The economic calendar for the week 23-27 April 2017 is having a focus today on the Purchasing Managers’ Index (PMI) for the Manufacturing and Services Sector in Germany, in the Eurozone and in the US economy. There is also economic data for the economy of Japan and a Speech by the Reserve Bank of Australia Assistant Governor. Moderate to high volatility is expected for the Euro, the US Dollar and the Japanese Yen. During this week top economic events which can move the EUR/USD currency pair are the first-quarter US GDP data and the ECB monetary policy decision.

These are the main economic events for today to focus on:

European Session

- Germany Markit PMI Composite, Markit Services PMI and Markit Manufacturing PMI, Eurozone Markit Services PMI, Markit Manufacturing PMI and Markit Composite PMI

Time: 07:30 GMT, 08:00 GMT

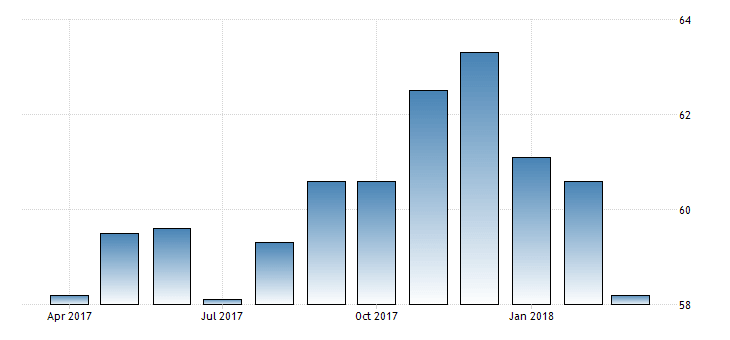

The Purchasing Managers’ Index (PMI) is an indicator of the economic health of the manufacturing, services and composite sector. It provides information about current business conditions, with a reading above the 50.0 level indicating expansion in the sector, and a reading below the 50.0 level indicating a contraction in the sector. Increased or higher than expected readings are considered both positive and supportive for the local currency and economy, in this case, Germany, the Eurozone and the Euro. As seen from the chart the IHS Markit/BME Germany Manufacturing PMI fell to 58.2 in March of 2018 from 60.6 in February and slightly lower than a preliminary reading of 58.4. The reading pointed to the slowest expansion in factory activity in eight months as output growth was the weakest since December 2016. Source: Trading Economics

As of 2018, the IHS Markit/BME Germany Manufacturing PMI has been trending lower for two consecutive months, indicating some form of weakness in the Manufacturing Sector. The forecast is for a decline and a figure of 57.6, lower than the previous figure of 58.2. The forecast is also for a decline of the Composite and Services PMI readings in Germany, while for the Eurozone the forecast is for an unchanged reading of 56.6 for the Markit Manufacturing PMI, a marginal increase for the market Services PMI with a reading of 55.0, higher than the previous reading of 54.9, and a decline for the Markit Composite PMI, with a reading of 54.2, lower than the previous reading of 55.2. Mixed economic data is expected for the Eurozone, which can move the Euro should any economic positive or negative economic surprises occur.

American Session

- Chicago Fed National Activity Index, US Markit PMI Composite, US Markit Manufacturing PMI and Markit Services PMI, US Existing Home Sales

Time: 12:30 GMT, 13:45 GMT, 14:00 GMT

The Chicago Fed National Activity Index measures economic activity in the 7th district area in US and is useful in tracking economic growth and identifying potential inflationary pressures in the broader economy. Increased readings are positive for the US Dollar, something which applies also for the PMIs figures as well. The forecast is for a reading of 0.41 for the Chicago Fed National Activity, well below the previous reading of 0.88. For the US PMIs readings the forecast is for an unchanged reading of 54.0 for the Markit Services PMI, an increase for the Markit Composite PMI with a reading of 55.3, higher than the previous reading of 54.2, and a decline for the Markit Manufacturing PMI with a reading of 55.0, lower than the previous reading of 55.6. Mixed economic data is expected therefore for the US economy, something which applies for the Eurozone as well.

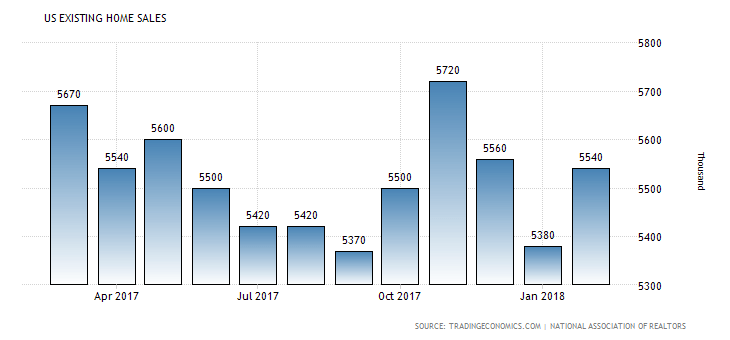

The Existing Home Sales in US jumped 3 percent month-over-month to a seasonally adjusted annual rate of 5.54 million in February of 2018 from 5.38 million in January. The forecast is for a reading of 5.55M in March 2018, a marginal increase compared to the previous reading of 5.54M.

The trend for the Existing Home Sales in US is a volatile one, and increased readings are considered positive for the economy and the US Dollar, reflecting a robust housing market, a leading indicator of the overall economy.

Pacific Session

- RBA Assistant Governor Kent Speech

Time: 22:00 GMT

A Speech by a central bank official is always important and can move the local currency with any insights on economic conditions.

Asian Session

- Japan All Industry Activity Index

Time: 04:30 GMT

The All Industry Activity Index measures the change in the total production of all industries in the economy of Japan, with increased figures considered positive and supportive for the Japanese Yen, reflecting expansion and growth in the Industrial Sector. The forecast is for a monthly reading of 0.1%, higher than the previous reading of -1.8%.