A new trading month in the forex market is starting today and a new weekly trading session with major economic data being released from the US such as the jobs report, trade balance, ISM PMIs, ADP employment and factory orders, the UK Markit PMIs and household spending in Japan, the interest rate decision from RBA and GDP growth, trade balance and retail sales in Australia and an interest rate decision from the Bank of Canada. Today is a holiday in the US and Canada due to Labor Day and the forex market will weigh this week on Brexit news, trade concerns and the non-agreement between Canada and the US to participate in the recently US-Mexico trade deal.

These are the key economic data to be released today to focus on the forex market, time is GMT:

European Session

Russia: Markit Manufacturing PMI, Spain: Markit Manufacturing PMI, Consumer Confidence, Switzerland: Retail Sales YoY, SVME Manufacturing PMI, Italy: Markit/ADACI Manufacturing PMI, Germany: Markit Manufacturing PMI Final, Bundesbank Weidmann Speech, Eurozone: Markit Manufacturing PMI Final, ECB Mersch Speech, UK: Markit/CIPS Manufacturing PMI

Time: 06:00, 07:15, 07:30, 07:45, 07:55, 08:00, 08:30, 17:15

The Manufacturing Purchasing Managers Index (PMI) released by the Markit Economics measures the business conditions in the manufacturing sector. The manufacturing PMI is an important indicator of business conditions and the overall economic conditions in the local economy with higher than expected readings considered positive and supportive for the local currencies indicating a robust manufacturing sector with expansion which can contribute positively to overall economic growth measured by the GDP level.

Lower than expected figures indicating weakness in the manufacturing sector are expected for the Manufacturing PMIs for all countries mentioned above and the Eurozone. For the Eurozone and Germany, the Markit Manufacturing PMI readings are expected to decrease to 54.6 and 56.1 respectively from 55.1 and 56.9 accordingly.

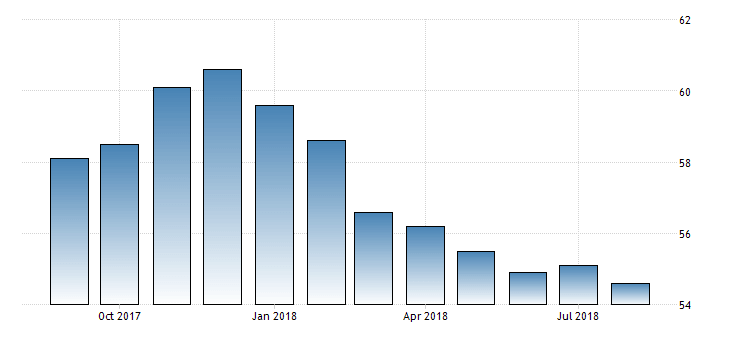

“The IHS Markit Eurozone Manufacturing PMI fell to 54.6 in August of 2018 from 55.1 in July, below market expectations of 55, preliminary estimates showed. The reading pointed to the slowest expansion in the manufacturing sector since November of 2016. Export orders rose the least in two years; backlogs of orders’ growth was the weakest in three years; job creation fell to a 17-month low; input inflation accelerated amid higher salaries, fuel, transport and commodity prices while output price inflation slowed. In addition, business confidence slumped to a 34-month low, dragged down by cooling demand, higher prices and rising political concerns.”, Source: Trading Economics.

As seen from the chart the Euro Area Manufacturing PMI in 2018 has peaked in January and even since has been declining, reflecting weaker business conditions in the manufacturing sector which may weigh negatively on the Euro.

The yearly Retail Sales in Switzerland which track the change of goods sold in the last month being also an important indicator of the consumer demand and the retail sector performance are expected to increase to 1.2% from 0.3%, which should be considered positive for the Swiss Franc as higher Retail Sales can lead to higher economic growth and indicate optimism for the current economic outlook.

Pacific Session

Australia: Retail Sales MoM

Time: 01:30

The Retail Sales shows the change of goods sold by retailers during the previous month and is indicator reflecting the pace of economic growth of the Australian economy, as consumer spending is a key driver to economic growth. It also shows the performance of the retail sector over the short and mid-term period with higher than expected figures considered positive for the Australian Dollar.

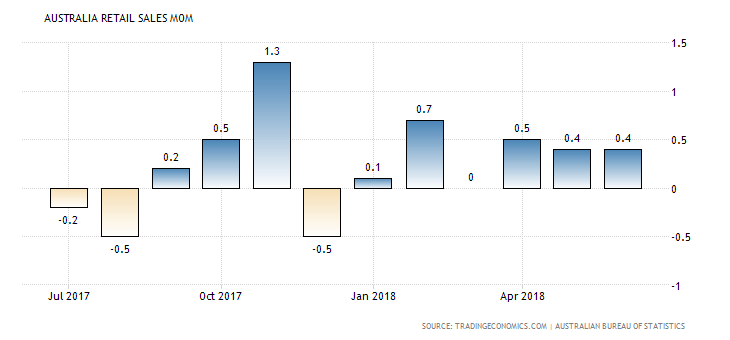

“Retail trade in Australia rose by 0.4 percent month-on-month in June of 2018, the same as in a month earlier but beating market consensus of a 0.3 percent gain. It was the sixth straight month of growth in retail trade, as sales rebounded for cafes, restaurants and takeaways (0.9 percent from -0.7 percent in May). Also, sales continued to increase for food retailing (0.4 percent, the same as in May); household goods (0.4 percent from 0.1 percent); and clothing, footwear and personal accessory (1.7 percent from 2.3 percent).Meanwhile, other retailing was relatively unchanged and sales in department stores fell by 1.2 percent, after a 3.6 percent rise in May.”, Source: Trading Economics.

As seen from the above chart the Australian Retail Sales are highly volatile but seem to have stabilized in the range of 0.5%-0.4% for the past three consecutive months. The forecast is for a decrease to 0.3% from 0.4%, which can be considered as negative indicating a slowdown in consumer spending.

Asian Session

Japan: Monetary Base YoY

Time: 23:50

The Monetary Base shows the supply of all the Japanese Yen in circulation in the overall economy considered as an important indicator of inflation, as monetary expansion can lead to higher inflationary pressures in the broader economy and weigh on the decision of the Bank of Japan to shift its monetary policy and increase the key interest rate. An increase for the Monetary Base is positive for the Japanese Yen. The forecast is however for a decrease to 5.5% from 7.0%.