Macroeconomic data about the Swiss economy, the labor market in US, the business conditions about the manufacturing sector in New Zealand, the ECB Economic Bulletin, the new housing price index in Canada and the GDP growth rate in Japan are to be released today in the forex market with a focus on the Japanese Yen which should be expected to witness increased volatility.

These are the key economic events which can move the forex market today, time is GMT:

European Session

Switzerland: Unemployment Rate, Eurozone: ECB Economic Bulletin

Time: 05:45, 08:00

The Unemployment Rate is the number of unemployed workers divided by the total civilian labor force. A lower than expected figure is considered positive for the Swiss economy and Swiss Franc as high unemployment in general leads to lower average wages and reduced consumer spending and slower economic growth. The forecast is for an unchanged Unemployment Rate at 2.6%. The ECB Economic Bulletin is important as it presents the economic and monetary information which may have an influence on policy decisions.

American Session

Canada: Housing Starts, New Housing Price Index (YoY, MoM), US: Producer Price Index ex Food and Energy, Continuing Jobless Claims, Initial Jobless Claims, Fed Evans Speech, Wholesale Inventories MoM

Time: 12:15, 12:30, 13:30, 14:00

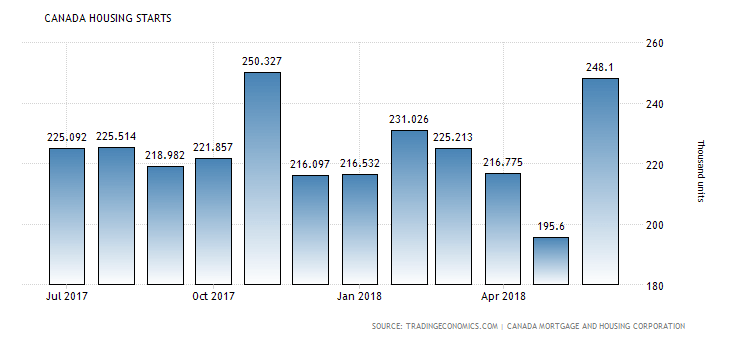

The Housing Starts measures how many new single-family homes or buildings were constructed showing the strength of the Canadian housing market. The New Housing Price Index (NHPI) is a monthly series that measures changes over time in the contractors’ selling prices of new residential houses, where detailed specifications pertaining to each house remain the same between two consecutive periods. The growth rate of the housing market has very significant effect on the Canadian Dollar volatility. Higher than expected figures for the Housing Starts and New Housing Price Index are considered positive for the Canadian Dollar, reflecting a robust housing market. The forecast is for a decline of the Housing Starts at 219.5K, lower than the previous figure of 248.1k while the monthly New Housing Price Index is expected to increase at 0.1%, higher than the previous figure of 0.0%.

“Canadian seasonally adjusted housing starts increased to 248.1 thousand units in June of 2018 from a downwardly revised 193.9 thousand units in May and beating market expectations of 210 thousand. It was the highest reading in seven months, as multiple urban starts surged 46.4 percent to 172.8 thousand and urban starts grew 29.9 percent to 228.8 thousand. On the other hand, single-detached urban starts decreased 3.5 percent to 56 thousand units. Rural starts were estimated at a seasonally adjusted annual rate of 19.3 thousand units.”, Source: Trading Economics.

For the US economy the Producer Price Index ex Food & energy measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded to capture a more accurate calculation of the changes in prices. Higher than expected readings indicate inflationary pressures in the economy, which is considered positive for the US Dollar. Lower than expected readings for the Continuing Jobless Claims, Initial Jobless Claims, and the Wholesale Inventories are considered positive for the US Dollar indicating a strong labor market and not the presence of economic slowing in the US economy. The forecasts are for higher figures for the Continuing Jobless Claims and Initial Jobless Claims at 1.740M and 220K respectively, compared to the previous figures of 1.724M and 218K accordingly. The Wholesale Inventories are expected to remain unchanged at 0.0%.

Pacific Session

New Zealand: Business NZ PMI

Time: 22:30

The Business NZ PMI shows the business conditions in New Zealand. The Business PMI is an important indicator of the overall economic condition. Values above 50 are considered positive for the New Zealand Dollar reflecting strong business conditions.

Asian Session

Japan: GDP Growth Rate QoQ Prel Q2, GDP Growth Rate Annualized Prel Q2

Time: 23:50

The Gross Domestic shows the monetary value of all the goods, services and structures produced in Japan within a given period, a gross measure of market activity. It is the most important fundamental report that reflects the state of the economy, if there is an expansion or a contraction. A high reading or a better than expected number is positive for the Japanese Yen.

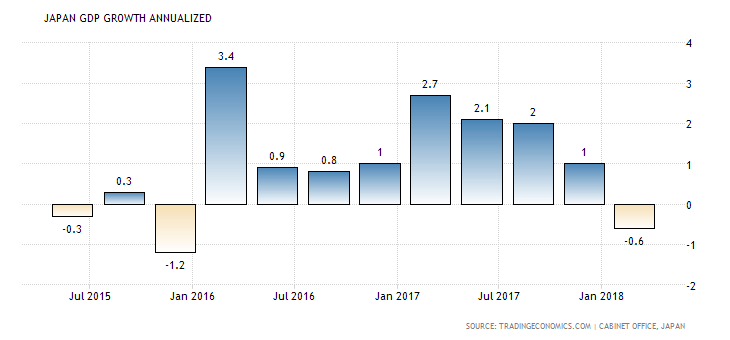

“Japan’s gross domestic product shrank an annualized 0.6 percent in the first quarter of 2018, the same as the preliminary estimate but worse than market consensus of a 0.4 percent contraction and following an upwardly revised 1 percent expansion in the preceding quarter. It is the first contraction since the December quarter 2015, ending the longest straight period of uninterrupted growth in 28 years.”, Source: Trading Economics.

As seen from the above chart Japan’s gross domestic product annualized growth in the first quarter of 2018 was negative and very weak compared to the year 2017. The forecast is for an annualized GDP Growth Rate of 1.4%, an increase compared to the previous reading of -0.6%. An increase is also expected for the quarterly figure for the second quarter with a figure of 0.3%, higher than the previous figure of -0.2%. Any economic surprise either positive or negative to the GDP figures may add further volatility and price action for the Japanese Yen upon their release.