Another trading week for the forex market is starting today, and the economic calendar is relatively light in economic data. This week 4-8 June 2018 has one monetary policy decision by RBA, which may influence the Australian Dollar.

For today important economic releases include the Unemployment Rate and Consumer Confidence in Spain, the Construction PMI in UK, the US Factory Orders, the Retail Sales and New Home Sales in Australia and the Household Spending in Japan. Moderate to high volatility is expected in the forex market, and after the strong US data on Friday, June 1, 2018, related to the Nonfarm payrolls, Average Hourly Earnings and lower than expected Unemployment Rate, the US Dollar may move, as the forex market will probably focus again on these labor market figures.

Key economic events for today to focus on:

European Session

- Spain: Unemployment Change, Consumer Confidence, UK: Construction PMI, BoE Tenreyro Speech

Time: 07:00 GMT, 08:00 GMT, 08;30 GMT, 17:00 GMT

The Unemployment Change in Spain shows the number of unemployed workers added during the previous month, being is a leading indicator for the local economy. If the number is negative, it indicates an expansion in the labor market, as more people are employed, and therefore can contribute positively to the economic growth with increased consumer spending. A decrease in the figure is considered positive for the Euro. The forecast is for a figure of -105.7K, compared to the previous figure of -86.7K. A higher than expected Consumer Confidence is also considered positive for the economy of Spain and the Euro, as it should lead to higher consumer spending and higher economic growth measured by the level of GDP Growth.

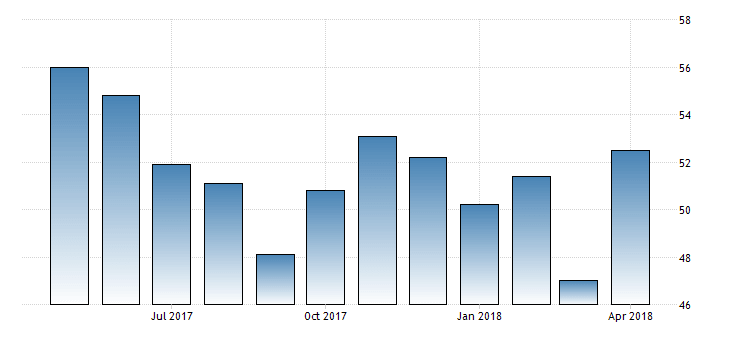

The UK Construction PMI is expected to decline at 52.0, lower than the previous level of 52.5. This Index shows business conditions in the UK construction sector, and values over the 50.0 level reflect expansion for the sector. Higher than expected or rising values are considered positive for the British Pound.

“The IHS Markit/CIPS UK Construction PMI rose to a five-month high of 52.5 in April 2018 from 47 in the previous month and way above market consensus of 50.5.” Source: Trading Economics.

As seen from the chart below from Trading Economics, the UK Construction PMI is relatively volatile, and still in 2018 has not made any higher values compared to the high values year in 2017, before the summer.

American Session

- US: Factory Orders MoM

Time: 14:00 GMT

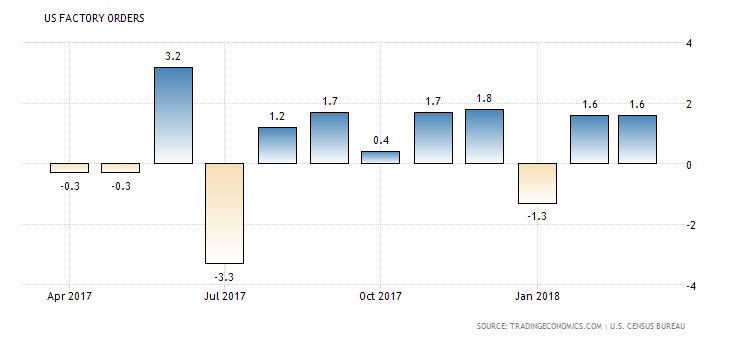

The US Factory Orders measure the total orders of durable and non-durable goods and can provide important economic insight into inflation and growth in the manufacturing sector. Higher than expected figures are considered positive for the US Dollar reflecting a strong manufacturing and production economic and business activity.

The US Factory Orders are volatile and for the past 2-months rose 1.6 percent, after the negative value of -1.3% in January 2018. The forecast id for a figure of -0.5%, lower than the previous figure of 1.6%, which may influence negatively the US Dollar. Any economic surprise either positive or negative may add significant volatility for the US Dollar.

Pacific Session

- Australia: IHA New Home Sales MoM, Retail Sales

Time: 01:00 GMT, 01:30 GMT

Important economic data for the economy of Australia is released today. The number of New Home Sales indicate the housing market condition, while the Retail Sales show the performance of the retail sector and are correlated with economic growth. Higher than expected values for both economic indicators are considered positive for the Australian Dollar and the local economy. The forecast is for an increase of the monthly Retail Sales at 0.2%, higher than the previous figure of 0.0%.

Asian Session

- Japan: Household Spending YoY

Time: 23:30 GMT

The Overall Household Spending is an economic indicator that measures the total expenditure by households. The level of spending can be used as an indicator of consumer optimism and is also considered as a measure of economic growth. Higher than expected values are considered positive and supportive for the Japanese Yen. The forecast is for a figure of 0.8%, higher than the previous figure of -0.7%.