The forex market trading session for the week May 7-11, 2018 start today with a light economic calendar, with the forex market participants focusing on the US economic data released on Friday, May 2, 2018. The US economy reading for the Non-farm payrolls missed the expectations with a figure of 164K, less than the forecast of 192K, while Average Hourly Earnings rose by 0.1% MoM and 2.6% YoY, both below expectations.

However, the US Unemployment Rate beat the expectation of 4.0%, with a figure at 3.9%. There will be a lot of focus on whether the Fed will raise interest rate in June or not, which will set the trend for the US Dollar against major currencies. For today there are no important economic events related to the US economy, but only a few events related to the economies of Germany, Switzerland, Australia and Japan. Low to moderate volatility is expected in the forex market today.

Key economic events for today to focus on:

European Session

- Germany: Factory Orders, Construction PMI, Switzerland: Inflation Rate YoY, Russia: Foreign Exchange Reserves, Eurozone: ECB Praet Speech

Time: 06:00 GMT, 07:15 GMT, 07:30 GMT 13:00 GMT, 16:30 GMT

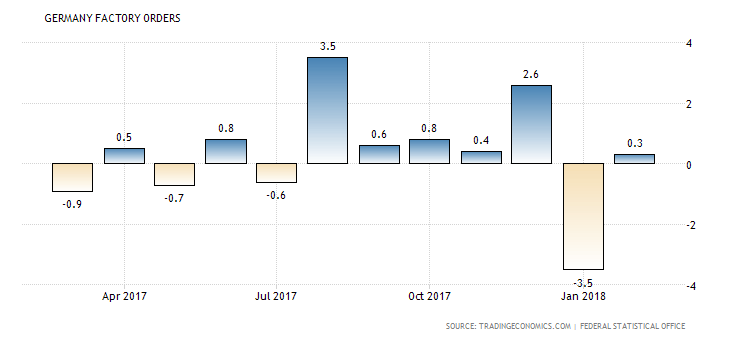

The Factory Orders in Germany figure is indicative of the strength of demand for German industrial products, while Factory Orders are an early indicator of the overall level of spending in the economy, and spending is one of the key drivers of economic growth. Higher than expected or rising figures for the Factory Orders in Germany, and an increased figure for the Construction PMI will be positive for the German economy and the Euro, reflecting expansion in the Construction Sector and the Industrial Sector.

As seen from the chart the Factory Orders in Germany are very volatile, with an unspecified trend for the past 12-months, with significant increases and declines. The forecast is for a monthly reading of 0.5%, higher than the previous reading of 0.3%.

Higher than expected or rising figures for the Inflation Rate in Switzerland are considered positive and supportive for the Swiss Franc, reflecting inflationary pressures in the economy, which may weigh on the Swiss National bank decision to start raining the key interest rate in the future. The forecast is for a yearly figure of 0.9%, marginally higher than the previous figure of 0.8%, which does not show any severe inflationary pressures, so most probably it should have a neutral effect on the Swiss Franc.

For Russia, the Foreign Exchange Reserves are money or other assets that are held by the central bank or other monetary authority for liabilities to be paid. A monitoring of the real figures is important as any important change in the Foreign Exchange Reserves may signal a Central Bank intervention to influence the exchange rate of the local currency, a shift in the monetary policy, and changes to inflation as well.

American Session

- US: Fed Bostic Speech, Fed Barkin Speech, Fed Kaplan Speech, Fed Evans Speech, Canada: BoC Lane Speech

Time: 12:25 GMT, 16:00 GMT, 19:00 GMT, 19:30 GMT

The Central Bank Officials Speeches should be monitored for any updates on current economic conditions that may indicate future changes in monetary policy or economic growth.

Pacific Session

- Australia: NAB Business Confidence

Time: 01:30 GMT

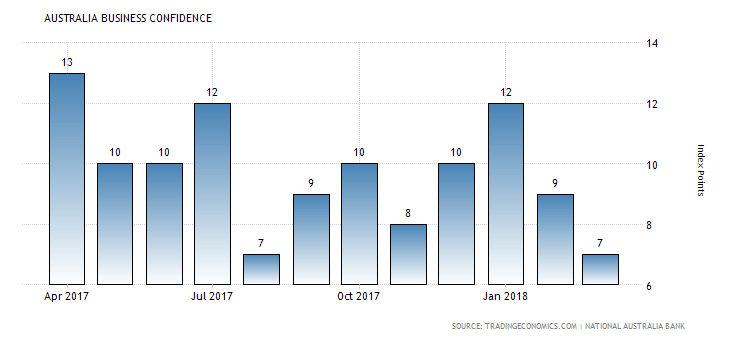

A survey of the current state of the business sector in Australia and the business short to mid-term business outlook in Australia can provide support to the Australian Dollar with increasing figures.

“The NAB business confidence index in Australia unexpectedly dropped to 7 in March of 2018 from 9 in February and missing market consensus of 12. It was the lowest reading since August 2017 amid fears of the US-China trade war.”, Source: Trading Economics.

Increased figures for Business Confidence can have positive effect on the employment and business investing, increasing the economic growth. The forecast is for an increase and a figure of 9.0, higher than the previous figure of 7.0.

Asian Session

- Japan: Household Spending YoY

Time: 23:30 GMT

Increased figures for the Household Spending in Japan are both supportive and positive for the Japanese Yen, as higher spending leads in most cases to higher economic growth, measures by the GDP Growth Rate. The forecast is for a yearly reading of 0.7%, higher than the previous reading of -0.9%.