A plethora of economic events in the European session today in the forex market economic calendar can move the Euro, the Swiss Franc and The British Pound. There are also important economic data in the American, Asian and Pacific sessions, especially the Trade Balance figures for Australia and the US. The volatility and price action today is expected to be moderate to high.

Key economic events for today to focus on:

European Session

- Germany Factory Orders, Spain Markit Services PMI, Switzerland Inflation Rate, Italy Markit/ADACI Services PMI, UK Markit/CIPS Services PMI

Time: 06:00 GMT, 07:15 GMT, 07:45 GMT, 08:30 GMT

Higher than expected or increasing figures for the Factory Orders in Germany and the PMIs Indexes in Spain and Italy are positive and supportive for the Euro, signaling spending in the economy, potential higher economic growth and expansion in the Services Sector and strong industrial production.

The forecast is for an increase of the Factory Orders in Germany, and a decline for the figures of PMIs in Spain and Italy. A decline is also expected for the UK Services PMI, which may have a negative influence on the British Pound. As seen from the chart the Inflation Rate in Switzerland has been trending up and down as of January 2017, with not a consistent trend. Increased figures for the Inflation Rate over time are considered positive for the Swiss Franc, as they may weigh on the Swiss National Bank to increase the key interest rate to fight inflationary pressures, which are absent from the market for now.

The forecast is for an Inflation Rate figure of 0.7% on yearly basis, a marginal increase compared to the previous figure of 0.6%.

- Eurozone Retail Sales, SNB Maechler Speech

Time: 10:00 GMT

Higher Retail Sales are positive and supportive for the Euro, as they indicate increased consumer spending, a key driver of economic growth measured by the GDP Growth rate. The forecast is for a decline of the Retail Sales on a yearly basis, with a figure of 2.1%, less than the previous figure of 2.3%, but an increase is expected for the Retail Sales on a monthly basis, with an expected figure of 0.5%, higher than the previous figure of -0.1%. A mixed economic data depending on the time frame selected, as the figure may be due to seasonality reasons.

American Session

- Canada International Merchandise Trade, US Balance of Trade, US Continuing and Initial Jobless Claims, Fed Bostic Speech

Time: 12:30 GMT, 17:00 GMT

A surplus for the Trade Balance is positive and supportive for a local economy, signaling a higher number of exports than exports, and increased demand for goods and services denominated in the local currency. In economic theory a trade surplus for a local economy should have a positive effect on its currency over time, causing its natural appreciation against other currencies.

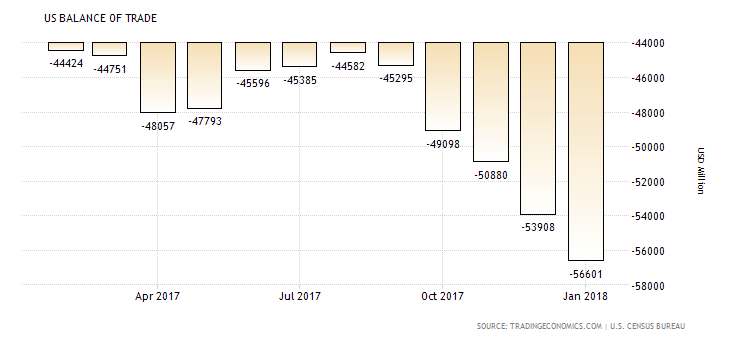

The forecast is for a trade deficit for the US Balance of Trade and a larger than expected figure of -56.8 Billion USD, compared to the previous figure of -56.6 Billion USD, and a trade deficit for the Canadian International Merchandise Trade as well. The forecast for the Canadian International Merchandise Trade is a figure of -2.00 Billion CAD, higher than the previous figure of -1.91 Billion CAD.

Lower than expected or declining figures for the US Initial and Continuing Jobless Claims are positive for the USD signaling a robust labor market. The forecast is for a decline for the Continuing Jobless Claims and an increase for the Initial Jobless Claims, a mixed data, which may have a whipsaw effect for the US Dollar. The chart shows that the US Balance of Trade is having a growing deficit for the past four consecutive months.

Pacific Session

- Australia Trade Balance

Time: 00:30 GMT

A trade surplus is expected for the Australian Trade Balance, but at the same time a decline in the figure. The forecast is for a figure of 700 Million Australian Dollars, significantly lower than the previous figure of 1,055 Million Australian Dollars. Τhis is considered positive, despite the lower anticipated trade surplus and amy provide support for the Australian Dollar.

Asian Session

- Japan Overall Household Spending

Time: 23:30 GMT

An increased figure for the Overall Household Spending is positive for the Japanese economy and the Japanese Yen, as it indicates increased consumer spending having a high correlation with economic growth. Increased spending most probably will lead to higher figures of GDP growth. The forecast is for a figure of 0.3%, which is significantly lower than the previous figure of 1.9% on a yearly basis, which may have a negative influence on the Japanese Yen upon its release.