As we move towards the end of this trading week, today the economic calendar is very rich in economic events related to the economies of Australia, France, Italy, Eurozone, US and Canada. Overall moderate to high volatility and price action is expected today in the forex market.

Main economic events for today are the following:

European Session

- France Unemployment Rate, Italy Balance of Trade, Eurozone Balance of Trade

Time: 06:30 GMT, 08:00 GMT, 10:00 GMT

Lower than expected or declining figures for the unemployment rate in France and rising figures, trade surpluses for the economies of Italy and the Eurozone are positive and supportive for the Euro, reflecting a robust labor market and capital inflows in the local economies, stronger demand for goods and services denominated in Euros, which in economic theory should weigh on the appreciation of the currency against other currencies over time.

The forecasts are for a small decline for the trade surplus in Italy, but a large increase for the trade surplus in Eurozone. These economic data have the potential to support the Euro, as yesterday there were positive fundamental data related to the industrial production in the Eurozone and the 4th quarter GDP growth rate came as expected at 2.7% on an annualized basis.

American Session

- US NY Empire State Manufacturing Index, Philadelphia Fed Manufacturing Index, Canada Existing Home Sales, US Industrial and Manufacturing Production, NAHB Housing Market Index, US Net Long-term Tic Flows

Time: 13:30 GMT, 14:00 GMT, 14:15 GMT, 15:00 GMT, 21:00 GMT

A plethora of US fundamental economic events which can move the US Dollar, with an emphasis on the industrial and manufacturing production and the US net long-term Tic flows. Higher than expected or rising figures for the NY Empire State Manufacturing Index and the Philadelphia Fed Manufacturing Index will be positive for the US Dollar reflecting improved business conditions and manufacturing growth in the areas of Philadelphia and New York, while also increased readings for the industrial production will be positive for the US Dollar indicating a strong industrial sector.

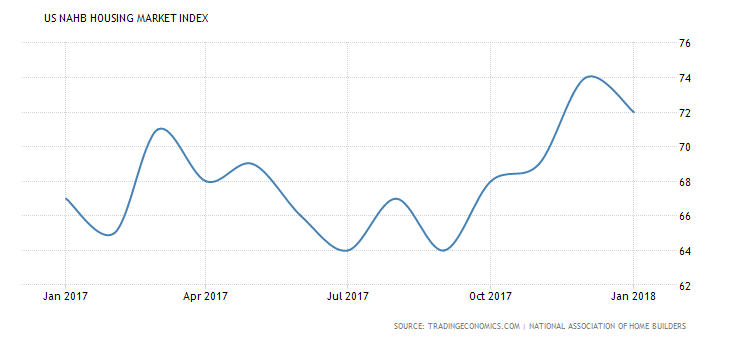

The forecast is for a reading of 3.8% on an annual basis, higher than the previous reading of 3.6%. Also the US NAHB Housing Market Index is expected to remain unchanged with a reading of 72.0, and any reading above the 50.0 level is indicative of a favorable outlook on home sales and the housing market in US. As seen from the 1-year chart of the NAHB Housing Market Index the current trend is an uptrend, which is supportive for the US housing market, and consequently for the US Dollar, being a leading indicator of the broader US economy.

The reading of the Net Long-term Tic Flows is important as it reflects the flow of financial assets such as stocks, bonds, and money market funds to and from the United States. A positive figure indicates that more capital is flowing into the US economy, and in theory should weigh positively on the value of the US Dollar. The forecast is for a marginal increase and a reading of $57.7 Billion, higher than the previous reading of $57.5 Billion. As for Canada higher than expected existing home sales will reflect also a robust housing market, increased consumer confidence and spending and will be supportive for the Canadian Dollar, as a strong housing market is a leading indicator of a strong economy.

Pacific Session

- Australia Unemployment Rate and Employment Change

Time: 00:30 GMT

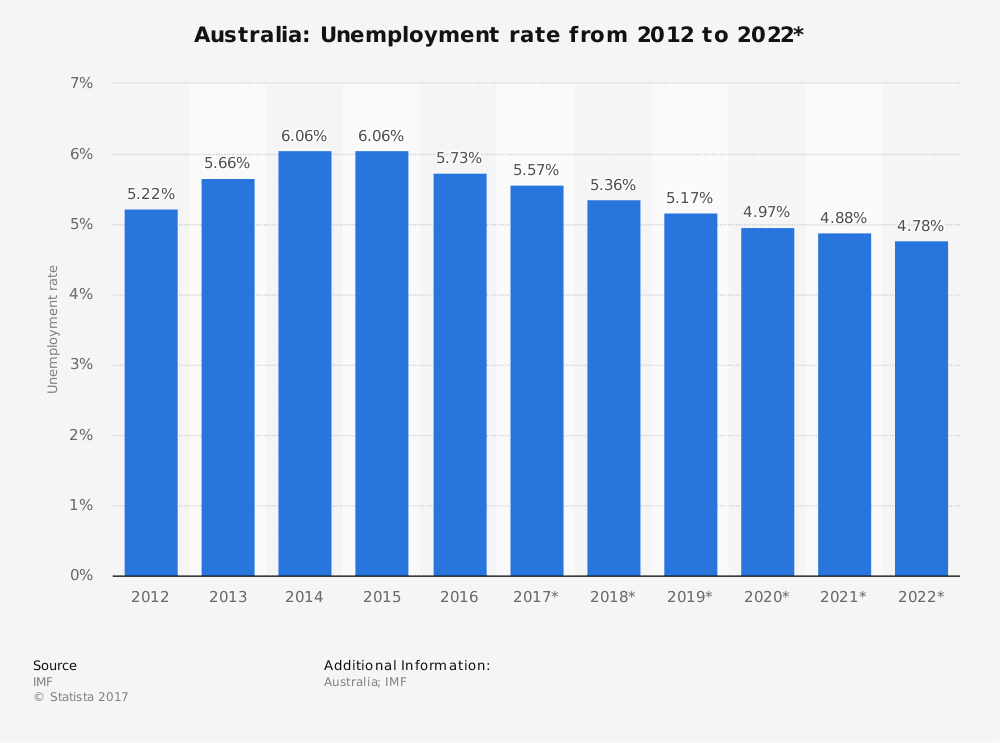

As seen from the graph the unemployment rate in Australia is expected to decline over the period of next 5 years from the current rate of 5.57% in 2017 to 4.78% in year 2022. This is positive for the Australian Dollar as more people employed lead to a stronger economic growth, measured by consumer spending and GDP growth rate.

The forecast is for an unchanged reading of 5.5% for the unemployment rate and a decline for the employment change with a reading of 15.0K, lower than the previous reading of 34.7K. This is considered to be a neutral to slightly negative fundamental factor, but seasonality could play a pivotal role for these readings, so a monitoring of the trend for the unemployment rate and employment change are more indicative over time to reflect the real labor market conditions.