After the Fed Interest Rate Decision, the focus today is on the ECB Interest Rate Decision and any changes to the asset purchasing program in the Eurozone. There is a plethora of important economic data to move the forex market, starting from the Inflation Rate in Germany and the UK Retail Sales, and moving on to the US Retail Sales and Jobless Claims data, the Unemployment Rate in Australia and the Business PMI for New Zealand. Overall moderate to high volatility is expected, mainly for the Euro due to the monetary policy decision.

These are the key economic events to focus on today in the forex market:

European Session

- Germany: Inflation Rate YoY Final, Sweden: Inflation Rate MoM, CPIF YoY, UK: Retail Sales (MoM, YoY), Retail Sales ex Fuel (MoM, YoY), Eurozone: ECB Interest Rate Decision, Deposit Facility Rate, ECB Press Conference

Time: 06:00 GMT, 07:30 GMT, 08:30 GMT, 11:45 GMT, 12:30 GMT

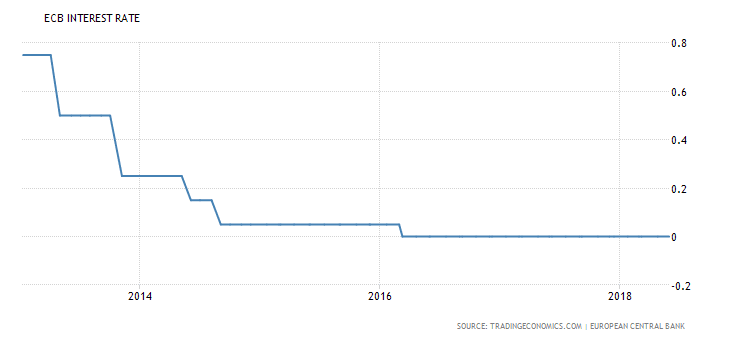

The ECB Interest Rate Decision has the potential to move the Euro, not only with the actual outcome, but also with the language used in the ECB press conference providing important signals about how ECB feels about inflation and the economy, economic growth. Any statements that will mention changes in the QE program, the asset purchasing program by the ECB currently at 30B euros until September 2018 can also add further volatility for the Euro. As seen from the below chart the 5-year key interest rate in the Eurozone has been at the rate of 0.0% as of 2016.

“The ECB held its benchmark refinancing rate at 0 percent on April 26th as expected and reaffirmed that the net asset purchases are intended to run at a monthly pace of €30 billion until the end of September, or beyond, if necessary. Policymakers agreed that an ample degree of monetary stimulus remains necessary for underlying inflation pressures to continue to build up. The deposit facility rate and the marginal lending facility rate were also kept at -0.4 percent and 0.25 percent, respectively.”, Source: Trading Economics.

The forecast is for an unchanged key interest rate of 0.0%.

Before the ECB Interest Rate Decision, the Euro could move with the release of the German Inflation Rate YoY Final, expected to increase at 2.2%, higher than the previous rate of 1.6%. This will indicate inflationary pressures in the largest economy of the Eurozone, having a significant weight on the Inflation Rate of the Eurozone, and is considered positive for the Euro. Any sustained inflationary pressures above the key level of 2.0% monitored by the ECB increases the odds of future monetary policy change by the ECB, making a future interest rate increase likely.

The yearly Sweden Consumer Price Index with a Fixed Interest Rate (CPIF) is expected to increase at 2.1%, higher than the previous rate of 1.9%, while the monthly Inflation Rate is expected to decline at 0.2%, lower than the previous reading of 0.4%. Higher than expected figures for the Inflation Rate are considered positive for the Swedish Krona, as it may weigh on Sweden’s central bank decision to start increasing the key interest rate to fight Inflation.

The Retail Sales in UK are expected to show some mixed economic data, with an increase for the yearly readings and a decline for the monthly readings. Changes in Retail Sales are an important indicator of consumer spending, which can stimulate economic growth measured by the GDP level. High readings for the Retail Sales are considered positive for the British Pound.

American Session

- US: Retail Sales MoM, Retail Sales ex Autos MoM, Retail Sales Control Group, Initial Jobless Claims, Continuing Jobless Claims, Business Inventories, Canada: New Housing Price Index (YoY, MoM)

Time: 12:30 GMT

High or better than expected readings for the Retail Sales and low readings for the Initial Jobless Claims and the Business Inventories are considered positive for the US Dollar reflecting increased consumer spending and business sales and a robust labor market, all signs of a strong economy. The forecast is for an increase of the US monthly Retail Sales at 0.4%, higher than the previous figure of 0.3%, an increase for the monthly Business Inventories at 0.3%, higher than the previous reading of 0.0% and a lower reading for the Continuing Jobless Claims but a higher reading for the Initial Jobless Claims. Overall some mixed economic data is expected for the US Dollar.

The New Housing Price Index (NHPI) measures changes over time for the selling prices of new residential houses. High readings indicate increased demand for new houses, a robust housing market, and inflationary pressures in the economy of Canada. The forecast is for a decline of the yearly New Housing Price Index (NHPI) in Canada at 1.7%, lower than the previous reading of 2.4%, and an increase for the monthly New Housing Price Index (NHPI) at 0.2%, higher than the previous reading of 0.0%.

Pacific Session

- Australia: Unemployment Rate, Employment Change, Consumer Inflation Expectation, New Zealand: Business PMI

Time: 01:00 GMT, 01:30 GMT, 22:30 GMT

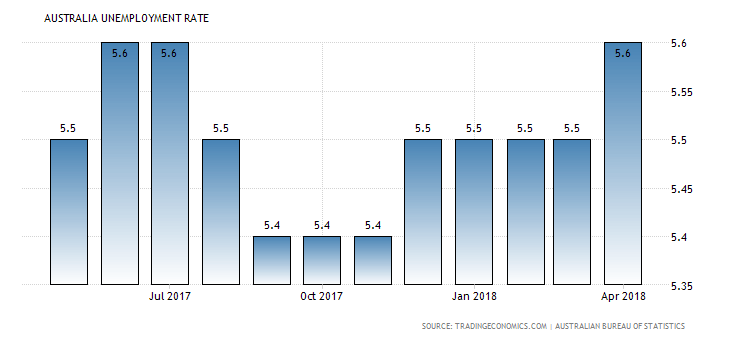

The Australian Unemployment Rate has lately increased from the low-price of 5.4% to the high-price of 5.6%. Lower readings for the Unemployment Rate and higher for the Employment Change and the Consumer Inflation Expectation are considered positive for the Australian Dollar. The forecast is for a decline for the Unemployment Rate at 5.5%, lower than the latest reading of 5.6%, and a decline for the Employment Change with an expected reading of 18.0K, lower than the previous reading of 22.6K.

For the New Zealand Dollar, a higher than expected reading for the Business PMI is considered positive, reflecting improved business and economic conditions.

Asian Session

- Japan: Industrial Production (YoY, MoM)

Time: 04:30 GMT

High figures for the Industrial production are considered positive for the Yen, reflecting the state of the Industrial and potential future changes in employment, earnings, and personal income. The forecast is for an increase of the yearly Industrial Production in Japan at 3.1%, higher than the previous figure of 2.5%, and an unchanged reading of the monthly Industrial Production at 0.3%.