of 0.3%, higher than the previous rate of 0.1%.

Pacific Session

- RBA Bulletin

Time: 01:30 GMT

The Bulletin, published by Reserve Bank of Australia will provide important economic data and information on economic and financial developments in Australia, and will be monitored by the forex market participants and it can influence the short-term trend for the Australian Dollar.

Asian Session

- Japan: Inflation Rate (YoY, Mom), Core Inflation Rate YoY

Time: 23:30 GMT

The National Consumer Price Index is the most significant way to measure changes in purchasing trends and inflationary pressures in the economy. The Core Inflation Rate is considered a more conservative measure of the Inflation Rate excluding the volatile prices of food and energy. A rising Inflation Rate is considered positive for the Japanese yen as it may weigh on the Bank of Japan decision to raise interest rates to manage inflation. The forecasts are for an unchanged yearly Core Inflation Rate at 0.7%, and an unchanged yearly Inflation Rate at 0.6%, which should have a neutral effect on the Japanese Yen.